Blog

Orange County Real Estate Market Update: July 2025

07.12.2025 09:28 AM - Comment(s)

As we analyze the market through June 2025, we’ll explore key trends, including month-over-month (MoM) and year-over-year (YoY) changes in home prices, sales, and inventory, alongside current mortgage rates, their recent trends, and forecasts for the remainder of the year.

Trust vs. Probate in California: Which Saves You More?

06.18.2025 06:16 PM - Comment(s)

Planning for the future includes ensuring your loved ones inherit your assets smoothly and cost-effectively. In California, two common paths for transferring your estate are setting up a living trust or letting your estate go through probate. Which option is right for you?

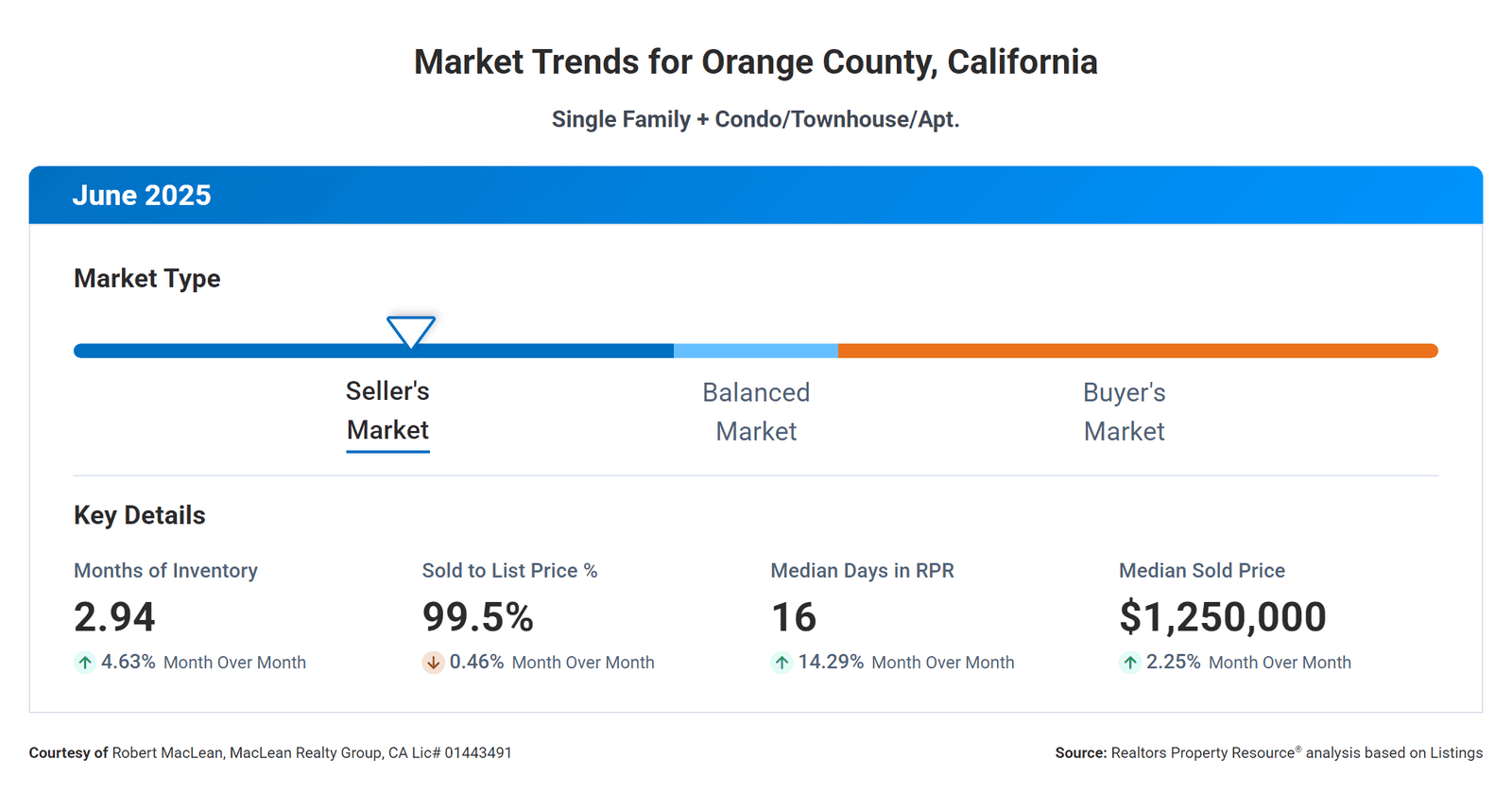

Orange County Real Estate Market Update: June 2025

06.10.2025 05:50 PM - Comment(s)

As we dive into the Summer of 2025, Orange County, California, continues to be one of the most dynamic and sought-after real estate markets in the nation. Let’s break down the latest trends, opportunities, and insights for buyers and sellers in this vibrant Southern California hub.

What Are The Most Common Home Improvements Before Selling?

05.21.2025 12:28 PM - Comment(s)

Strategic improvements can boost your home’s appeal, attract more offers, and maximize your return on investment (ROI). Here’s a guide to the most common and high-ROI upgrades to make your home shine in 2025.

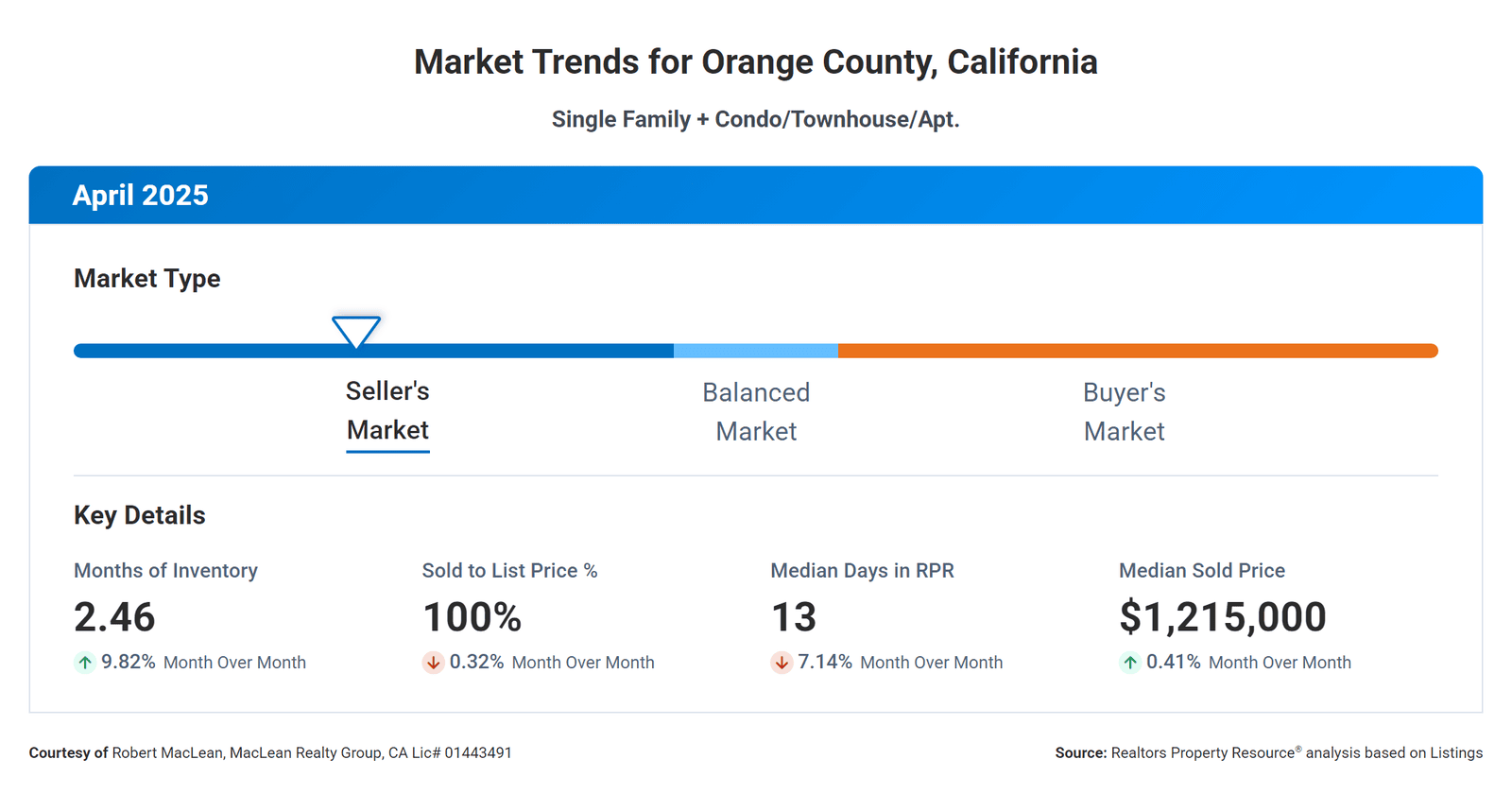

Orange County Real Estate Market Update: May 2025

05.14.2025 02:36 PM - Comment(s)

Orange County remains one of the most sought-after real estate markets in the U.S. As we move through 2025, the market is showing signs of both resilience and evolution. Whether you’re a buyer, seller, or investor, here’s what you need to know about the current trends, opportunities, and challenges.

How to Do a 1031 Exchange in California

05.13.2025 05:43 PM - Comment(s)

A 1031 Exchange allows you to reinvest the proceeds from a property sale into a like-kind property while deferring federal and state taxes. In this guide, we'll walk you through the process step-by-step, with a focus on California’s unique regulations.

Safeguarding the Estate: Protecting and Managing Property in California Probate

05.13.2025 08:20 AM - Comment(s)

If you’ve been named the personal representative of an estate in California, you’re tasked with a big job: managing the deceased’s assets through the probate process. In this blog post, we’ll dive into what’s involved in safeguarding and managing estate property in California probate.

Simplifying Probate in California: Transferring a Home Under $750,000 Without Full Probate

05.07.2025 12:01 PM - Comment(s)

In California, the probate process for transferring real property can be complex and costly. However, a new law, Assembly Bill 2016, effective April 1, 2025, offers a streamlined solution for transferring a primary residence valued under $750,000 without full probate.

Understanding Step-Up Basis in California: A Guide for Heirs

05.04.2025 02:50 PM - Comment(s)

The step-up basis can significantly reduce your tax burden when you sell assets. In this blog post, I will break down what the step-up basis is, how it works in California, and key considerations for heirs, including the impact of Proposition 19.

Understanding the Heggstad Petition in California: A Guide to Avoiding Probate

05.04.2025 02:35 PM - Comment(s)

What happens if an asset, like a house or bank account, was accidentally left out of the trust? In California, a Heggstad petition can be a lifesaver, helping families avoid the lengthy and expensive probate process. In this blog post, we’ll break down what a Heggstad petition is and how it works.