Orange County, California, remains one of the most sought-after real estate markets in the U.S., blending coastal charm, economic strength, and lifestyle appeal. As we move through 2025, the market is showing signs of both resilience and evolution. Whether you’re a buyer, seller, or investor, here’s what you need to know about the current trends, opportunities, and challenges in Orange County’s housing market.

A Snapshot of the Market

Prices Rising Moderately

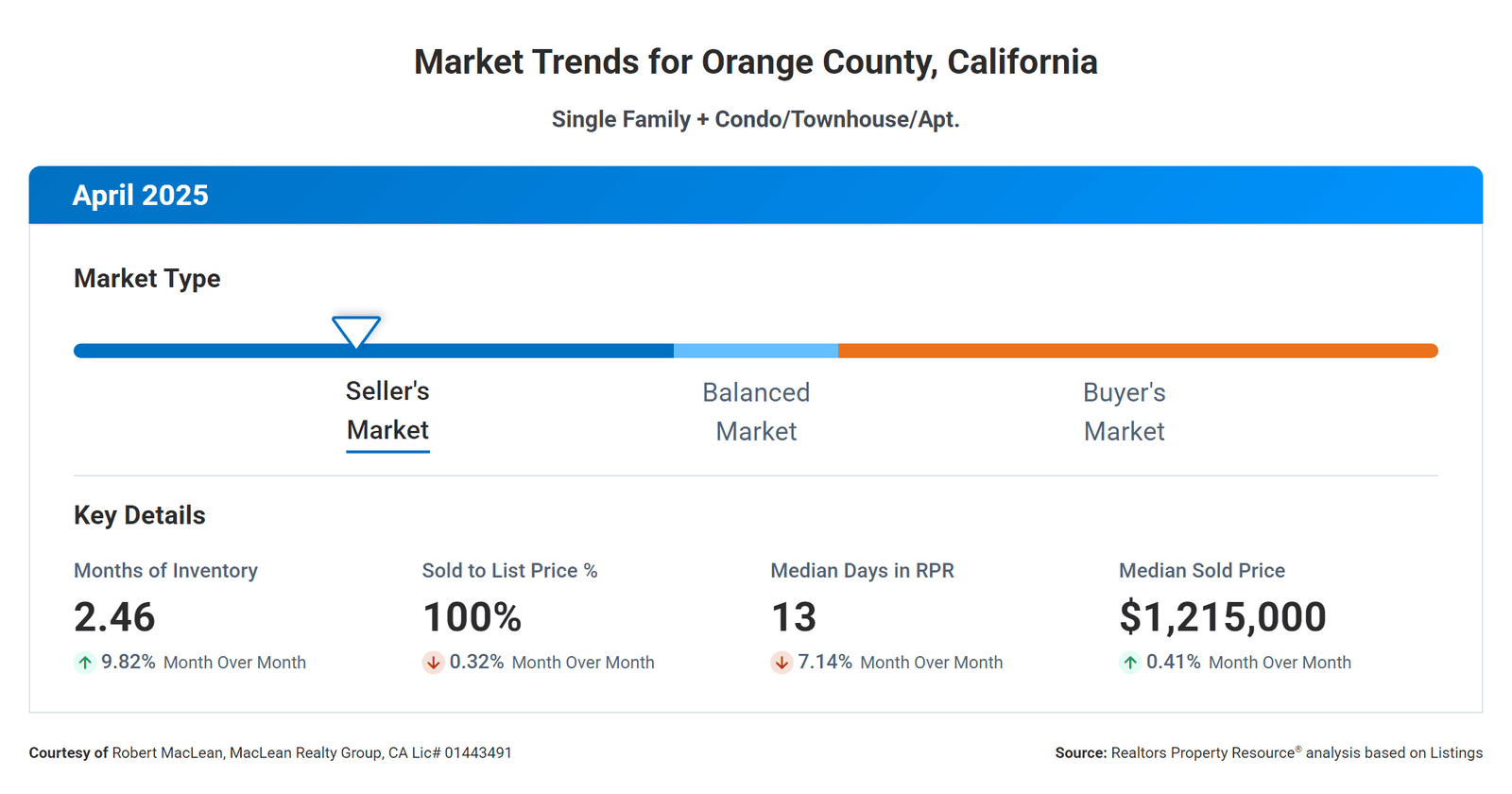

Home prices in Orange County continue to climb, though the pace is moderating. The median home price hovers around $1.2 million, with single-family homes median price at $1.45 million. Year-over-year, prices have risen by about 1.3%.

Inventory Growing but Still Tight

Good news for buyers: inventory is increasing. As of April 2025, active listings are up 48% at about 5,000 homes. However, this is still below the balanced market threshold of over 10,000 homes, keeping Orange County in a seller’s market territory. Compared to pre-pandemic levels (June 2019 at 9,000 homes), inventory remains constrained, fueling competition, especially for desirable properties.

Sales and Speed

Home sales are down, with a -5.8% year-over-year decrease. Homes move fast — 73% sell within 30 days, with a median of 13 days and an average of 27 days on the market. That said, this is slightly slower than last year, hinting at a market that’s becoming more balanced.

What’s Driving the Market?

Economic Factors

High mortgage rates (6–7%) are squeezing affordability, making buyers more cautious. Despite this, Orange County’s robust economy—driven by tech, healthcare, and tourism—continues to attract buyers, including those relocating from pricier Los Angeles areas after recent wildfires.

Regional Appeal

Orange County’s lifestyle—think beaches, top schools, and vibrant communities—keeps demand steady. Coastal cities are particularly strong, while up-and-coming neighborhoods like Santa Ana offer opportunities for investors seeking undervalued properties.

Low Distressed Properties

Only 220 homes were listed as distressed (e.g., foreclosures) in early 2025, signaling a stable market with minimal forced sales.

What to Expect in 2025

- Price Growth: Experts forecast a 4.6% increase in home prices, slower than previous years but still positive due to persistent demand and limited supply.

- More Balance: As inventory grows, the market may shift closer to neutral, potentially easing price pressure if interest rates stabilize or drop.

- Investment Opportunities: Fixer-uppers and properties in opportunity zones are ripe for investors. Networking with local realtors can uncover hidden gems.

- Mortgage Rate Projections: Fannie Mae and Wells Fargo predict we will be close to 6% by the end of the year while the Mortgage Bankers Association predicts we will be around 6.7%.

Tips for Navigating the Market

For Buyers

Act Strategically: With more inventory, you may have room to negotiate, especially on homes listed longer than 30 days. Monitor mortgage rates closely and lock in when favorable.

Work with Experts: Partner with a local realtor who knows Orange County’s nuances, especially in highly competitive area.

Consider Alternatives: Look at up-and-coming neighborhoods or attached homes (median $810,000) for more affordable entry points.

For Sellers

Price Right: Overpricing can lead to longer days on the market. Work with an agent to set a competitive price based on recent comps.

Stage to Impress: With buyers having more options, professional staging and marketing can make your home stand out.

Time It Well: Spring and early summer remain peak selling seasons in Orange County.

For Investors

Seek Off-Market Deals: Connect with local agents for distressed properties with high ROI potential.

Focus on Value-Add: Properties needing renovations or in emerging areas can yield strong returns.

Stay Informed: Keep an eye on economic trends, like interest rates and construction costs, to time your investments.

Final Thoughts

Orange County’s real estate market in 2025 is dynamic, balancing strong demand with a slowly shifting supply landscape. Buyers can capitalize on growing inventory, sellers can leverage the market’s competitiveness, and investors can find opportunities in undervalued properties. Stay informed, work with local experts, and act strategically to make the most of this vibrant market.

If you need any help or guidance do not hesitate to reach out. Simply click below to send us a message or book an appointment.