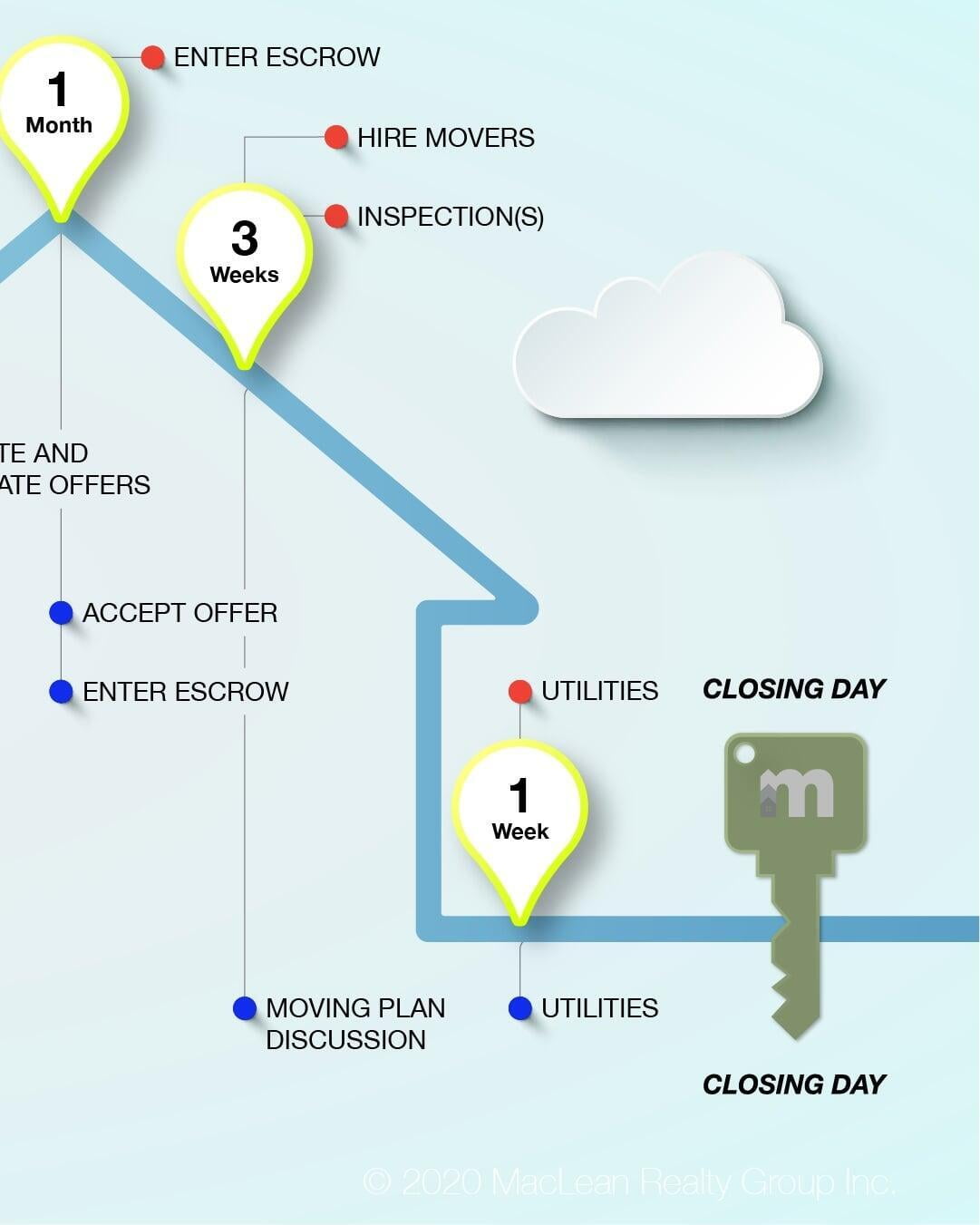

Home Buyer and Seller Journey Timeline

|  |  |

Embarking on the journey to buy or sell a home is a significant milestone. Preparing your finances over a six-month period is key to success. Whether you’re a buyer dreaming of your perfect home or a seller aiming to maximize your property’s value, a structured financial plan can make the process smoother and more rewarding. This blog post breaks down a six-month roadmap to guide you through the financial steps of buying or selling a home.

Why a 6-Month Plan?

The MRG Journey to the Sale emphasizes a six-month timeline, recognizing that buying or selling a home requires careful financial preparation. For buyers, this means building a strong financial foundation to secure a mortgage and afford a new home. For sellers, it involves optimizing your home’s value and managing sale proceeds. A six-month plan allows enough time to address financial details, avoid rushed decisions, and navigate the real estate market confidently.

Here’s a month-by-month guide to prepare your finances for the journey:

Months 1–2: Lay the Financial Groundwork

For Buyers:

Assess Your Finances: Review your income, expenses, and debts. Calculate your debt-to-income ratio (DTI) by dividing monthly debt payments by gross monthly income—aim for a DTI below 43%.

Check Your Credit Score: Obtain a credit report from Equifax, Experian, or TransUnion. Dispute errors and pay down high-interest debts to boost your score, as it affects mortgage rates.

Start Saving: Begin saving for a down payment (ideally 10–20% of the home’s price) and closing costs (2–5% of the purchase price). Set up a dedicated savings account to stay disciplined.

For Sellers:

Evaluate Your Home’s Value: Research local market trends or consult a real estate agent to estimate your home’s worth. This helps set realistic expectations for sale proceeds.

Review Debts: If you have an existing mortgage or home equity loans, gather payoff amounts to understand your net proceeds after the sale.

Plan for Repairs: Budget for minor repairs or upgrades (e.g., painting, fixing leaks) to increase your home’s appeal and value.

Months 3–4: Build Momentum

For Buyers:

Get Pre-Approved: Contact lenders for a mortgage pre-approval. Provide pay stubs, tax returns, and bank statements. Compare loan options (conventional, FHA, VA) to find the best fit.

Set a Budget: Use mortgage calculators to estimate monthly payments, including property taxes, insurance, and maintenance. Keep housing costs within 28–30% of your income.

Explore Assistance Programs: Research down payment assistance or first-time buyer grants available in your area.

For Sellers:

Stage Your Home: Invest in professional staging or small updates (e.g., landscaping, decluttering) to attract buyers. Allocate funds for these costs.

Hire a Real Estate Agent: Choose an agent to guide you. Discuss commission fees and factor them into your financial plan.

Plan Your Next Move: If relocating, budget for moving costs or temporary housing. If buying another home, align your finances with the buyer’s steps above.

Months 5–6: Finalize and Close

For Buyers:

Shop for Homes: Work with an agent to find properties within your budget. Attend open houses and narrow your choices.

Make an Offer: Submit a competitive offer based on market conditions. Be prepared for negotiations and have funds ready for an earnest money deposit (1–3% of the purchase price).

Secure Financing: Finalize your mortgage application. Avoid new debt or major purchases, as lenders will recheck your finances before closing.

For Sellers:

Put Your Home on the Market: Put your home in the MLS at a competitive price. Be ready for showings and open houses.

Negotiate Offers: Review buyer offers with your agent. Consider contingencies (e.g., inspections, appraisals) and their financial impact.

Prepare for Closing: Budget for closing costs (e.g., title fees, transfer taxes) and ensure all repairs or agreed-upon conditions are met.

Tips for Success

Stay Disciplined: Avoid major financial changes, like new loans or job changes, during the six months to maintain stability for lenders or buyers.

Work with Professionals: Partner with a reputable real estate group like MacLean Realty Group to navigate the process efficiently.

Be Flexible: Market conditions may shift, so stay open to adjusting your timeline or expectations.

Your Journey Starts Now

The MRG Journey to the Sale underscores that a six-month financial preparation plan is essential for a successful home purchase or sale. By assessing your finances, saving strategically, securing approvals, and working with experts, you’ll be ready to close the deal with confidence. Whether you’re buying your dream home or selling a property, this journey is an exciting step toward your real estate goals.

If you need any help or guidance do not hesitate to reach out. Simply send us a message or book an appointment.