When a loved one passes away, their estate—the assets they owned—often goes through a legal process called probate. In California, probate is a court-supervised procedure to settle a deceased person’s estate, ensuring their debts are paid and assets are distributed to the rightful heirs or beneficiaries. While probate is a common process, it can be complex, time-consuming, and confusing for those unfamiliar with it. This blog post explains what probate is in California, how it works, and key considerations for navigating it.

What is Probate?

Probate is the legal process used to administer a deceased person’s estate when they die with or without a will. In California, the probate court oversees this process to:

- Validate the Will: If the deceased left a will, the court confirms its authenticity and ensures it meets legal requirements.

- Identify and Distribute Assets: The court supervises the inventory, appraisal, and distribution of the deceased’s assets, such as real estate, bank accounts, and personal property.

- Settle Debts and Taxes: The estate’s debts, including creditors’ claims and taxes, are paid before assets are distributed to heirs or beneficiaries.

- Appoint an Executor or Administrator: The court appoints a person to manage the estate, either the executor named in the will or an administrator if there is no will.

Probate applies to assets owned solely by the deceased that do not have a designated beneficiary or transfer mechanism, such as a living trust, joint tenancy, or payable-on-death account California Probate Code governs the process, ensuring it is conducted fairly and transparently.

When is Probate Required?

Probate is typically required when:

- The deceased left a will, and their assets (e.g., real estate, bank accounts) are in their name alone.

- The deceased died intestate (without a will), and their estate must be distributed according to California’s intestacy laws.

- The estate includes significant assets, such as a house, that need to be sold or transferred.

Probate is not required if:

- Assets are held in a living trust, which allows them to bypass probate and transfer directly to beneficiaries.

- Assets are held in joint tenancy with a surviving co-owner, such as a home owned with a spouse.

- Accounts have designated beneficiaries, like life insurance policies or retirement accounts with named recipients.

- The estate qualifies for a simplified procedure, such as a small estate affidavit for estates valued under $750,000.

A decedent’s real property used as a primary residence may be disposed of outside of probate administration when the gross value does not exceed $750,000. In lieu of probate administration, a successor may petition the court to determine succession. This increased limit will be in effect for the period starting April 1, 2025, through March 31, 2028, after which the value would be adjusted at a three-year interval based on the Consumer Price Index.

If a decedent dies leaving real property that was their primary residence in this state and the gross value of that real property does not exceed $750,000, as adjusted periodically, and 40 days have elapsed since the death of the decedent, the successor of the decedent to an interest in that real property, without procuring letters of administration or awaiting the probate of the will, may file a petition in the superior court of the county in which the estate of the decedent may be administered requesting a court order determining that the petitioner has succeeded to that real property.

A successor who files this petition shall deliver a notice of the petition to each heir and devisee named in the petition.

This law raises the current small estate exception from $184,500 (when decedents passed after April 1, 2022) to $750,000, but only as to real property that was the decedent’s primary residence. This small estate exception previously applied to any type of real property including commercial, vacant land or any type of residential property, but is now eliminated for those types of properties.

The author of the bill states that, “an increase in the small estate value threshold to $750,000 [will] protect the financial security of low- and middle-income heirs, ensuring they can utilize the expedited probate process and safeguard their family homes and assets.

Assembly Bill 2016 is codified as Probate Code§§ 13100, 13101, 13150, 13151, 13152 and 13154. Effective January 1, 2025.

The Probate Process

The probate process in California involves several steps, typically taking 6–12 months or longer, depending on the estate’s complexity. Here’s an overview:

Filing a Petition:

- The process begins by filing a petition with the probate court in the county where the deceased resided or owned property.

- If there’s a will, the petition requests its validation and the appointment of the executor. If there’s no will, the court appoints an administrator (usually a close relative).

Notifying Interested Parties:

- Heirs, beneficiaries, and creditors must be notified of the probate proceedings.

- A public notice is published in a local newspaper to alert potential creditors.

Inventory and Appraisal:

- The executor or administrator compiles an inventory of the estate’s assets, such as real estate, bank accounts, and personal property.

- A court-appointed probate referee appraises the assets to determine their fair market value.

Paying Debts and Taxes:

- The estate settles outstanding debts, including creditor claims, funeral expenses, and taxes (e.g., income or estate taxes).

- Creditors have four months from the notice publication to file claims, or they may be barred.

Distributing Assets:

- After debts and taxes are paid, the remaining assets are distributed to heirs or beneficiaries according to the will or intestacy laws.

- If the estate includes real property, a probate sale may be required, which could involve court confirmation (see our previous blog posts for details).

Closing the Estate:

- The executor or administrator files a final accounting with the court, detailing all transactions.

- Once approved, the estate is closed, and the executor is discharged.

Probate with a Will vs. Without a Will

- With a Will: The will dictates how assets are distributed, and the named executor manages the process. The court ensures the will is valid and follows its instructions, barring any legal challenges (e.g., claims of fraud or undue influence).

- Without a Will (Intestate): California’s intestacy laws determine asset distribution, prioritizing close relatives. For example:

- If the deceased had a spouse but no children, the spouse inherits everything.

- If there’s a spouse and children, the spouse gets half of the separate property, and the children share the rest.

- If there’s no spouse or children, assets go to parents, siblings, or more distant relatives.

Costs and Fees of Probate

Probate in California can be costly, with expenses including:

Probate Attorney and Personal Representative Fees

- 4% on the first one hundred thousand dollars ($100,000).

- 3% on the next one hundred thousand dollars ($100,000).

- 2% on the next eight hundred thousand dollars ($800,000).

- 1% on the next nine million dollars ($9,000,000).

- ½ of 1% on the next fifteen million dollars ($15,000,000).

- For all amounts above twenty-five million dollars ($25,000,000), a reasonable amount will be determined by the court.

Additional Fees other than Attorney and PR Fee

- Initial court filing fee: $465

- Publication: $205 - $1,000 (on average $250 - $500)

- Probate Referee: The fee is 1/10 of 1% of the estate value (i.e. if house is appraised at $1,000,000, then 1/10 of 1% is $1,000)

- Bond: Probate generally takes one year to complete, therefore the court imposes a bond on the personal representative to ensure that the personal representative does not run away with the money. The fee will depend on the value of the estate (i.e. if the net value of the estate is $1,000,000, then bond costs might be $5,000 to $10,000 for the year depending on your credit score)

Simplified Probate Procedures

For smaller estates, California offers streamlined options:

- Small Estate Affidavit: For estates valued under $750,000, heirs can transfer assets without formal probate by filing an affidavit 40 days after death.

- Spousal Property Petition: Allows a surviving spouse to transfer community property without full probate, typically faster and less costly.

These procedures are ideal for modest estates but may not apply if real property or disputes are involved.

Common Challenges in Probate

Probate can be fraught with challenges, including:

- Family Disputes: Heirs may contest the will, disagree on asset distribution, or challenge the executor’s actions, leading to delays and litigation.

- Creditor Claims: Unexpected debts can complicate the process, especially if the estate lacks sufficient funds.

- Probate Sales: Selling a house in probate often requires court approval, appraisals, and an overbidding process, extending the timeline (see our blog post on probate sales).

- Emotional Toll: Grieving family members may find the process stressful, particularly if it involves selling a sentimental family home.

How to Navigate Probate Successfully

To manage probate effectively:

- Hire a Probate Attorney: An experienced attorney can guide you through legal requirements, file documents, and resolve disputes, saving time and reducing errors.

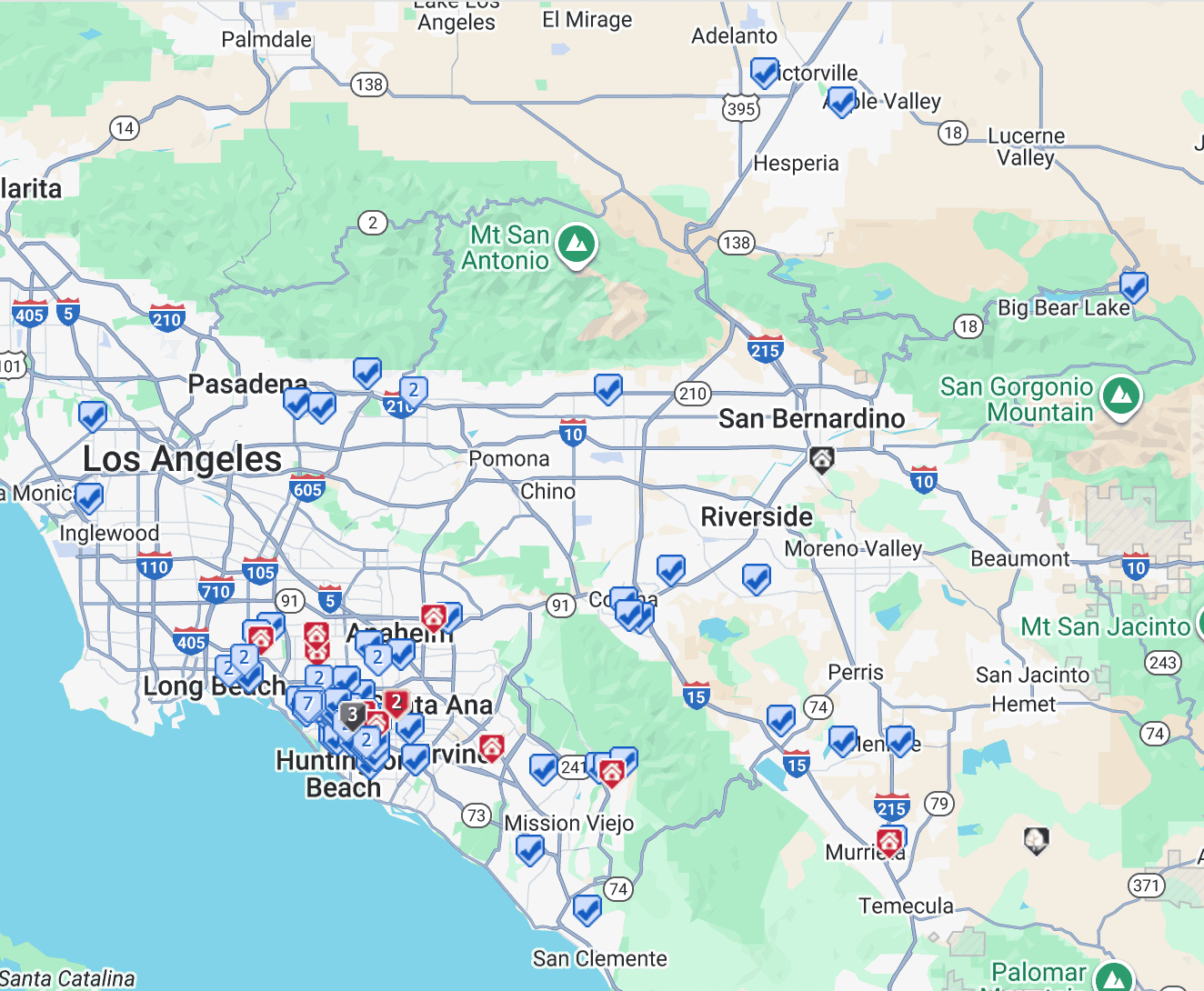

- Work with a Certified Probate Real Estate Agent: If the estate includes a house, a probate-savvy agent can handle the sale, market the property, and coordinate with the court. Check out the Probate Services we provide.

- Communicate with Heirs: Keep beneficiaries informed to minimize conflicts and foster transparency.

- Plan Ahead: To avoid probate for your own estate, consider creating a living trust, designating beneficiaries on accounts, or holding property in joint tenancy.

Conclusion

Probate in California is a court-supervised process to settle a deceased person’s estate, ensuring debts are paid and assets are distributed fairly. While it’s necessary for many estates, it can be time-consuming, costly, and emotionally challenging. By understanding the process, working with professionals like probate attorneys and real estate agents that are Certified Probate Specialists and addressing potential issues proactively, executors and heirs can navigate probate with greater ease. For those planning their own estate, exploring probate-avoidance strategies like trusts can spare loved ones the burden of this process.

If you’re facing probate in California, seek expert guidance to protect the estate’s value and honor the deceased’s legacy. If you need any help or guidance do not hesitate to reach out. Simply send us a message or book an appointment.