Probate Timeline

Navigating the Probate Process: A Step-by-Step Timeline

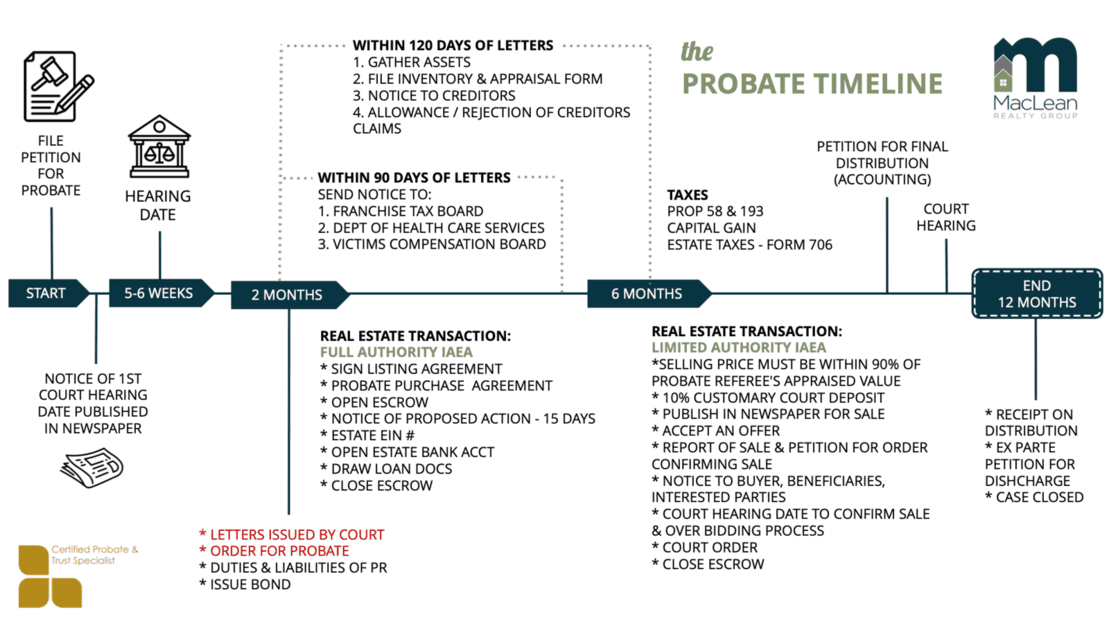

Navigating the probate process can feel overwhelming, especially when dealing with the loss of a loved one. Understanding the timeline and key steps involved can make the process smoother and less stressful. Let's breaks down the essential steps and considerations for managing a probate case, including asset management, creditor notifications, and real estate transactions.

Understanding the Probate Process

Probate is the legal process of administering a deceased person’s estate, ensuring assets are distributed according to their will or state law if no will exists. The process involves several critical steps, from gathering assets to settling debts and finalizing real estate transactions. Below is a clear, step-by-step guide to the probate timeline, designed to help executors and beneficiaries navigate the process efficiently.

Key Steps Within 90–120 Days of Receiving Letters of Administration

Once the court issues Letters of Administration or Letters Testamentary, the probate process begins in earnest. Here are the critical tasks to complete within the first 90 to 120 days:

Gather Assets: Collect and document all assets of the estate, including bank accounts, investments, personal property, and real estate. This step ensures a comprehensive inventory for the court and beneficiaries.

File Inventory & Appraisal Form: Within 120 days, submit an inventory and appraisal form to the court. This form lists all estate assets and their appraised values, often determined by a probate referee.

Send Notice to Creditors: Notify all potential creditors of the probate proceedings. This step is crucial to allow creditors to file claims for any debts owed by the deceased. Notices must also be sent to specific entities, such as:

Department of Health Care Services

Victims Compensation Board

Allowance or Rejection of Creditors’ Claims: Within this period, review and decide whether to allow or reject creditors’ claims. If disputes arise, a hearing may be scheduled to resolve them.

Real Estate Transactions in Probate

Real estate transactions are often a significant part of probate, especially when the estate includes property. If the executor has Independent Administration of Estates Act (IAEA) authority, they can handle property sales with some autonomy, though court oversight may still be required. Here’s how the process typically unfolds:

Steps for Selling Real Estate Under IAEA Authority

Sign Listing Agreement: Work with a real estate agent to list the property for sale.

Execute a Probate Purchase Agreement: Formalize the sale terms with the buyer.

Open Escrow: Initiate the escrow process to manage the transaction securely.

Notice of Proposed Action: Provide a 15-day notice to beneficiaries and interested parties about the proposed sale.

Obtain an Estate EIN: Secure a federal Employer Identification Number (EIN) for the estate to handle financial transactions.

Open an Estate Bank Account: Set up a dedicated account for estate funds.

Draw Loan Documents: If financing is involved, prepare necessary loan paperwork.

Close Escrow: Finalize the sale and transfer the property to the buyer.

Court-Supervised Real Estate Sales

If IAEA authority is not granted, the sale requires court approval, which involves additional steps:

Appraisal by Probate Referee: The selling price must be within 90% of the probate referee’s appraised value.

Court Deposit: A customary 10% deposit is required.

Publish Sale Notice: Advertise the property sale in a local newspaper.

Accept an Offer: Review and accept a buyer’s offer.

File Report of Sale & Petition for Confirmation: Submit a report to the court detailing the sale and request confirmation.

Notify Buyer, Beneficiaries, and Interested Parties: Provide formal notice of the sale.

Court Hearing: Attend a hearing where the court confirms the sale and allows for an overbidding process, where higher offers may be considered.

Court Order & Close Escrow: Once the court issues an order confirming the sale, finalize the escrow process.

Tax Considerations in Probate

Handling taxes is a critical aspect of the probate process. Executors must address:

Proposition 58 & 193: These California laws may allow certain property transfers to avoid reassessment for property tax purposes.

Capital Gains Tax: Calculate and report any capital gains from the sale of estate assets.

Estate Taxes (Form 706): File federal estate tax returns if the estate exceeds the federal exemption threshold.

Additional Probate Responsibilities

Upon issuance of the Letters by the court, the executor receives an Order for Probate, which outlines their Duties and Liabilities as the personal representative (PR). Depending on the court’s requirements, the executor may need to:

Issue a Bond: Provide a surety bond to protect the estate against mismanagement.

Fulfill Ongoing Duties: Manage estate assets, pay debts, and distribute property to beneficiaries according to the will or state law.

Why Professional Guidance Matters

The probate process can be complex, with strict deadlines and legal requirements. Mistakes can lead to delays, disputes, or financial penalties. If you find yourself overwhelmed about what to do let our Certified Probate Specialists assist you.

If you need any help or guidance do not hesitate to reach out. Simply send us a message or book an appointment.