The Orange County, California, real estate market remains a dynamic and closely watched region due to its premium status within Southern California. As we analyze the market through June 2025, we’ll explore key trends, including month-over-month (MoM) and year-over-year (YoY) changes in home prices, sales, and inventory, alongside current mortgage rates, their recent trends, and forecasts for the remainder of the year.

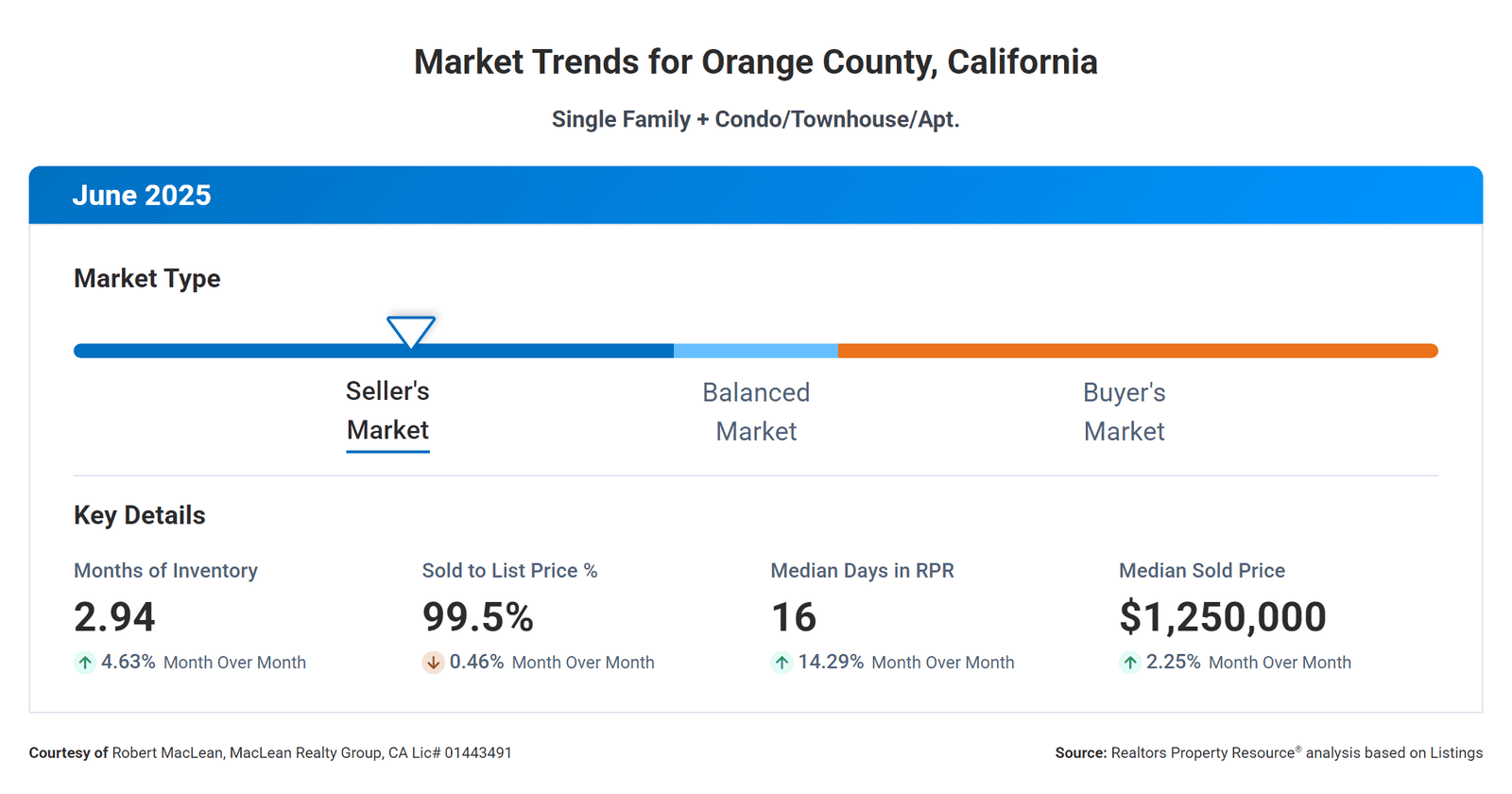

Market Overview: June 2025

Home Prices

In June 2025, the median home price in Orange County reached an all time high of $1,250,000, reflecting a modest YoY increase of 2.5% compared to June 2024. MoM data shows an uptick of 2.5% from May 2025, when the median price was approximately $1.22 million. This indicates a stabilization in price growth, with Orange County maintaining its position as a high-value market.

Home Sales

Home sales in June 2025 totaled 1,750, a slight MoM decrease from May’s 1,760 sales. YoY, sales were down just a bit at 1,730 in June 2024, reflecting a stabilized market.

Inventory

Inventory levels have been a critical factor in Orange County’s market dynamics. At the end of June 2025, there were 4,971 active listings, that's a 1.05% MoM increase from 4,750 homes in May 2025. YoY, inventory has risen notably, with 3,510 homes for sale at the end of June 2024, that's a 41.6% increase. This growth in inventory suggests a shift toward a more balanced market, providing buyers with more options and potentially more negotiating power.

Days on Market

Sold homes in Orange County spent an average of 16 days on the market in June 2025, which is an increase from the 10 days in June 2024. MoM, the days on market increased slightly from 14 days in May 2025. However, home that are active for sale have been on the market for 39 days.

Despite the increase in listing duration, 67% of homes sold within 30 days, 27% within 30–90 days, and 6% over 90 days, suggesting that well-priced properties in desirable areas continue to move quickly.

Mortgage Rates: Current Status, Trends, and Year-End Forecast

Current Mortgage Rates

As of early July 2025, the average 30-year fixed-rate mortgage (FRM) stands at 6.67%, a slight decrease from 6.77% at the end of June 2025, marking the lowest level since early April 2025. The 15-year FRM averages 5.80%. These rates reflect a five-week downward trend, driven by muted inflation data.

Recent Trends

Mortgage rates have shown volatility throughout 2025:

Peak: Rates hit 7.04% in January 2025, driven by inflationary concerns and geopolitical tensions.

Decline: By March, rates dipped to the mid-6% range, and by early July, they settled at 6.67% after five consecutive weeks of decreases.

Context: Rates are below the long-term average of 7.71% (1971–2025).

The Federal Reserve’s decision to maintain the federal funds rate at 5.25%–5.50% in June 2025, following three cuts in 2024, has kept mortgage rates relatively stable. The 30-year FRM closely tracks the 10-year Treasury yield, which was 4.26% in early July, contributing to the current rate environment.

Year-End Forecast

Experts predict that mortgage rates will remain in the mid-to-high 6% range through the end of 2025, with gradual declines possible if economic conditions soften:

Fannie Mae: Forecasts rates at 6.5% by year-end.

Mortgage Bankers Association (MBA): Predicts 6.7% for Q4 2025, with a further drop to 6.6% in Q1 2026.

National Association of Home Builders (NAHB): Expects rates to average 6.62% by year-end, falling to just above 6% by 2026.

Realtor.com: Projects a slight decline to 6.3% by December 2025.

The Federal Reserve’s cautious approach, with only two potential rate cuts anticipated in 2025, suggests limited downward movement.

Market Dynamics and Implications

For Buyers

The increased inventory and slightly longer days on market provide buyers with more choices and negotiating leverage compared to the frenetic seller’s market of recent years. Strategies for buyers include:

Pre-approval: Secure mortgage pre-approval.

Patience: With more inventory, buyers can be selective, focusing on location and condition.

Future Refinancing: Buyers purchasing now at higher rates may refinance if rates drop significantly in 2026.

For Sellers

Sellers must adapt to a market with increased competition due to rising inventory. Approximately 34% of listings in Orange County experienced price reductions, indicating the need for realistic pricing. Well-priced homes under $1.5 million continue to attract interest, while overpriced properties linger. Sellers should work with experienced agents to leverage local market data and craft effective pricing strategies.

Market Outlook

The Orange County housing market is transitioning toward a more balanced state, driven by increased inventory and moderated price growth. While demand remains strong due to the region’s desirability, high mortgage rates and affordability concerns are tempering sales volume. The market is expected to remain competitive but stable through 2025, with no significant price crashes anticipated due to robust underlying demand and significant home equity among homeowners.

Conclusion

Orange County’s real estate market shows resilience despite a cooling in sales and elevated mortgage rates. The median home price of $1,250,000 reflects steady YoY growth, though MoM changes are minimal. Inventory growth offers buyers more opportunities, while sellers must price strategically to attract interest. Mortgage rates, currently at 6.67%, are trending slightly downward but are expected to remain above 6% through year-end, with forecasts ranging from 6.3% to 6.7%. Buyers and sellers should stay informed and work with local experts to navigate this evolving market successfully.

For the latest market insights or to explore buying or selling opportunities, simply book an appointment or just reach out.