The Orange County, CA real estate market in October 2025 reflects a stabilizing yet competitive landscape, with cooling sales, steady median home prices, and extended days on market. As inventory grows and mortgage rates ease, buyers gain negotiation power, while sellers must strategize to stand out. This comprehensive update explores median home prices, sales trends, days on market, and mortgage rates.

Median Home Prices: Stability in a Premium Market

Orange County’s housing market remains one of California’s most sought-after, with median prices holding steady despite slight year-over-year fluctuations. Increased inventory and cautious buyer sentiment have tempered growth.

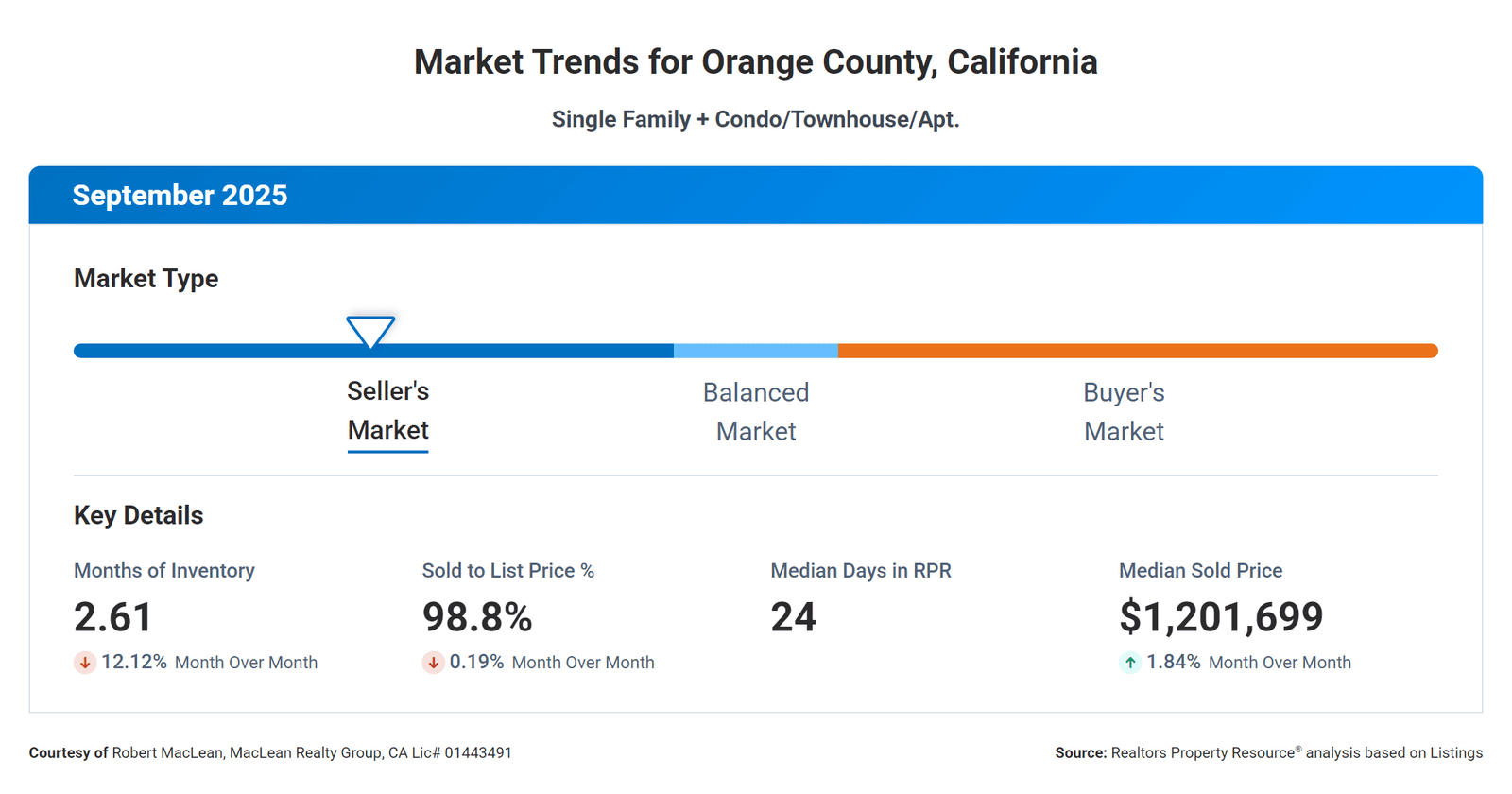

- Overall Median Sale Price: $1.20M (stable, +1.7% year-over-year)

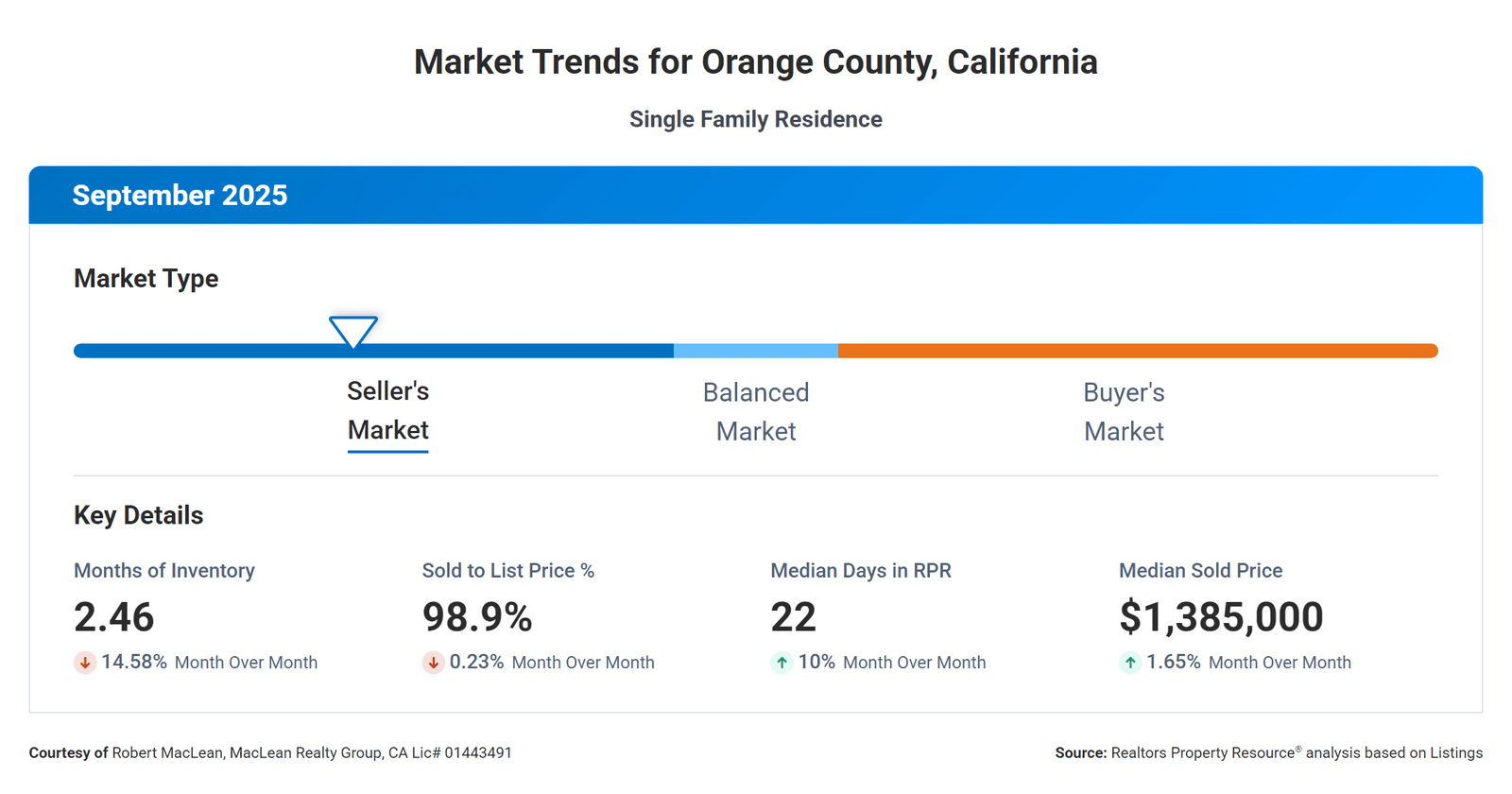

- Detached Single-Family Homes: $1.385M (+1.1% year-over-year)

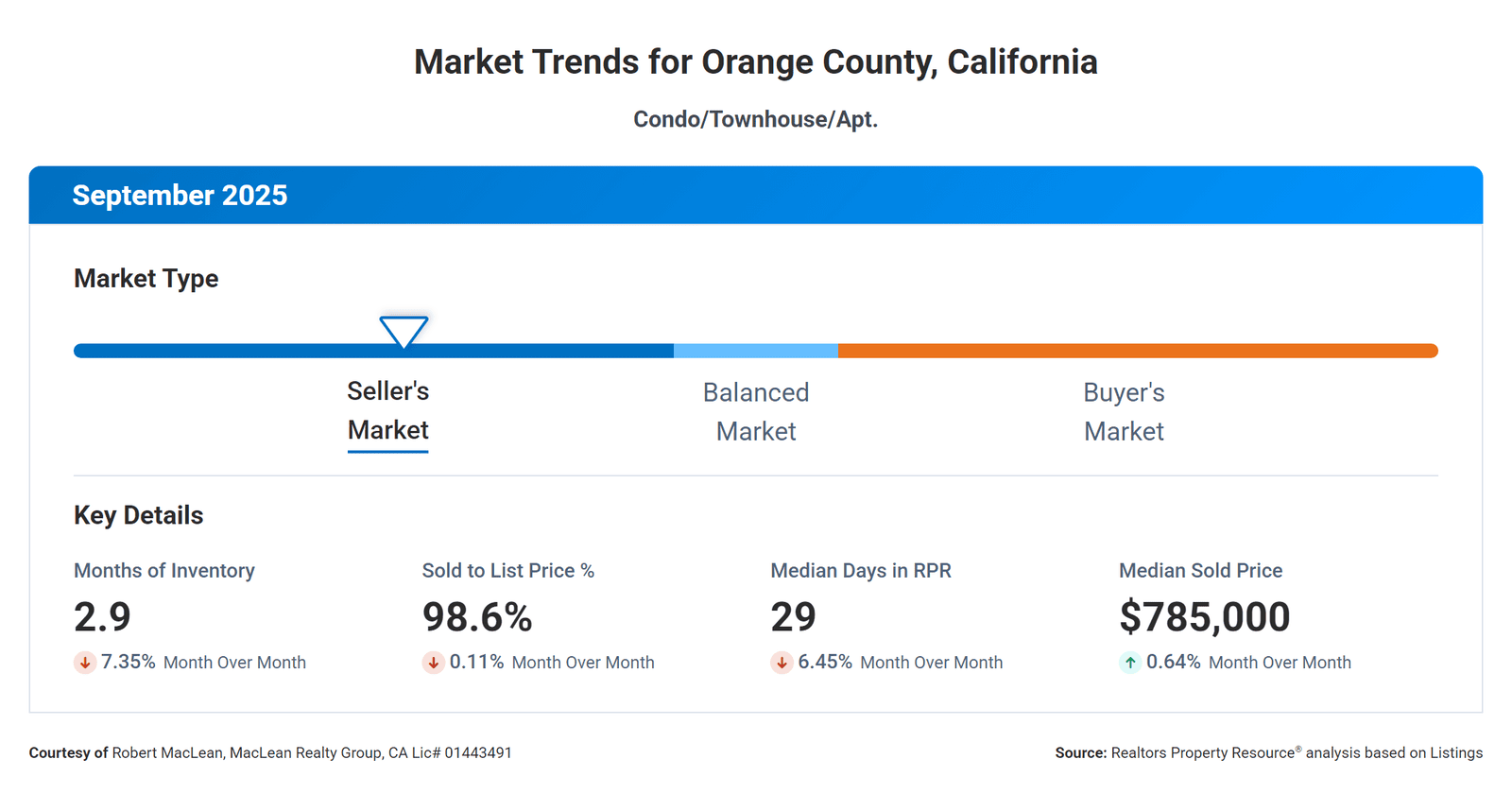

- Attached Homes (Condos/Townhomes): $785K (-1.2% year-over-year)

Key Insight: Home prices surpassed $1.1M earlier in 2025 and remain resilient, driven by strong demand from tech and tourism sectors. Zillow’s Home Value Index reports a typical home value of $1.04M (up 0.5% annually), while Redfin notes a median of $1.2M for August sales. Flat or modest price growth is expected through 2025, offering stability for buyers and sellers.

Sales Trends: A Balanced Market with Buyer Opportunities

Home sales in Orange County are cooling, aligning with a broader Southern California slowdown. Increased inventory (up 14% month-over-month in early 2025) has reduced bidding wars, creating a more balanced market.

- September 2025 Sales Single Family Homes: 1,149 sold (12.7% increase year-over-year)

- September 2025 Sales Condos/Tonwhomes: 586 sold (14% increase year-over-year)

- Sales-to-List Ratio: 98.8% (indicating slight buyer advantage)

- Local Highlight: The city of Lake Forest recorded 64 home sales in September, up from 56 last year.

Key Insight: Sales peaked in spring but softened into fall, reflecting a 1.7% regional sales drop. Mortgage applications are rising as cash purchases decline, signaling financing-driven demand. Forecasts suggest a cautious market through 2027, with recovery tied to employment growth by 2028.

Days on Market: Longer Selling Times Empower Buyers

Homes are staying on the market longer as buyers leverage growing inventory to negotiate, shifting the market dynamic.

- Median Days on Market: 24 days (+71% from 14 days last year)

- Active Listing Days: 53 days (+17.8% from 45 days year-over-year).

Key Insight: Redfin’s August data highlights a significant increase in days on market, a departure from the frenzy of prior years. Well-priced homes still go pending in about 24 days, but average listings linger, giving buyers room to negotiate. National surveys show 60% of sellers view now as a good time to list, but competitive pricing is critical.

Mortgage Rates: Easing Rates Boost Affordability

Mortgage rates have declined since the Federal Reserve’s September 2025 rate cut, offering relief to buyers in a high-price market.

- 30-Year Fixed Rate: 6.34% APR (lowest since early 2025)

- 15-Year Fixed Rate: 5.70% APR (stable)

Key Insight: Rates dropped to 6.32% mid-week (per Mortgage News Daily), down from a 2023 peak of 7.74%. This has increased mortgage applications and improved buyer sentiment (Fannie Mae index at 73.5, a 2025 high). Affordability remains challenging due to high prices, but rates may fall to 6.0–6.2% by 2026 if inflation cools.

Navigating Orange County’s 2025 Market: Tips for Buyers and Sellers

October 2025 offers a more balanced market than earlier this year, with rising inventory, lower rates, and longer selling times creating opportunities. Coastal areas like Newport Beach remain premium, while inland cities like Rancho Santa Margarita offer relative affordability.

- For Buyers: Partner with us to explore sub-market nuances and negotiate effectively in a buyer-friendly environment.

- For Sellers: Price competitively to attract multiple offers and avoid extended listing times.

- For Investors: Monitor employment trends and inventory growth, as recovery is projected for 2028.

Ready to dive into Orange County’s real estate market? Contact us to navigate this evolving landscape. Subscribe to our blog for monthly updates on Southern California housing trends!