October 2024 Real Estate Market Report

October 2024 Real Estate Market Report

The market has definitely been going through some swings. It really can change on a dime from one direction to another in any given day. You need to dive deep into the data to see what is really going on. The numbers can be a little deceiving.

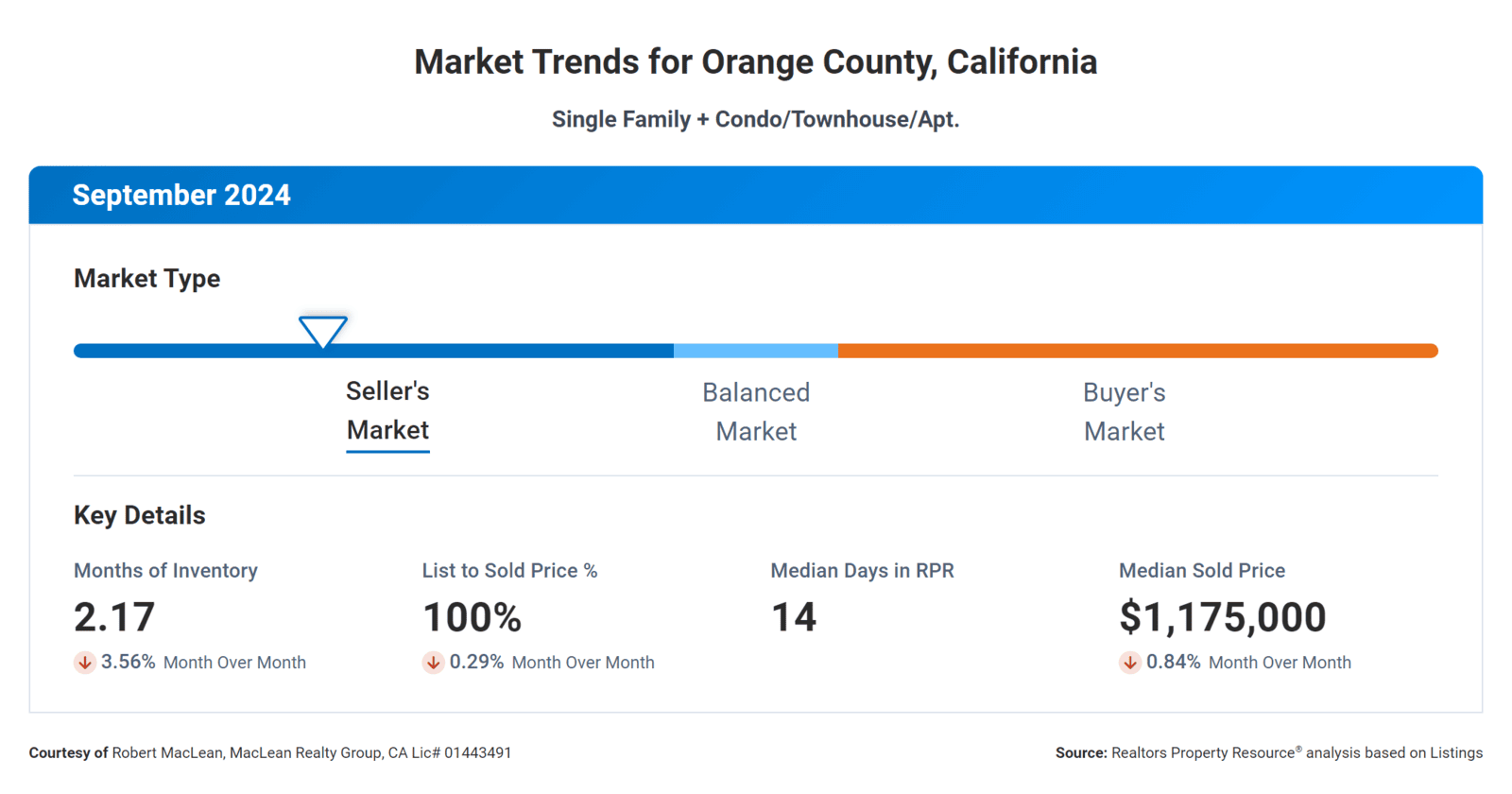

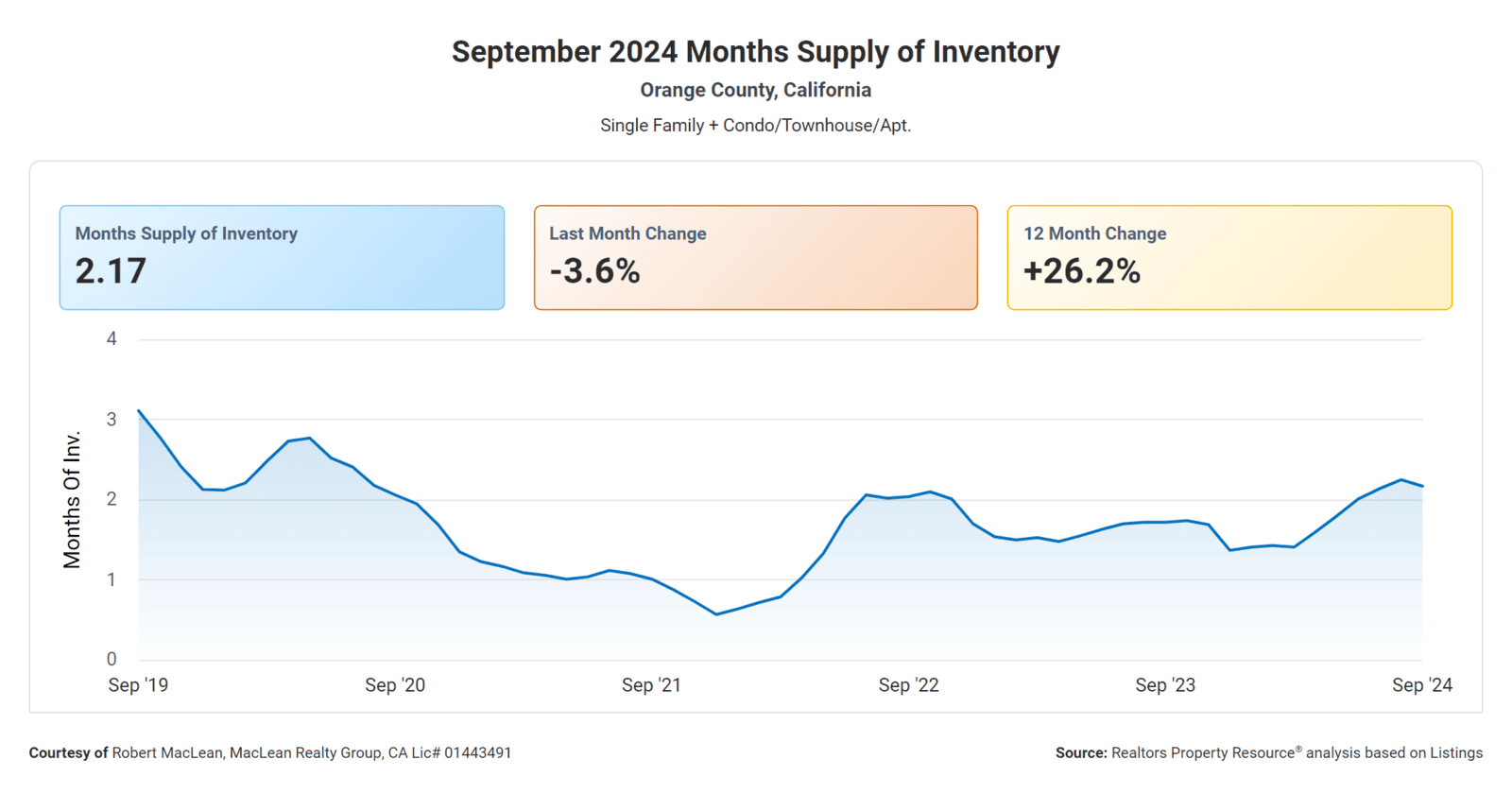

Months Supply of Inventory is sitting at a low 2.17. We need to be somewhere between 3 and 6 months to get back to a more equilibrium market. Generally we would see prices continuing to rise with this low of inventory, but with rates staying in the 6's, it has kept prices a little more stabilized. The good news is that we are seeing an upward trend in home inventory.

12-Month Change in Months of Inventory has increased by 26.2%. This indicates that the market may be shifting towards a more balanced state, with more inventory becoming available for buyers to choose from. Inventory can really be different from city to city and neighborhood to neighborhood. I would drill down and look specifically at the inventory in the city and neighborhood you are interested in.

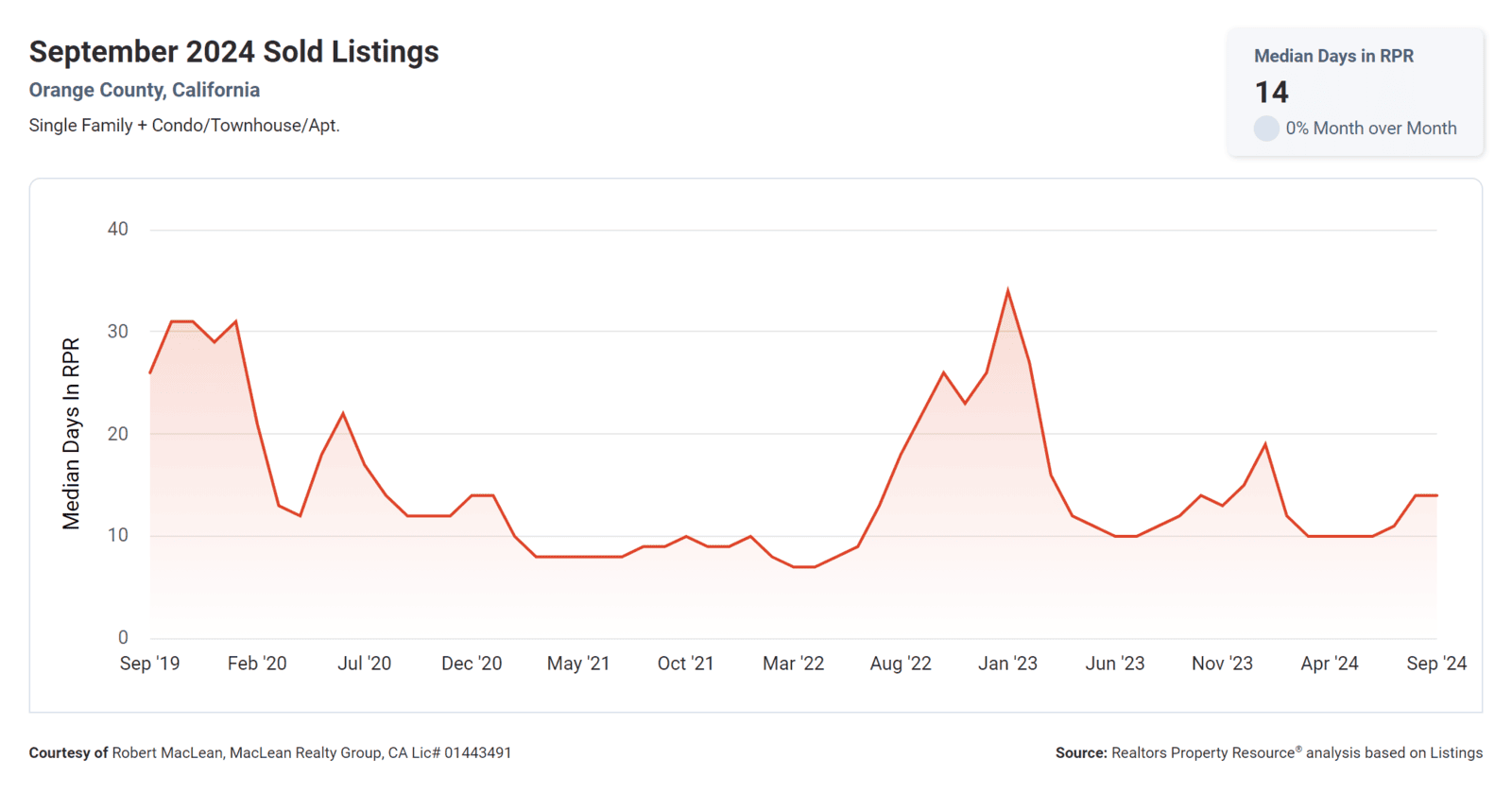

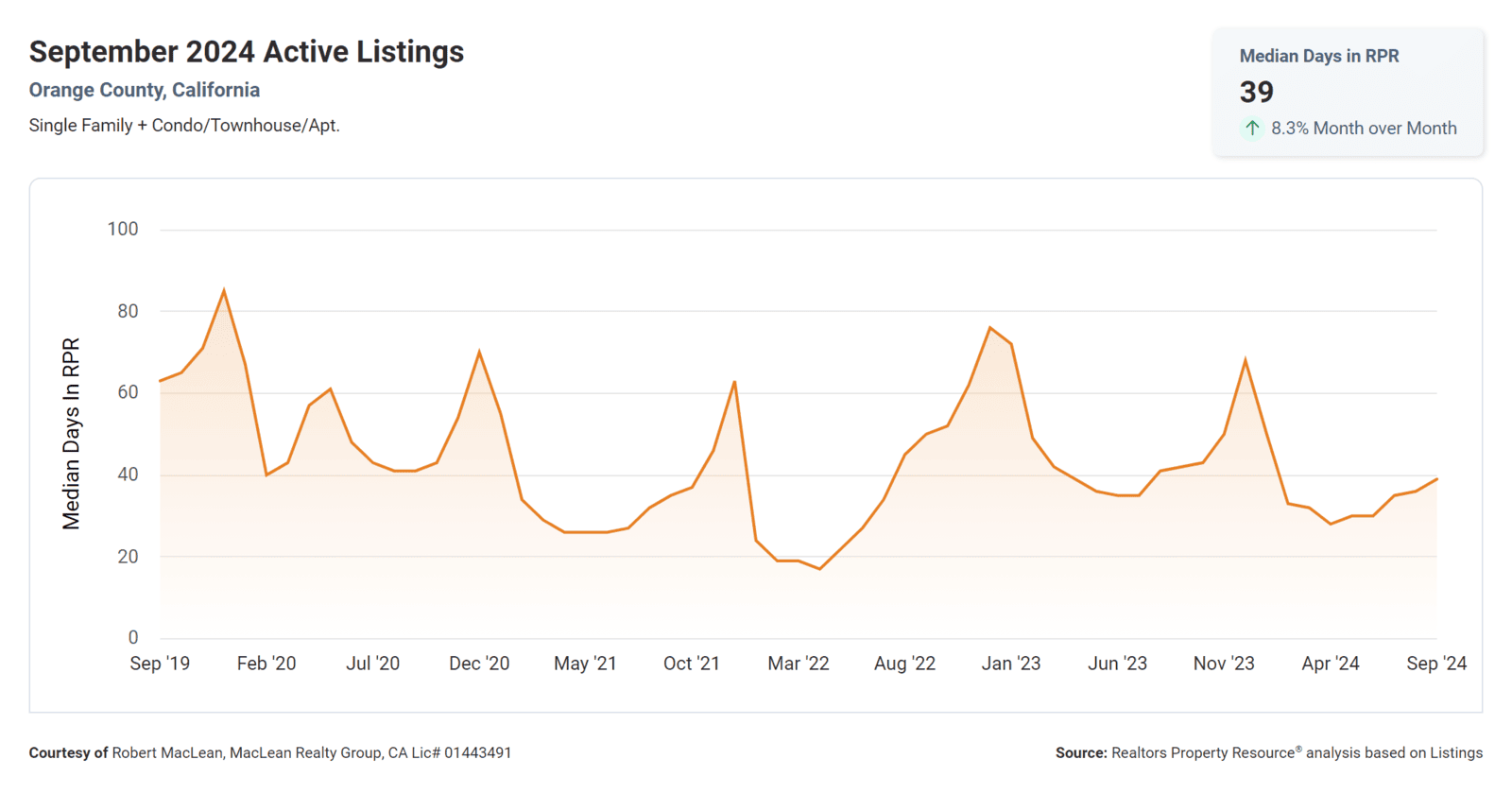

Median Days Homes are On the Market is a mere 14 days. This quick turnover time suggests that homes are selling fast in this market, making it a great time for sellers to list their properties. We would need to be closer to 60 to 90 days on the market to be more balanced.

This is where I was telling you the data can be deceiving. Although sold data shows only 14 days on the market, current listings have been on the market for 39 days. Which tells us inventory is sitting quite a bit longer all of a sudden. Is this because homes are coming on the market listed too high? Did rates all of a sudden jump? Both may be true.

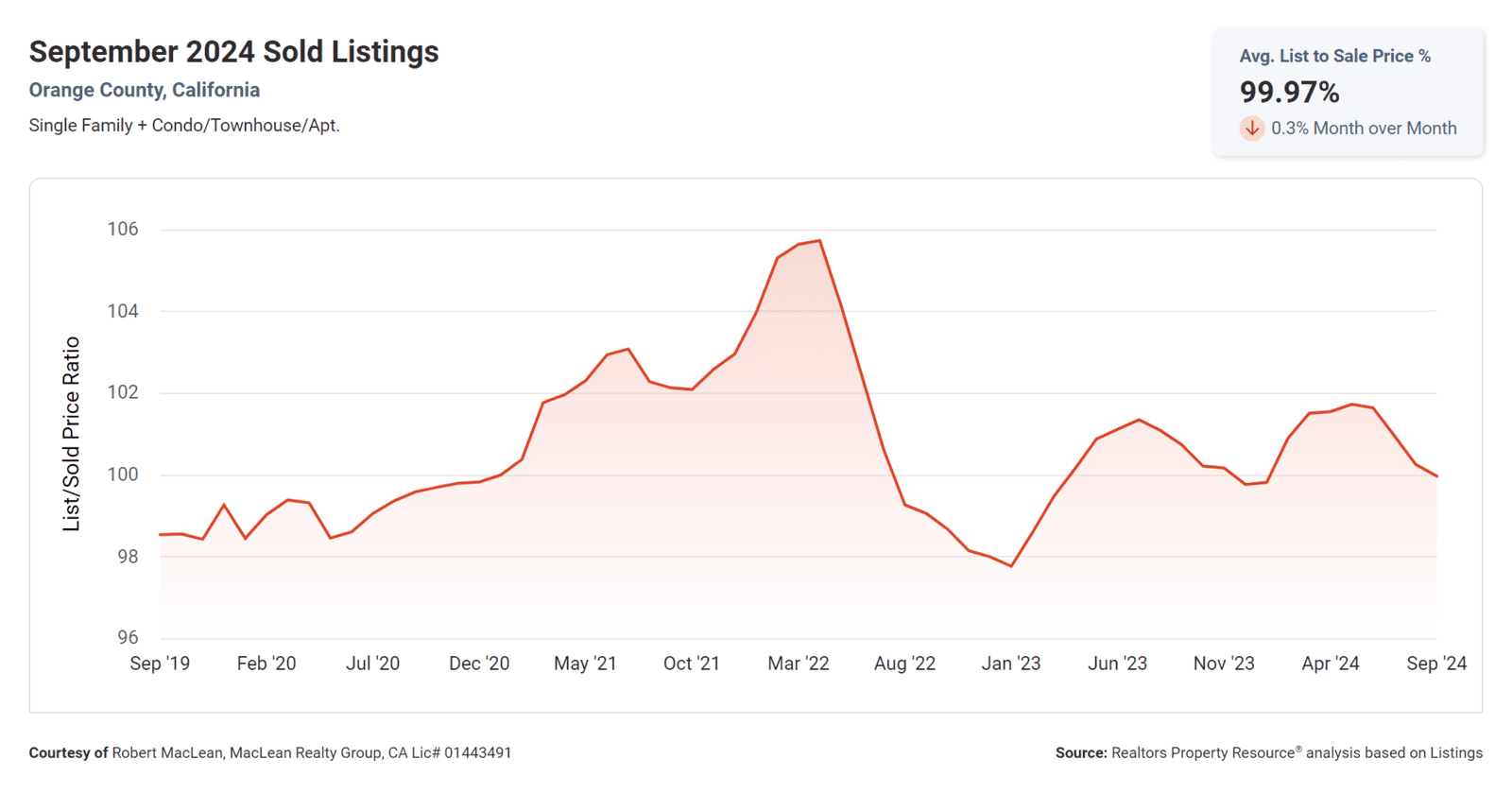

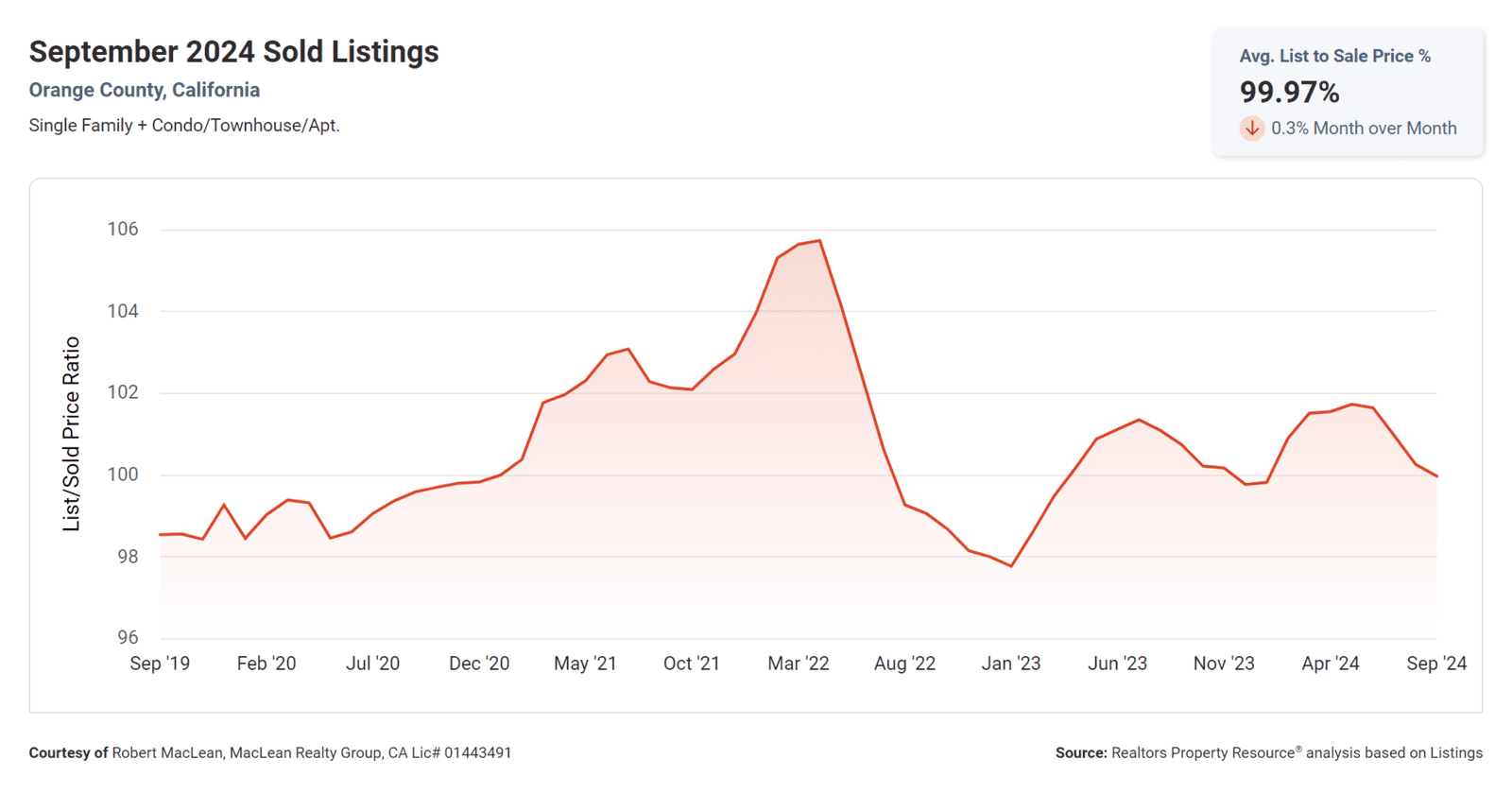

List to Sold Price Percentage is 99.97%. We can see that homes are generally selling for their last asking price. Which means the house could have started out listed higher and they had to drop their price to get an offer. You need to look at the historical listing data on the individual home to see the exact story on that.

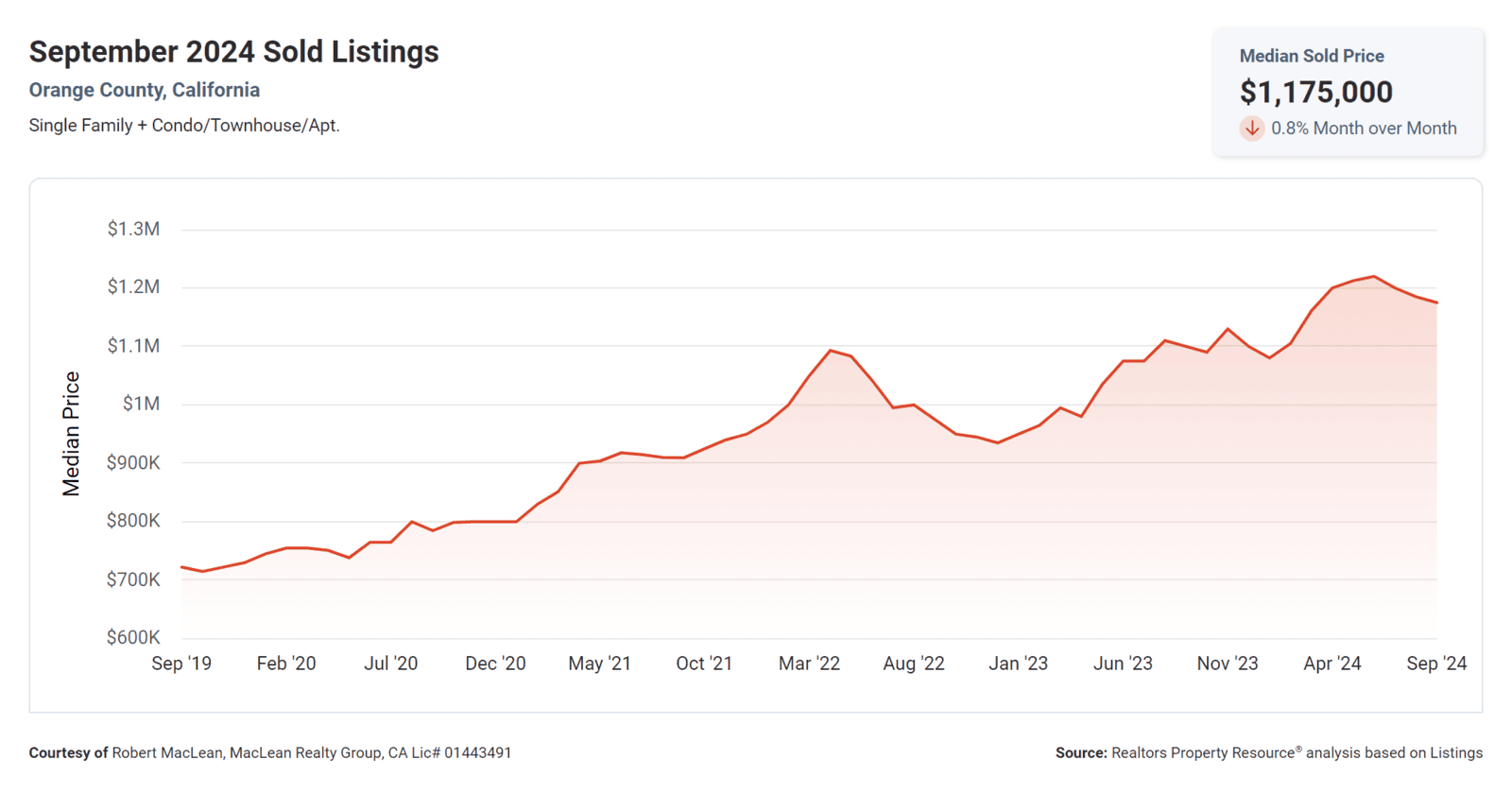

Median Sold Price is $1,175,000. That's 6.8% higher than a year ago but down 3.8% from June. We will need to watch this to see if this is a trend or a just a fluctuation of interest rates driving the market.

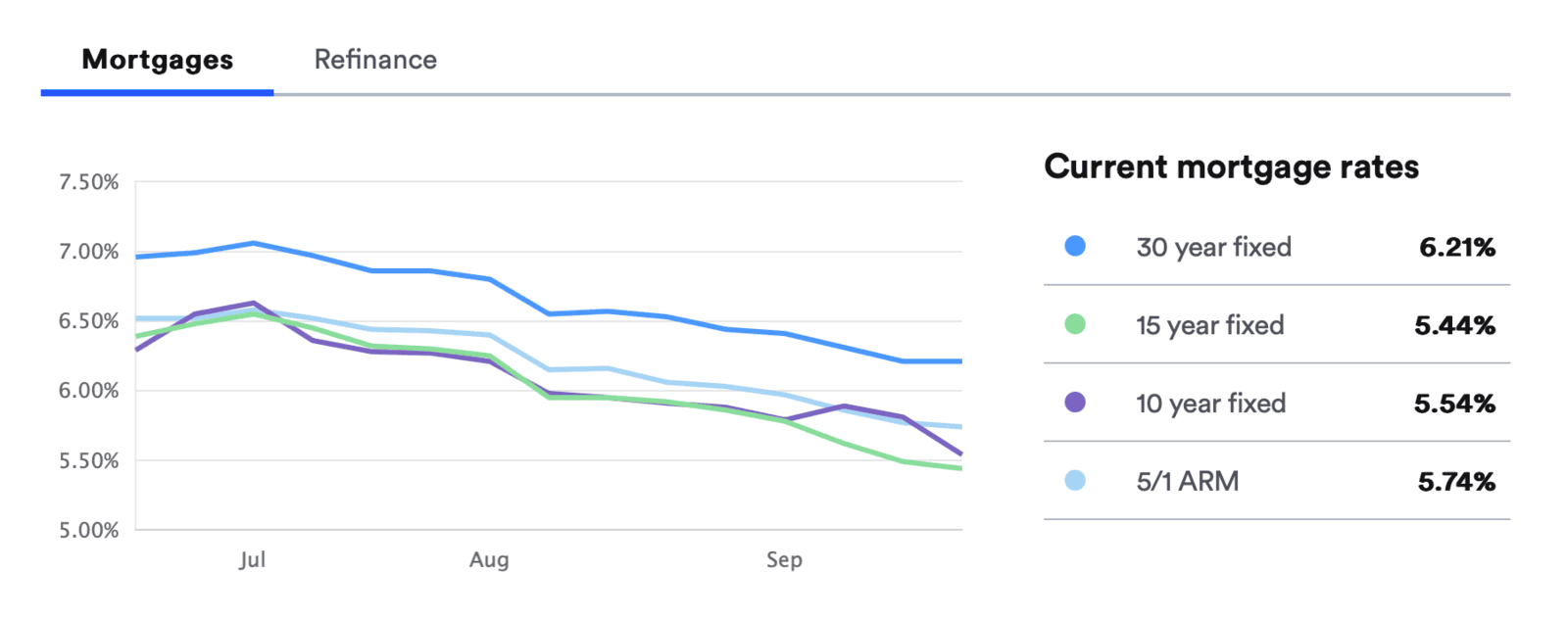

Mortgage Rates Info

- On Wednesday, October 09, 2024, the current average interest rate for a 30-year fixed mortgage is 6.46%, increasing 26 basis points from a week ago.

- If you're planning to refinance, the national average interest rate for a 30-year fixed refinance is 6.48%, up 26 basis points from a week ago.

- The current average 15-year fixed refinance interest rate is 5.79%, increasing 30 basis points from a week ago.

- For now, the consensus is that mortgage rates will ease down in 2024.

Conclusion

The market seems to be changing weekly based on many moving pieces like mortgage rates, housing inventory, and inflation. To understand what is going on in your neighborhood simply send me a quick message and I will prepare a market report specifically for your needs.