February 2025 Real Estate Market Report

February 2025 Real Estate Market Report

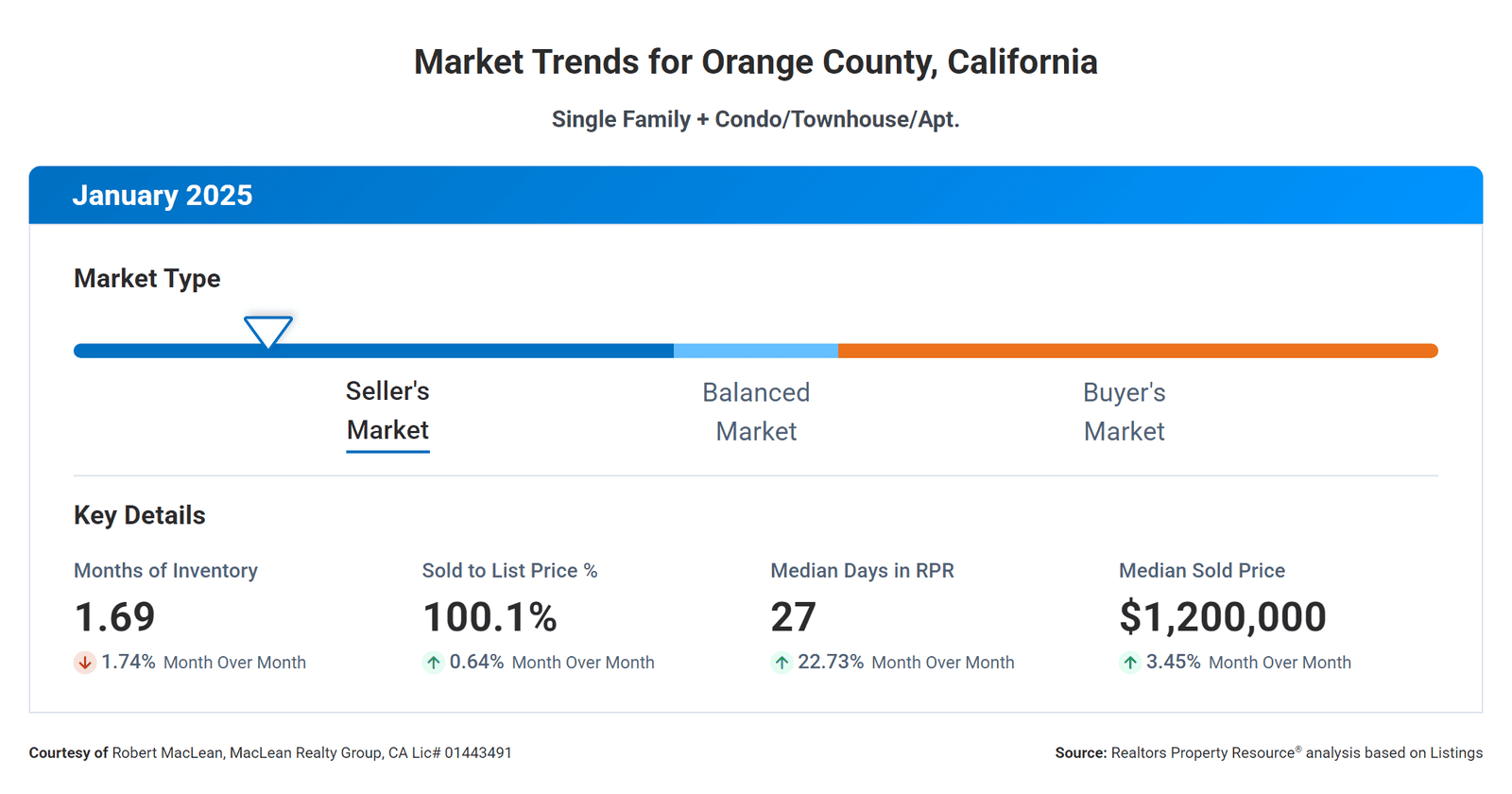

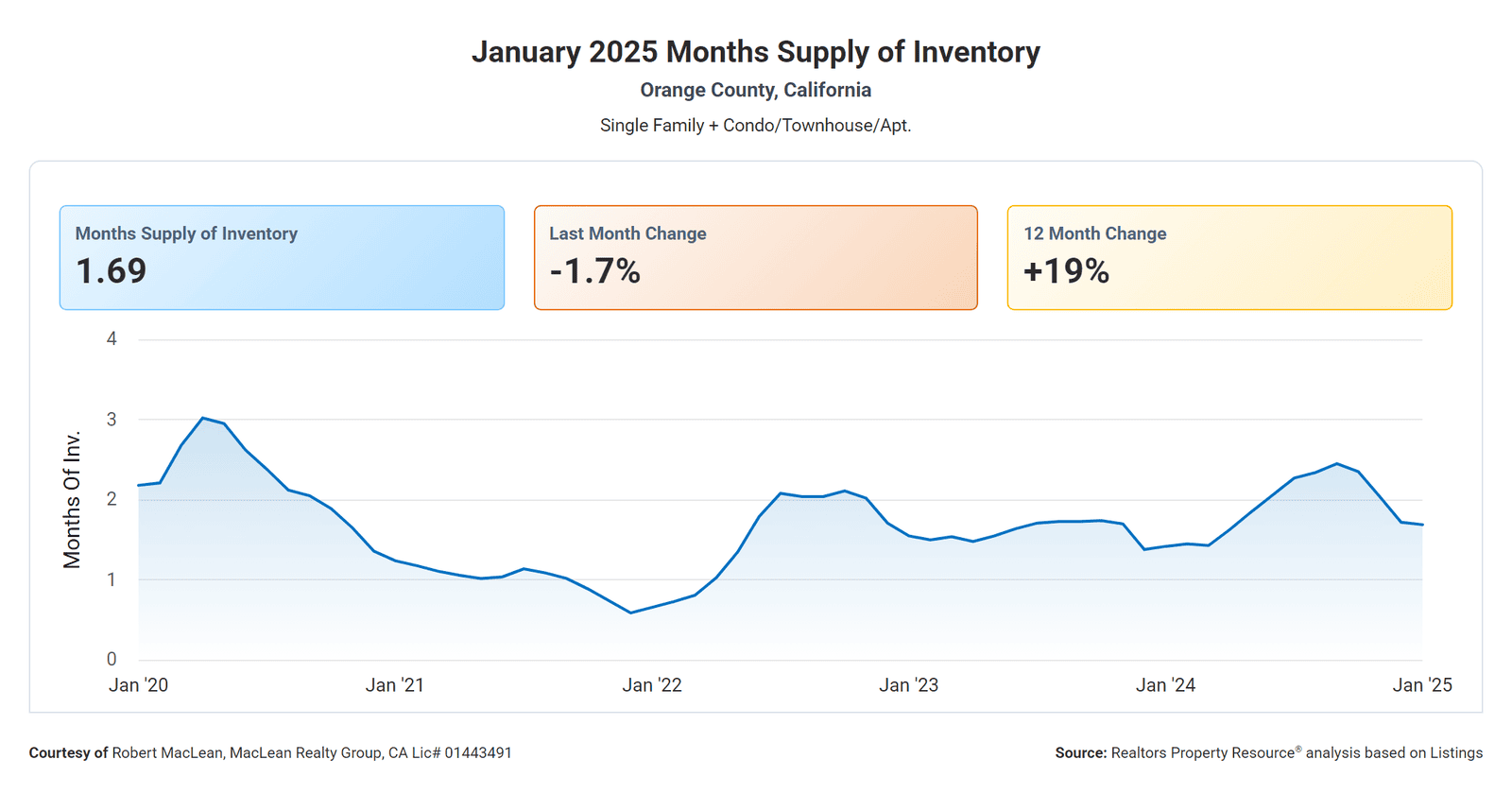

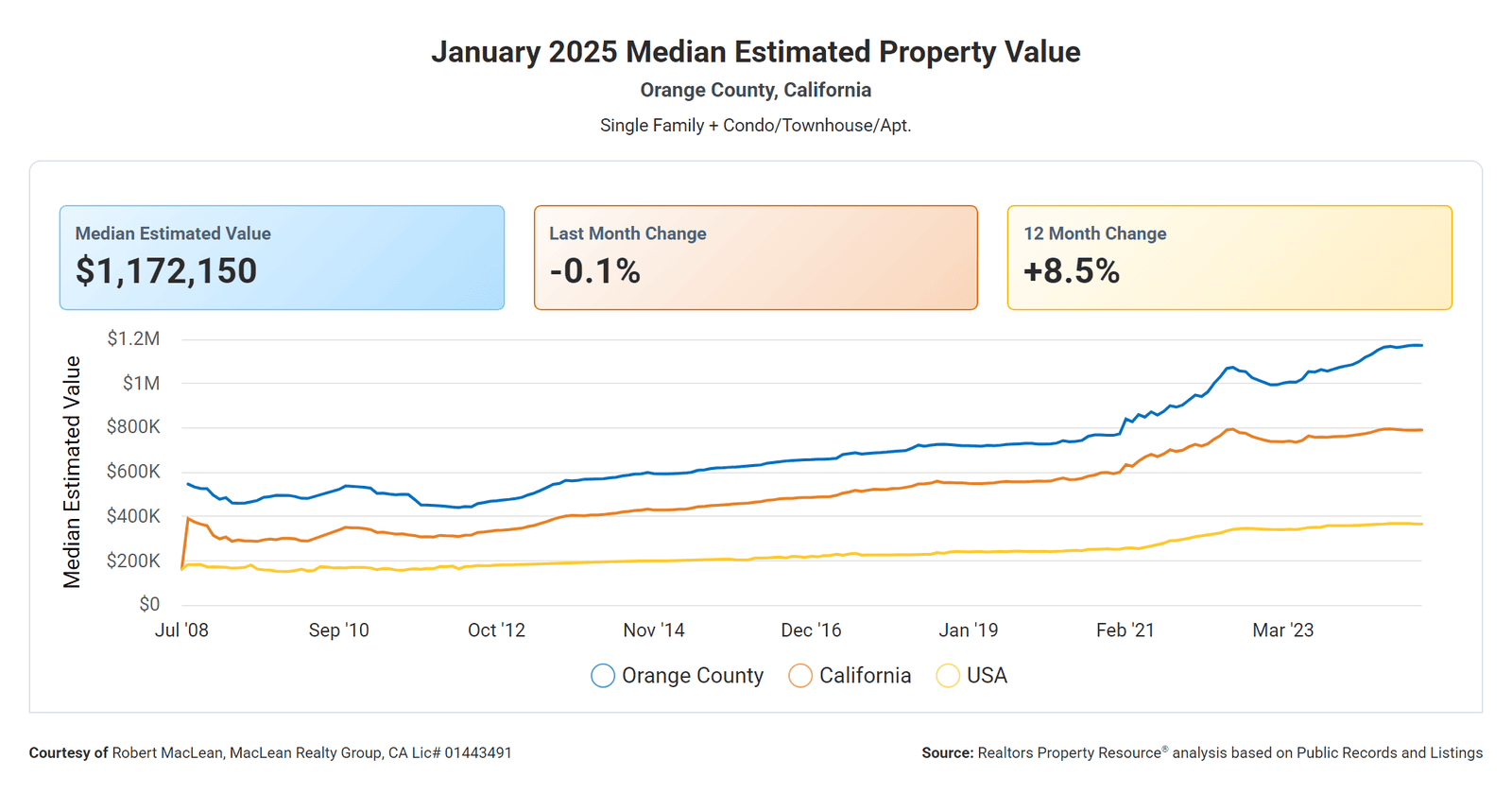

A quick overview shows that the market seems to be maintaining itself. We did have a sharp drop in days on market which can be explained. Mortgage rates remain stubbornly high and mortgage experts have been invoking the phrase “higher for longer.” Let take a deep dive and see what the numbers tell us.

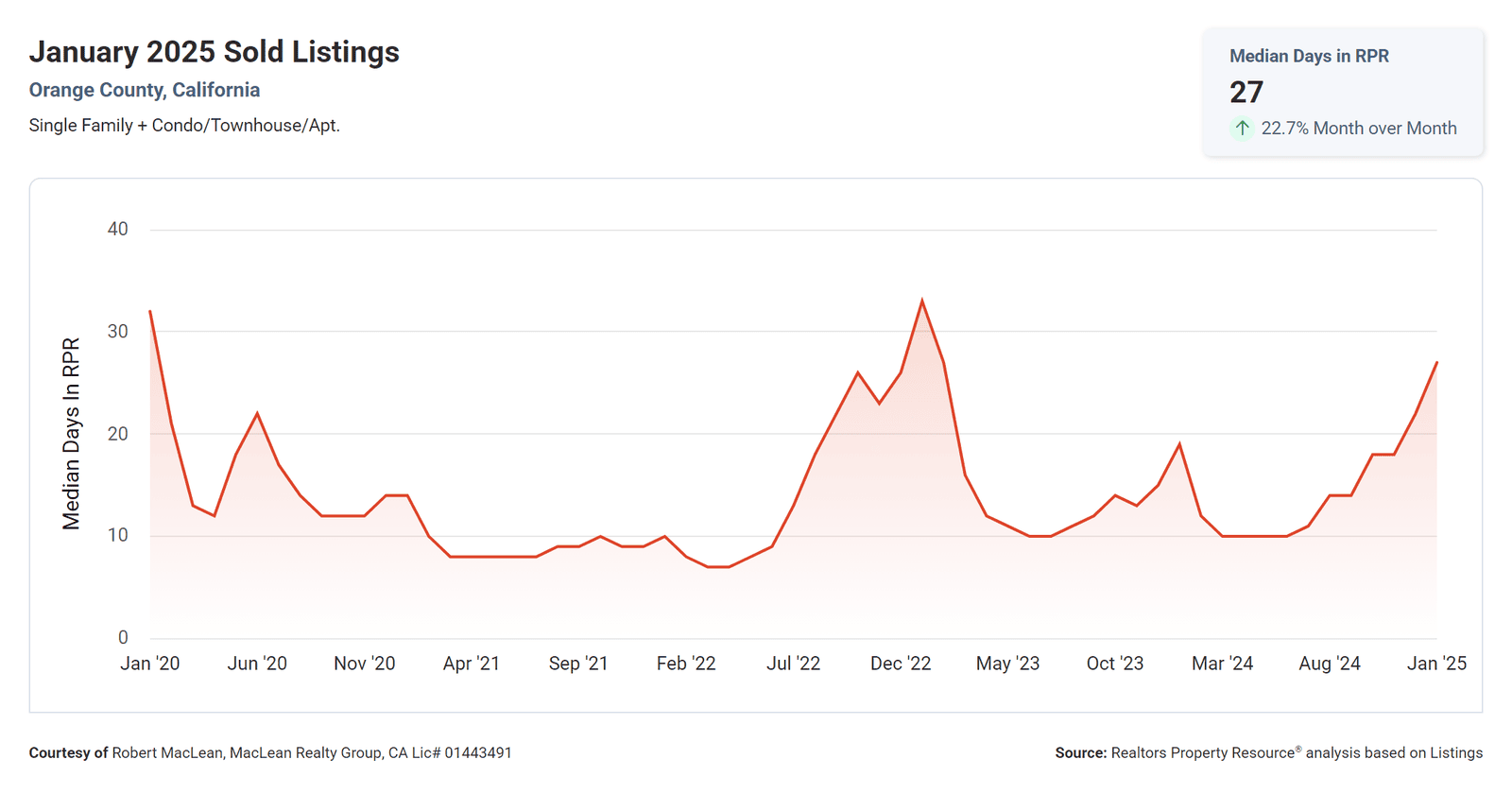

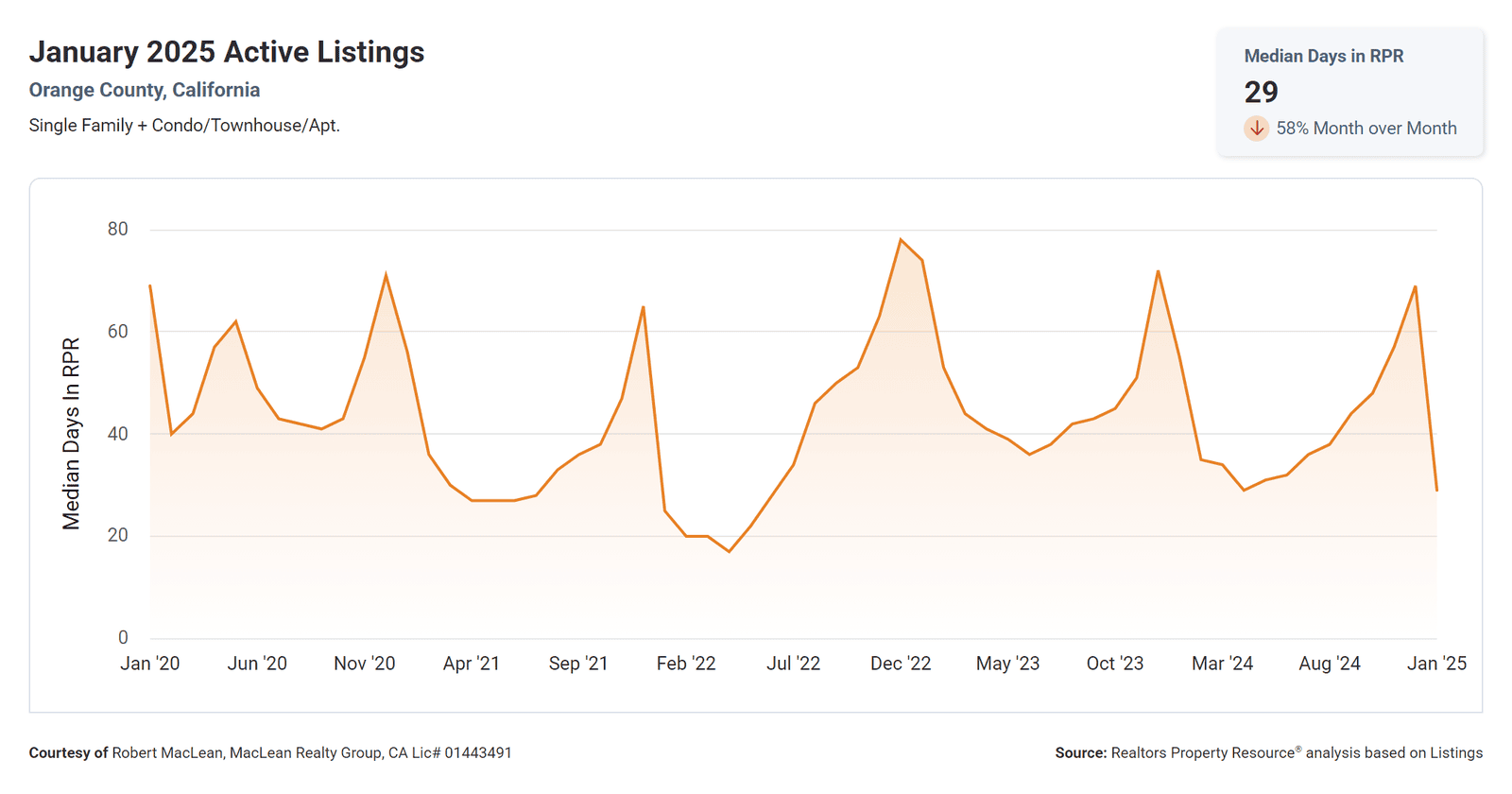

Active Listings Days on Market dropped from 66 in December to 29 in January. The reason for this is we had 972 houses and condos get withdrawn, cancelled or expired. Most of those having very high days on market. Homes that are priced according to market trends get sold relatively quickly. Those that over reach will stay on the market.

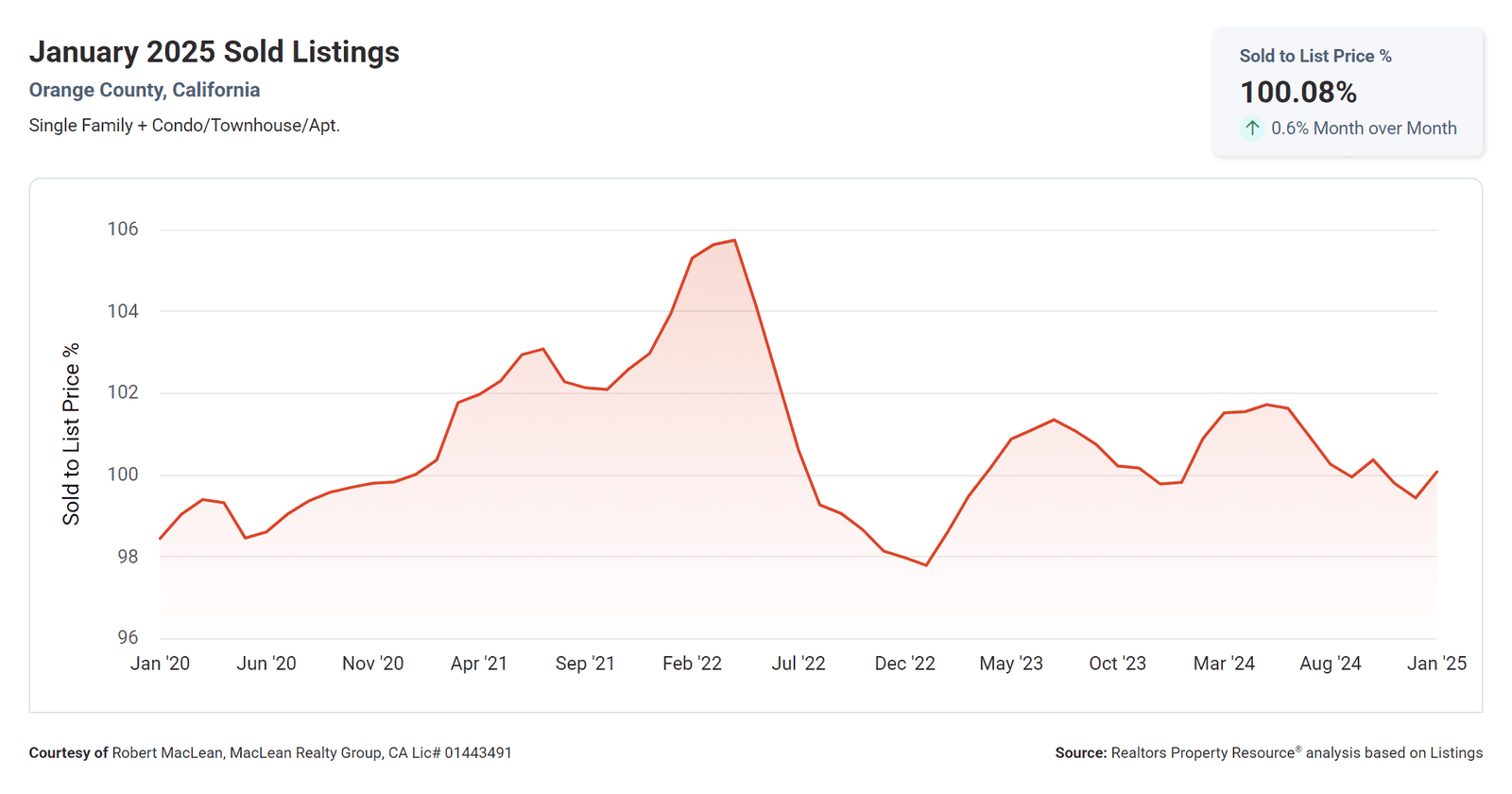

Active Listings Days on Market dropped from 66 in December to 29 in January. The reason for this is we had 972 houses and condos get withdrawn, cancelled or expired. Most of those having very high days on market. Homes that are priced according to market trends get sold relatively quickly. Those that over reach will stay on the market.  Sold to List Price Percentageis 100.08%. We can see that homes are generally selling for their last asking price. However, the house could have started out listed higher and they had to drop their price to get an offer. You need to look at the historical listing data on the individual home to see the exact story on that.

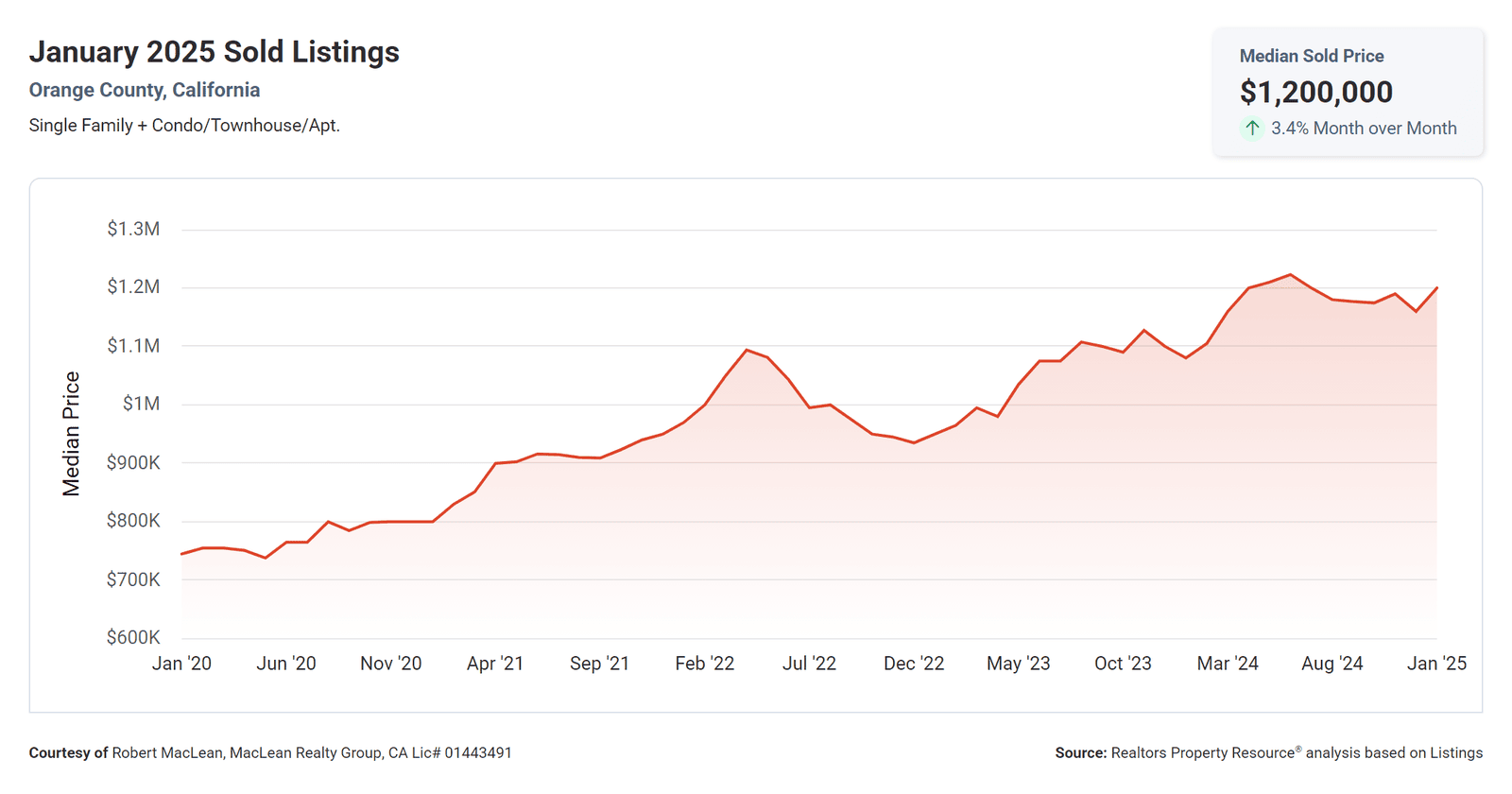

Sold to List Price Percentageis 100.08%. We can see that homes are generally selling for their last asking price. However, the house could have started out listed higher and they had to drop their price to get an offer. You need to look at the historical listing data on the individual home to see the exact story on that. Median Sold Price is $1,200,000. That is up 3.4% from last month which is starting to trend back to the June 2024 peak of $1.22 million.

Median Sold Price is $1,200,000. That is up 3.4% from last month which is starting to trend back to the June 2024 peak of $1.22 million.

Orange County Fun Facts

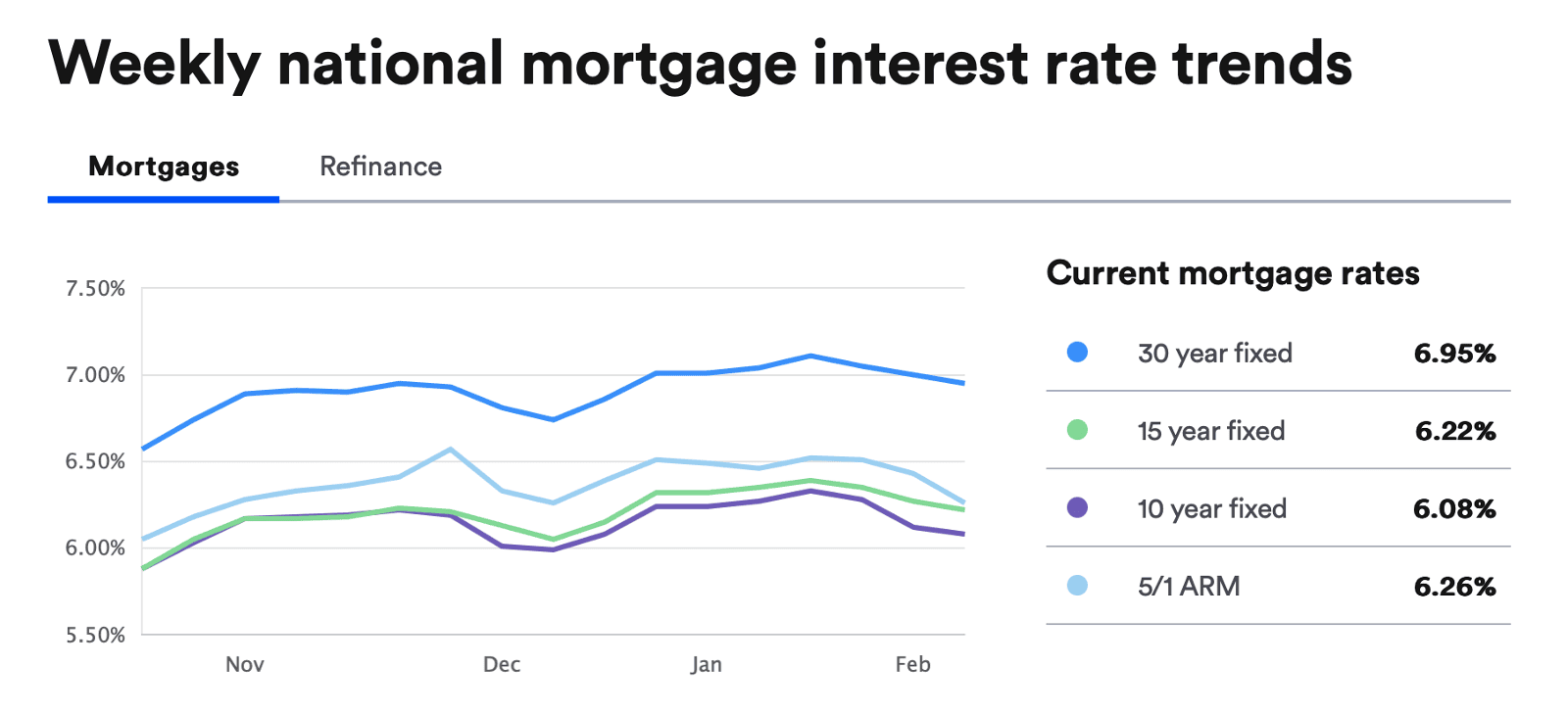

- On Wednesday, January 08, 2025, the current average interest rate for the benchmark 30-year fixed mortgage is 7.02%, up 1 basis point from a week ago.

If you're looking to refinance your current mortgage, the current average 30-year refinance interest rate is 6.91%, decreasing 4 basis points since the same time last week.

The national average 15-year fixed refinance interest rate is 6.22%, decreasing 1 basis point compared to this time last week. For now, the consensus is that mortgage rates will ease down in 2024.

Reflecting the new reality that mortgage rates aren’t going to plunge, mortgage experts have been invoking the phrase “higher for longer.” The Federal Reserve announced no change to its benchmark federal funds rate at its first meeting of 2025, coming off three consecutive rate cuts that started in September.

The Fed cuts haven’t played out as expected. When the central bank first started cutting, housing economists fully expected the Fed’s policy to bring back sub-6 percent mortgage rates. Instead, they stubbornly remain above 7 percent. Despite the Fed's decision to hold rates steady, it does not control the direction of mortgage rates — that influence comes mostly 10-year Treasury bond yields.