Orange County, California, remains one of the most desirable places to live in the United States, blending coastal charm, vibrant communities, and proximity to major economic hubs like Los Angeles and San Diego. As we move through 2025, the real estate market in Orange County continues to evolve, shaped by economic shifts, buyer preferences, and local dynamics. Whether you're a prospective buyer, seller, or investor, understanding the current trends in this competitive market is key to making informed decisions. Here's a deep dive into what's happening in Orange County's real estate scene.

Market Overview: A Resilient Yet Competitive Landscape

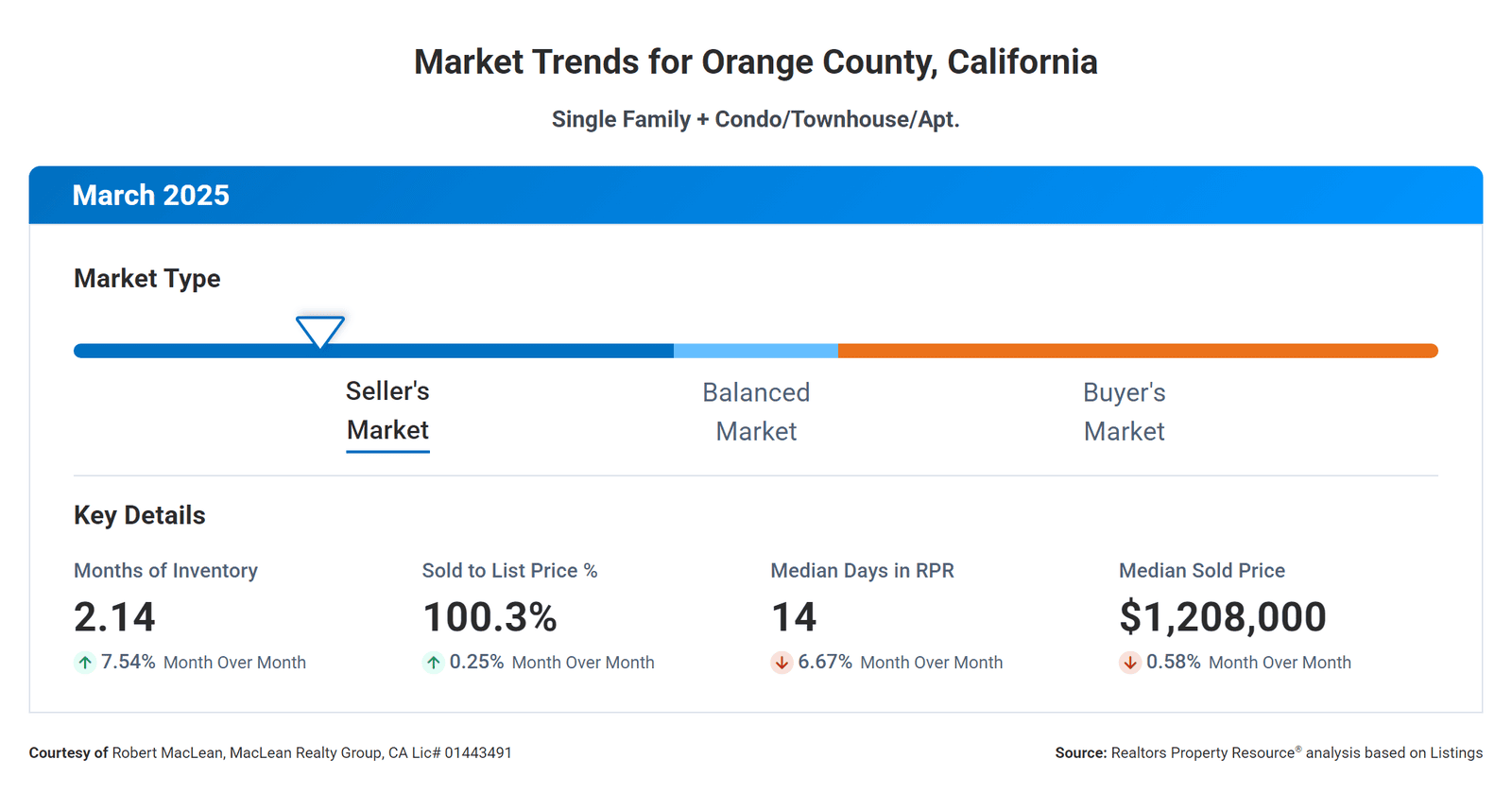

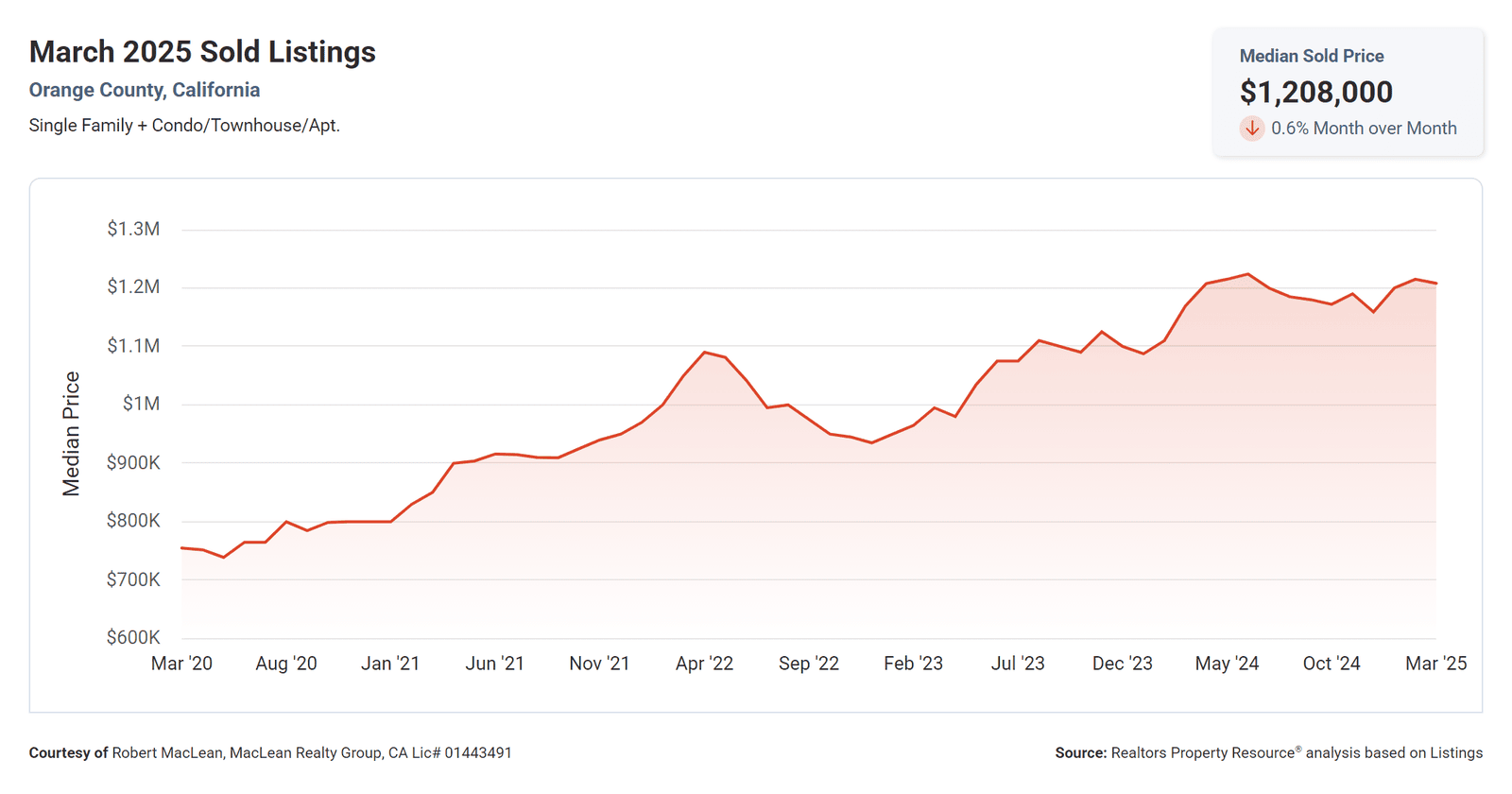

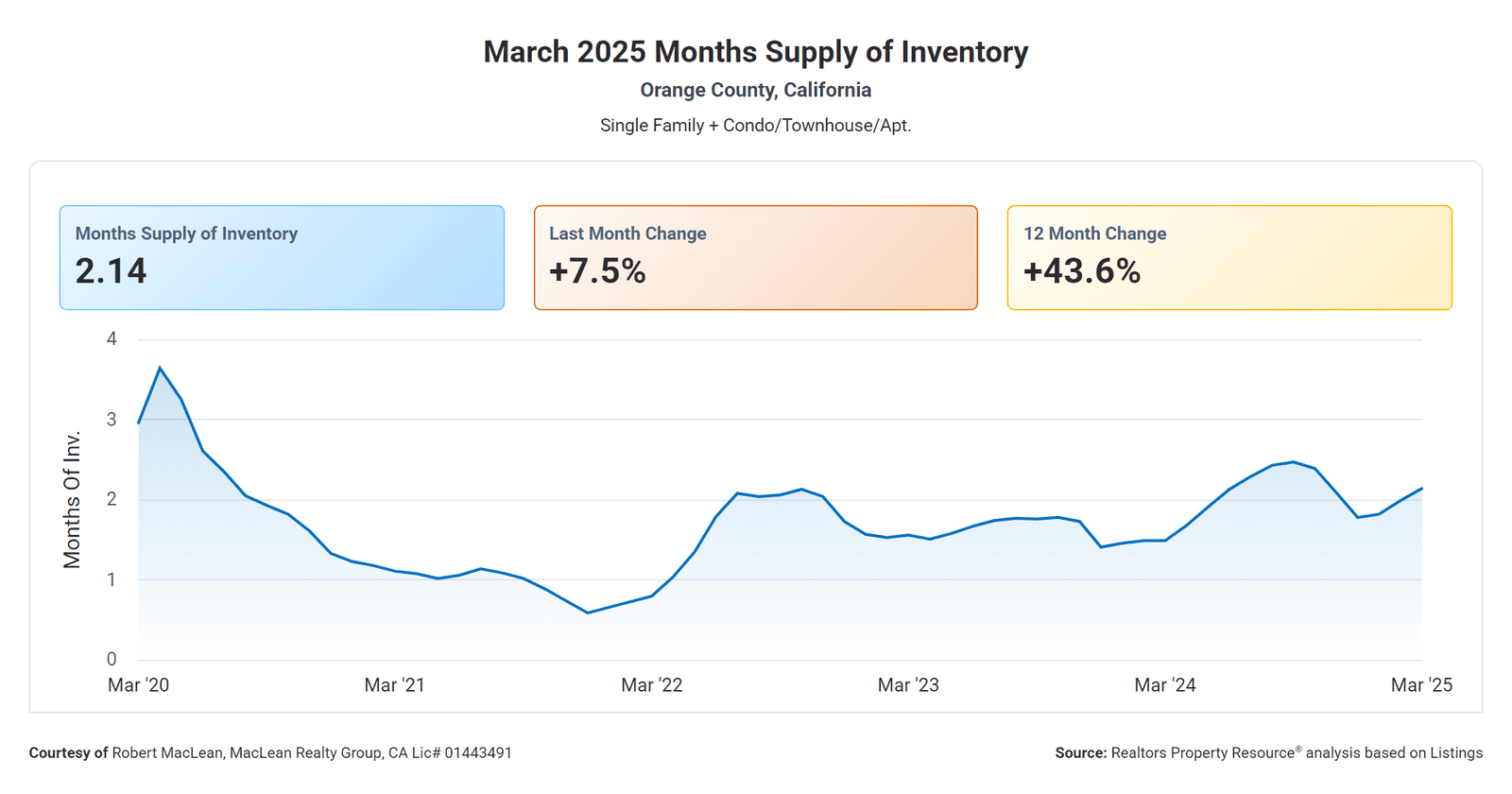

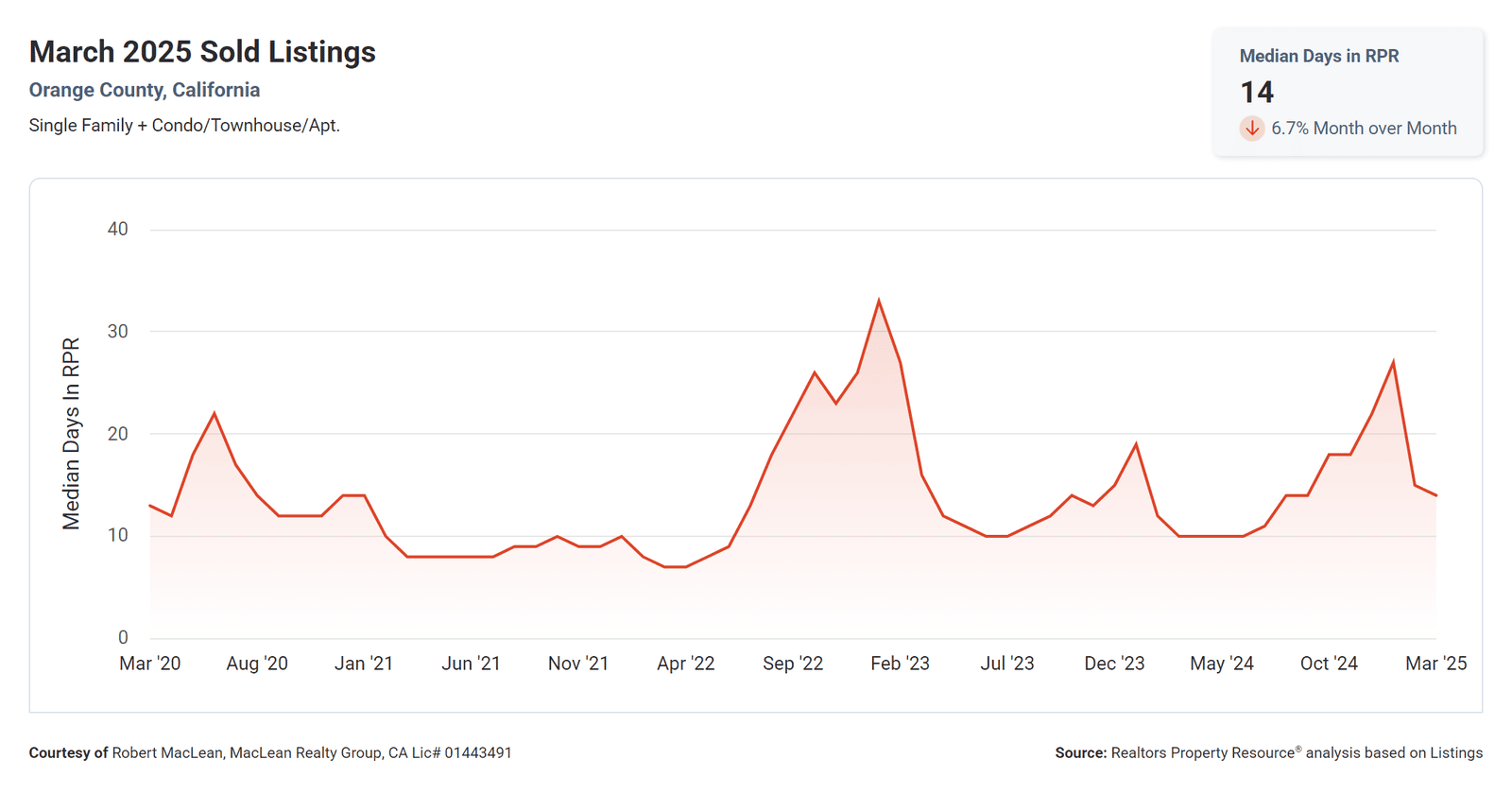

Orange County's real estate market has long been characterized by high demand and limited supply, and 2025 is no exception. Despite broader economic uncertainties, the county's appeal—driven by its beaches, top-tier schools, and diverse lifestyle offerings—keeps it a hotspot for buyers. According to recent data the median home price in Orange County hovers around $1.2 million, reflecting a modest year-over-year increase of about 4%. While this growth is slower than the frenzy of 2021-2022, it signals a stable market with sustained interest.

However, the rate of price growth is tapering off. After years of double-digit year-over-year increases, 2025 projections point to more modest gains—likely in the 3% to 5% range. This slowdown reflects a balancing act between persistent demand and a gradual uptick in supply, alongside broader economic factors like stabilizing interest rates. For buyers, this might mean a slightly less daunting climb, but for sellers, the days of jaw-dropping appreciation may be pausing.

Key Trends Shaping the Market

- Shift Toward Affordability in Inland Areas

While coastal cities like Newport Beach and Dana Point command premium prices (with median homes often exceeding $2 million), inland areas like Santa Ana, Tustin, and Fullerton are gaining traction for their relative affordability. First-time buyers and young families are increasingly drawn to these neighborhoods, where townhomes and condos can start around $700,000-$900,000. Developers are responding with new mixed-use communities, blending residential and commercial spaces to cater to modern lifestyles. - Luxury Market Stays Strong

Orange County's luxury segment, particularly in areas like Coto de Caza and Laguna Niguel, continues to thrive. High-net-worth individuals and international buyers are investing in custom estates and ocean-view properties, often paying cash to secure their dream homes. Features like smart home technology, sustainable design, and expansive outdoor spaces are top priorities for these buyers. - Rental Market Pressures

The rental market in Orange County is under strain, with average monthly rents for a two-bedroom apartment sitting at approximately $2,800-$3,200. Demand for rentals is driven by professionals relocating for jobs in tech, healthcare, and finance, as well as residents priced out of homeownership. Investors are capitalizing on this trend, with multi-family units and short-term rental properties (like Airbnb) seeing strong returns, especially in tourist-heavy areas like Huntington Beach. - Interest Rates and Buyer Behavior

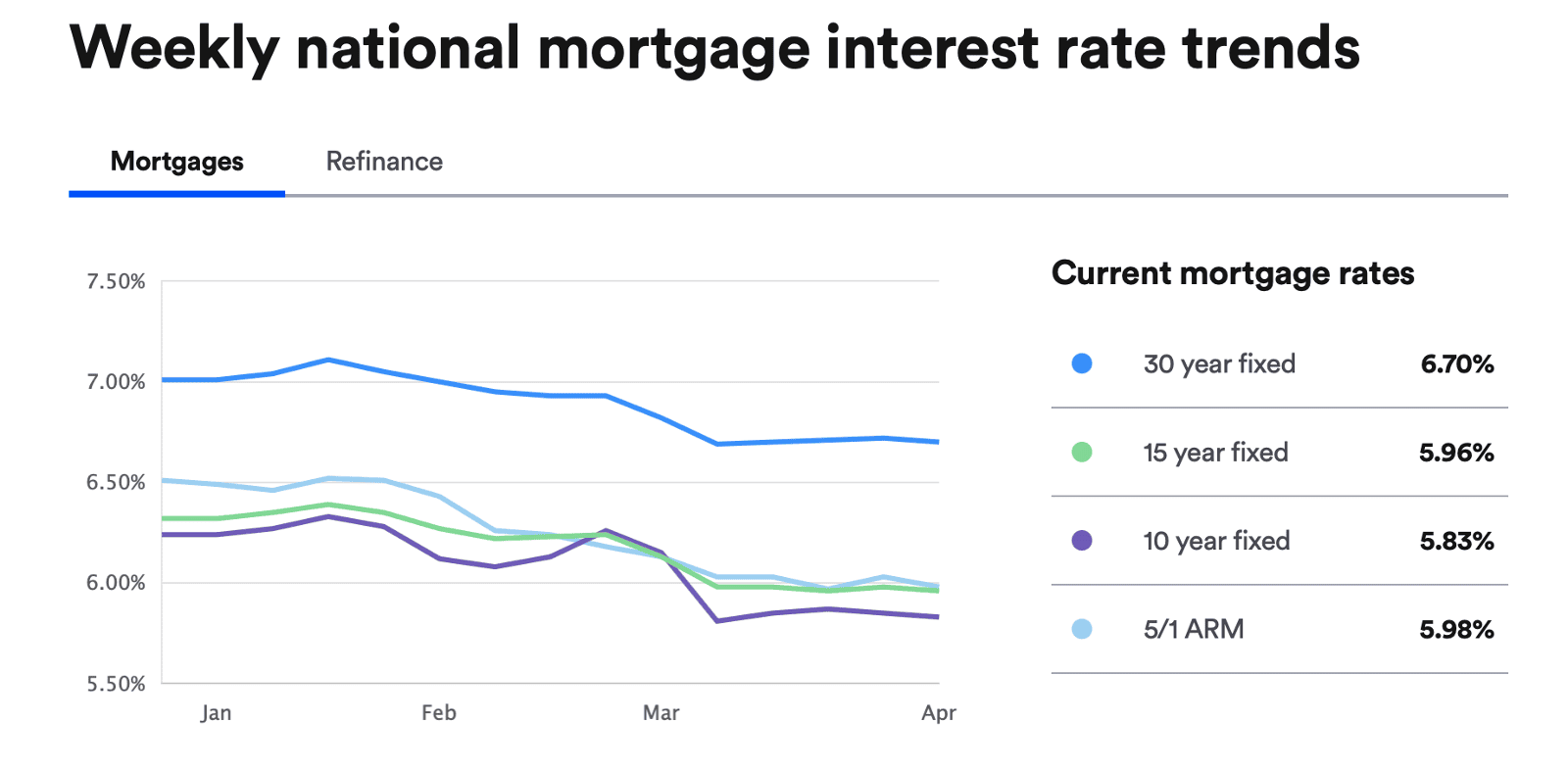

Mortgage rates, which have fluctuated between 6.5% and 7% in 2025, are influencing buyer decisions. Some are opting for adjustable-rate mortgages or waiting for potential rate drops, while others are moving forward with purchases to lock in properties before prices climb further. Sellers are also adjusting, with more offering concessions like covering closing costs to attract buyers in a higher-rate environment. - Sustainability and Modern Amenities

Eco-conscious buyers are prioritizing energy-efficient homes with solar panels, drought-resistant landscaping, and smart thermostats—a nod to California's environmental regulations and rising utility costs. New constructions in planned communities, such as Irvine's Great Park Neighborhoods, are setting the standard with green certifications and walkable designs.

Opportunities for Buyers

For buyers, 2025 presents both challenges and opportunities. While competition remains fierce, there are ways to navigate the market successfully:

- Explore Emerging Neighborhoods: Look beyond traditional hotspots to areas like Lake Forest or Mission Viejo, where price points are more accessible, and new developments are adding inventory.

- Work with Local Experts: A knowledgeable real estate agent can help identify off-market listings and negotiate in competitive situations.

- Consider Condos or Townhomes: These options often provide a more affordable entry point into Orange County's market, especially for young professionals or downsizers.

Opportunities for Sellers

Sellers in Orange County hold a strong position due to persistent demand, but strategic pricing and presentation are critical:

- Highlight Unique Features: Emphasize upgrades like renovated kitchens, outdoor living spaces, or proximity to top schools to stand out.

- Stage for Success: Professionally staged homes tend to sell faster and at higher prices, especially in a market where buyers are discerning.

- Be Flexible: Offering flexibility on closing dates or minor repairs can make your property more appealing in a competitive pool.

Interest Rates and Economic Factors

Mortgage rates are a big piece of the puzzle. As of early 2025, 30-year fixed rates have dipped below 7%—hovering around 6.5% to 6.7%—down from highs above 7.5% in 2023. This decline is sparking renewed buyer interest, though affordability remains a challenge in a county where the median sale price is nearly three times the national average. Orange County’s strong job market and low unemployment continue to buffer it from broader economic headwinds, but global factors like inflation and employment trends could still sway affordability down the line.

In recent economic headlines, the Fed has yet to cut rates this year, but it’s worth remembering that the central bank doesn’t control mortgage rates directly. Rather, mortgage rates tend to move with 10-year Treasury yields, which have bounded around amid uncertainty surrounding President Donald Trump’s tariff policies and federal employment cuts.

What’s Next for Orange County Real Estate?

Looking ahead, Orange County's market is likely to remain robust, driven by its unmatched lifestyle and economic stability. However, external factors like interest rate trends, job growth in Southern California, and potential policy changes (e.g., property tax regulations) could influence affordability and demand. Investors should keep an eye on commercial real estate, too, as hybrid work models are reshaping office space needs in cities like Irvine and Costa Mesa.

Final Thoughts

Orange County's real estate market in 2025 is a dynamic blend of opportunity and competition. Whether you're drawn to the surfside allure of Huntington Beach, the family-friendly vibe of Irvine, or the luxury estates of Laguna Beach, there’s something for everyone—but success requires preparation and strategy. Stay informed, partner with professionals, and act decisively to make the most of this vibrant market.

Have questions about buying, selling, or investing in real estate? Drop a comment below or connect with me to get started!