Welcome to September 2023's Real Estate Metrics Analysis. Whether you're a buyer or a seller, this information is crucial to understanding the current market trends and making informed decisions.

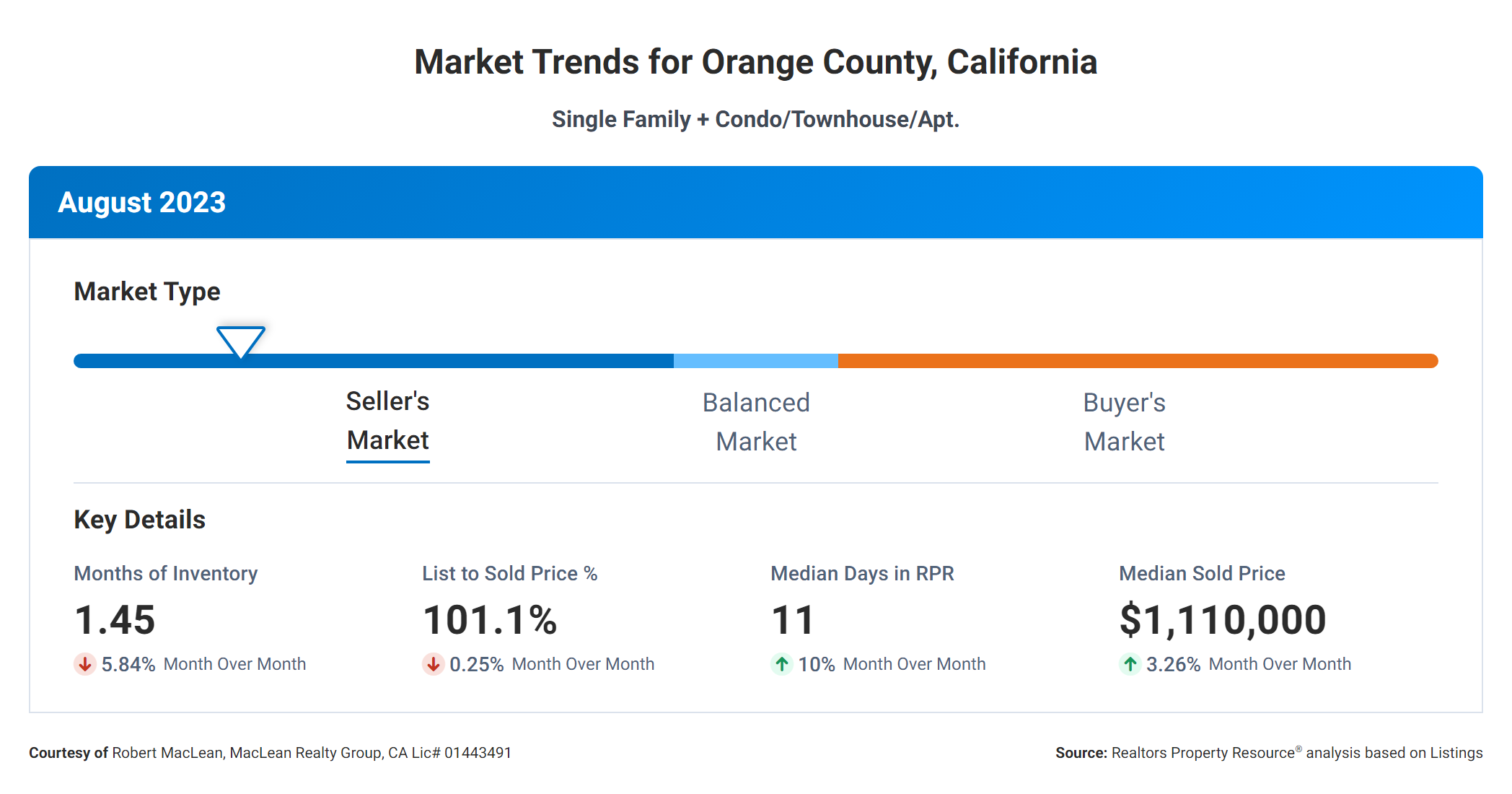

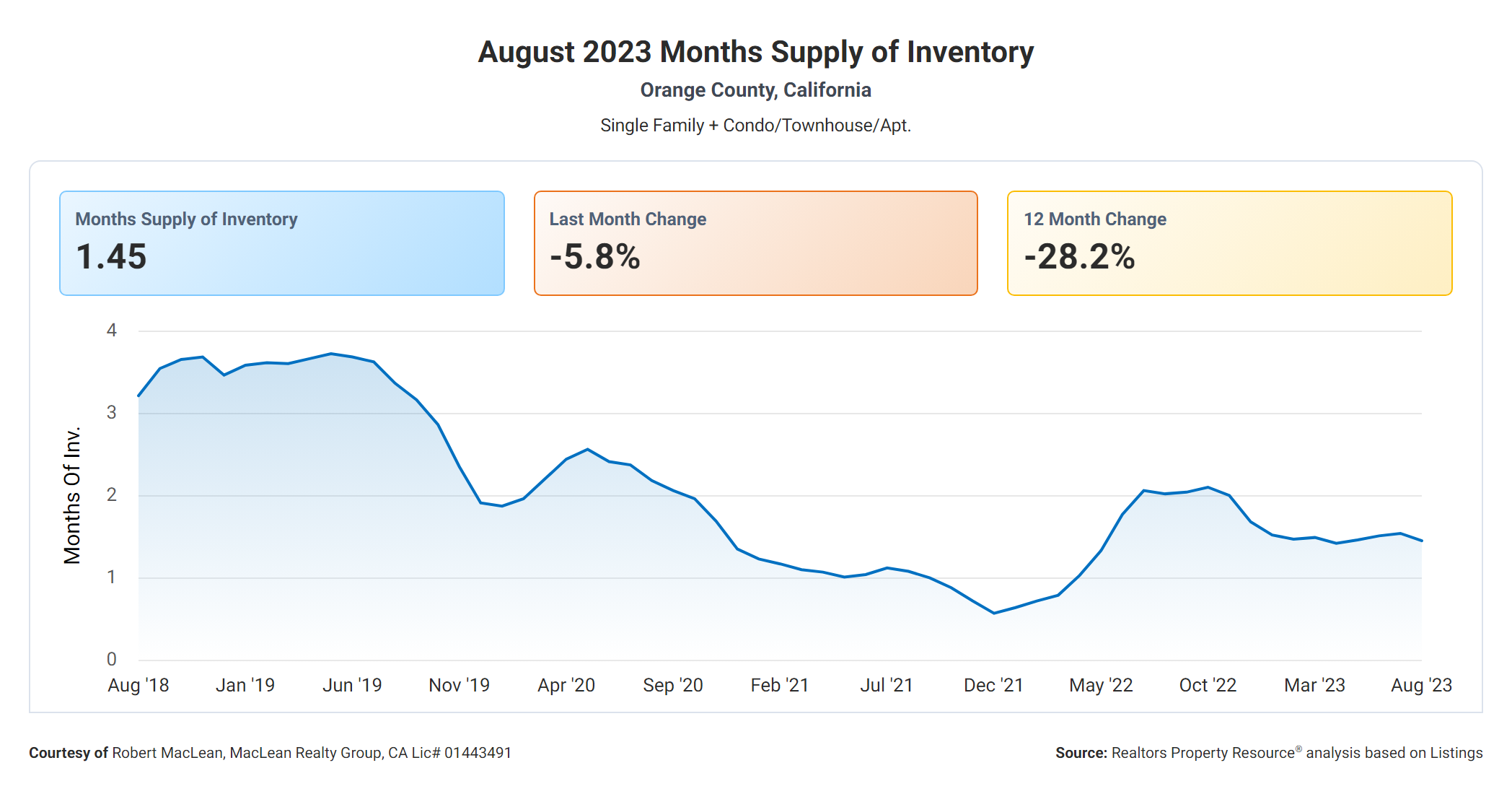

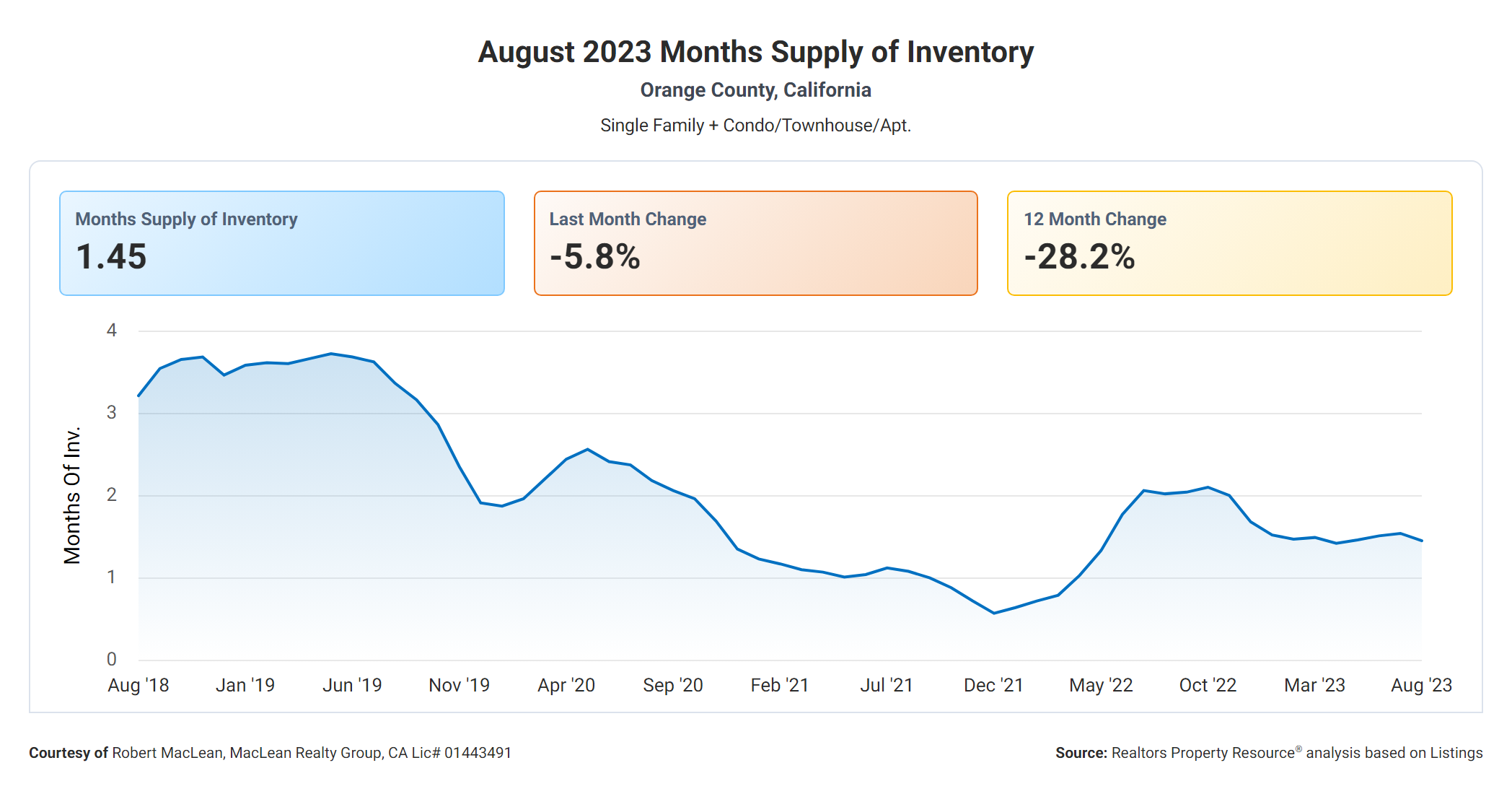

Months Supply of Inventory currently stands at 1.45. This metric represents the number of months it would take to sell all the homes on the market if no new properties were listed. With such a low supply, it's safe to say that the market is highly competitive, and sellers have the upper hand.

The 12-Month Change in Months of Inventory shows a significant decrease of -28.22%. This means that the supply of homes has decreased over the past year, further intensifying the competition. As a seller, this is excellent news as it suggests that your property is likely to sell quickly.

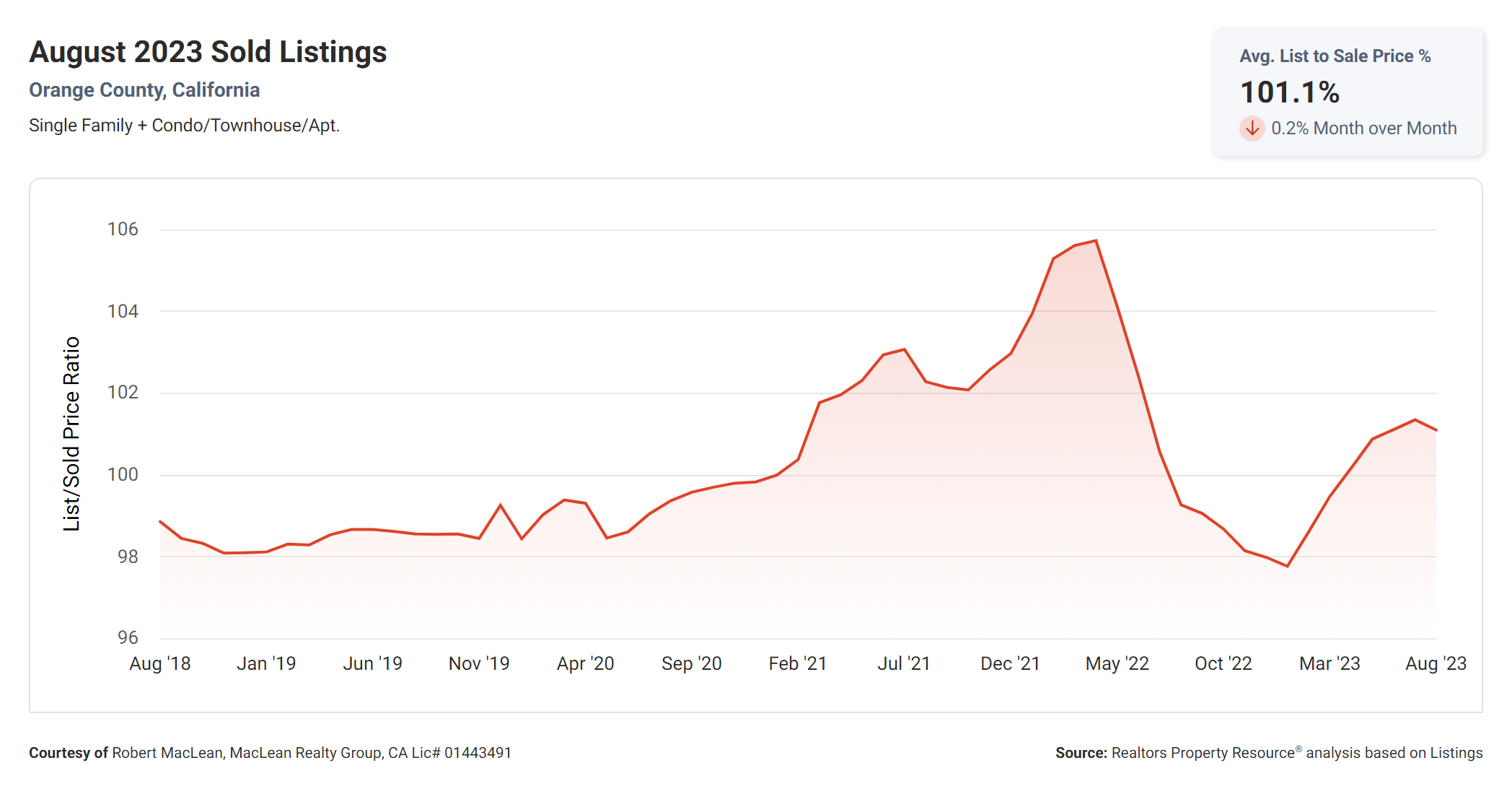

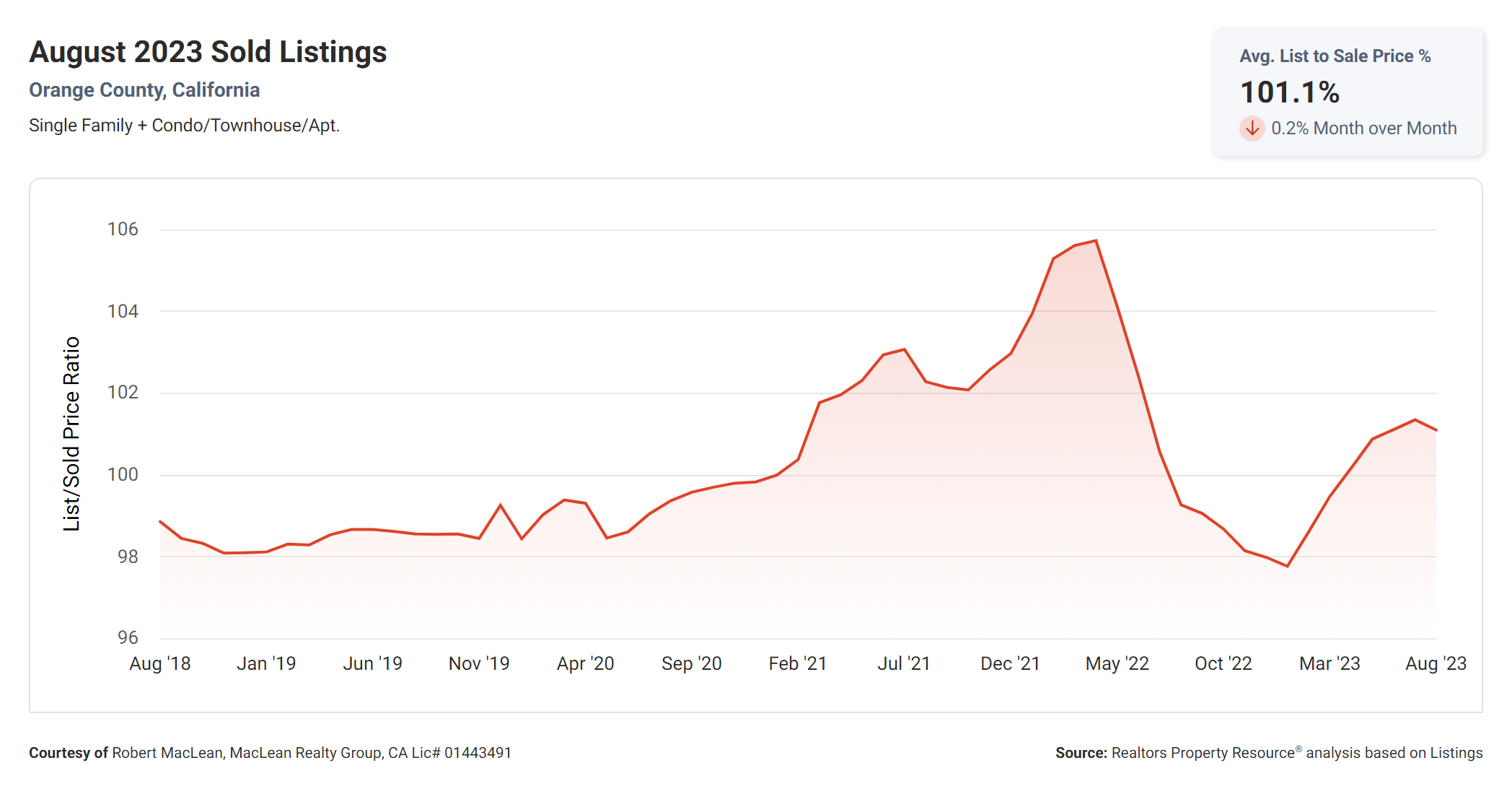

The List to Sold Price Percentage is 101.1%. This metric reveals that, on average, homes are selling for slightly above their listing price.

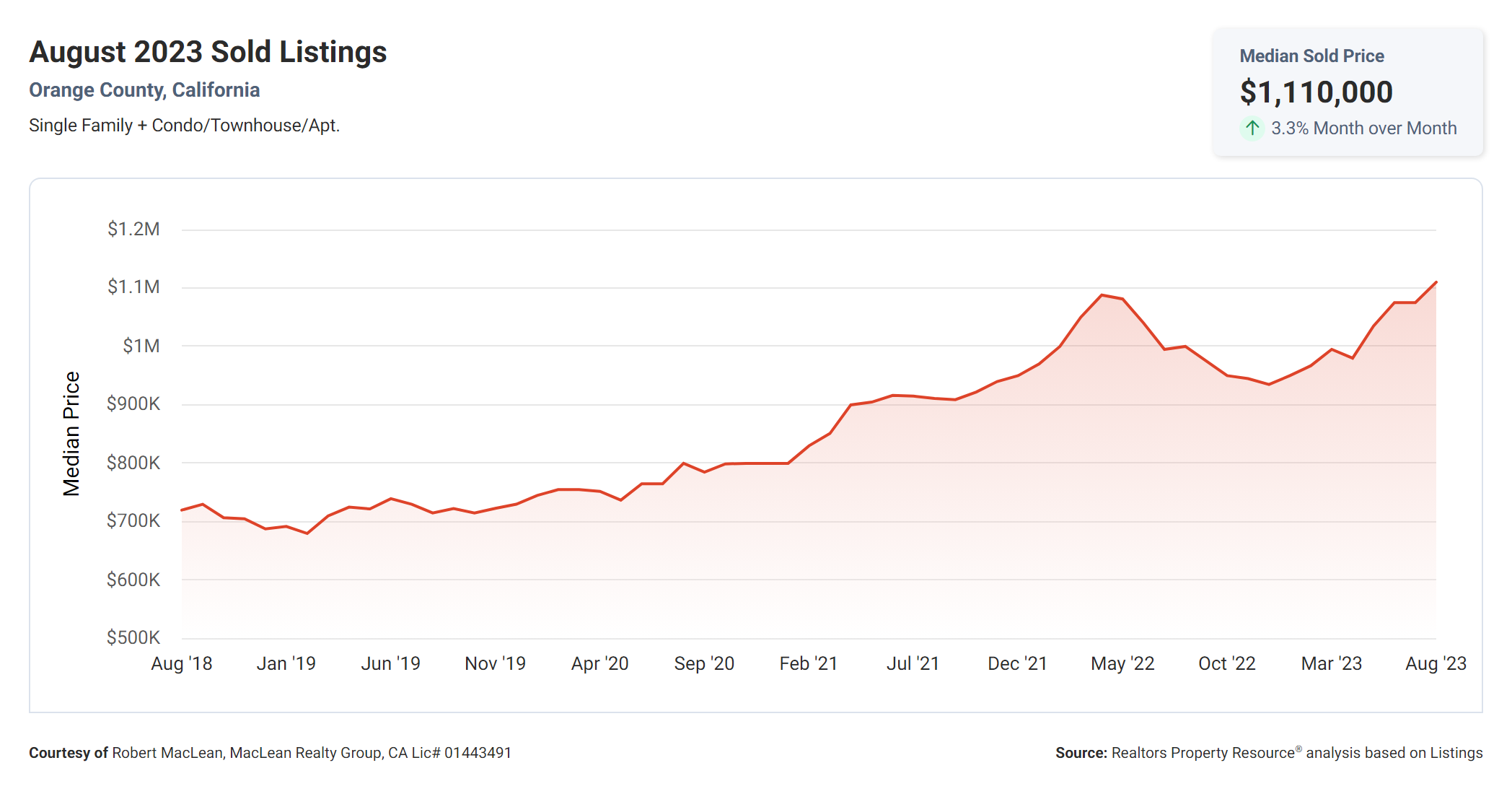

The Median Sold Price currently stands at $1,110,000. This metric represents the midpoint of all the home prices sold in the market. It's important to note that this is just the median, and there may be properties that sell for higher or lower amounts. However, it does provide an overall indication of the market's price range.

Active Listings for sale are down 7.6% from last month and down 52.2% from this time last year.

Mortgage

The average rate on 30-year mortgages rose to 7.42 percent this week, up from 7.32 percent last week, according to Bankrate’s weekly national survey of large lenders. The fresh 7.42 percent represents the highest level since December 2000, according to Bankrate data.

The increase reflects a variety of factors, including the Federal Reserve's continuing fight against inflation, last month’s downgrade of U.S. government debt, rising Treasury yields and the fading prospects of a recession.

The central bank in July raised rates a quarter point, its 11th increase since 2022, and it will consider another rate hike at its Sept. 20 meeting. While the Fed doesn't directly set fixed mortgage rates, it does establish the overall tone.

The most relevant benchmark for 30-year mortgage rates, though, is the 10-year Treasury yield, which has been at about 4.3 percent.

Many borrowers have been spooked by the recent rise in rates. The Mortgage Bankers Association reported this week mortgage applications fell to their lowest level since 1996.

Inflation, the economy and Fed policy will remain the main factors driving mortgage rates in the coming months.

These real estate metrics paint a picture of a highly competitive market with limited supply and fast-paced transactions. Sellers can expect a quick sale while buyers need to act swiftly and be prepared for some negotiation. Understanding these trends will help both buyers and sellers make informed decisions in the current real estate landscape. Feel free to reach out to me to get the market data for your specific city or neighborhood.