When it comes to understanding the real estate market, there are several key metrics that buyers and sellers should pay attention to. These metrics provide valuable insights into the current state of the market and can help guide decision-making processes. Let's take a closer look at the correlation between these metrics to better understand their significance.

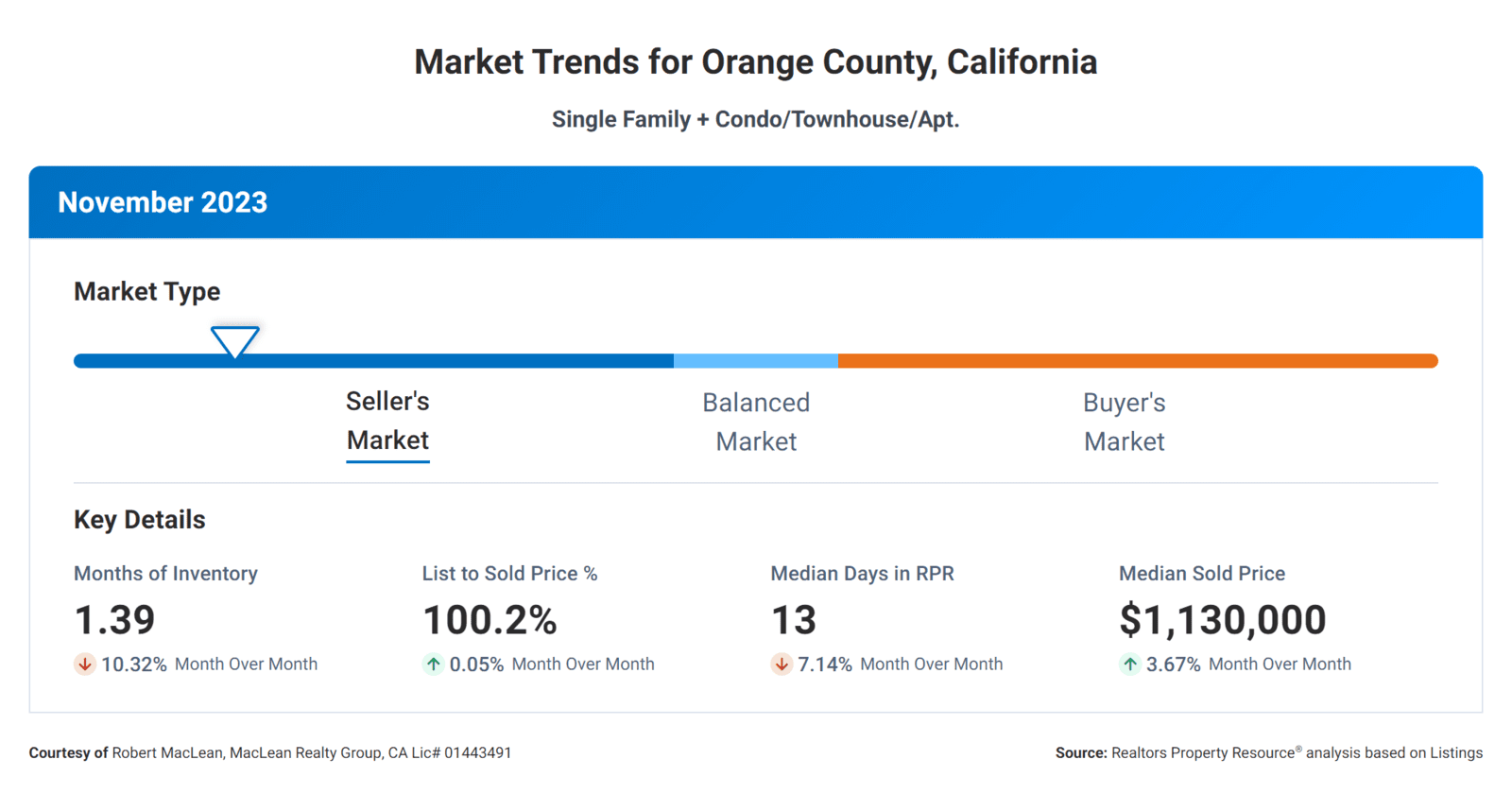

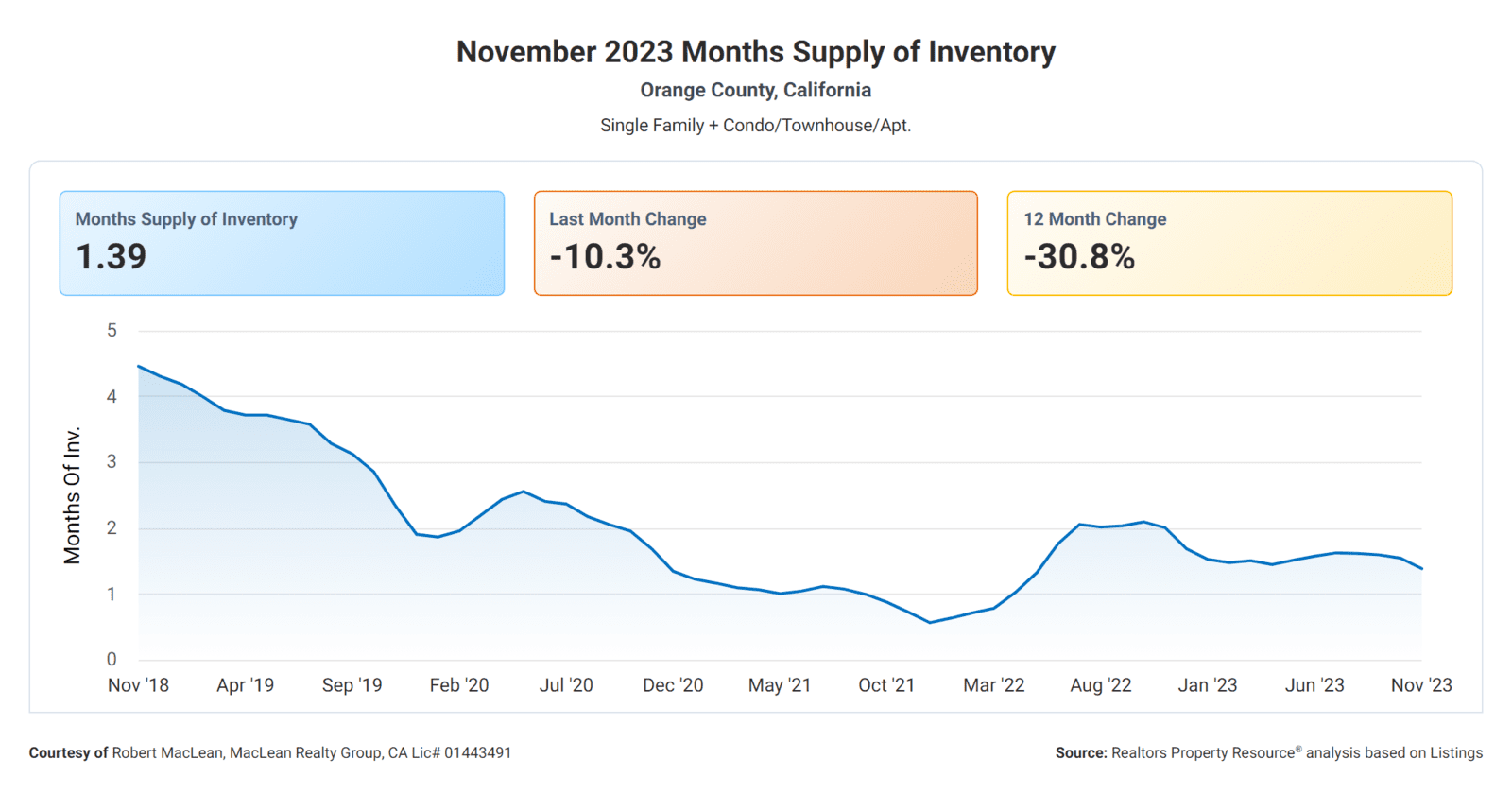

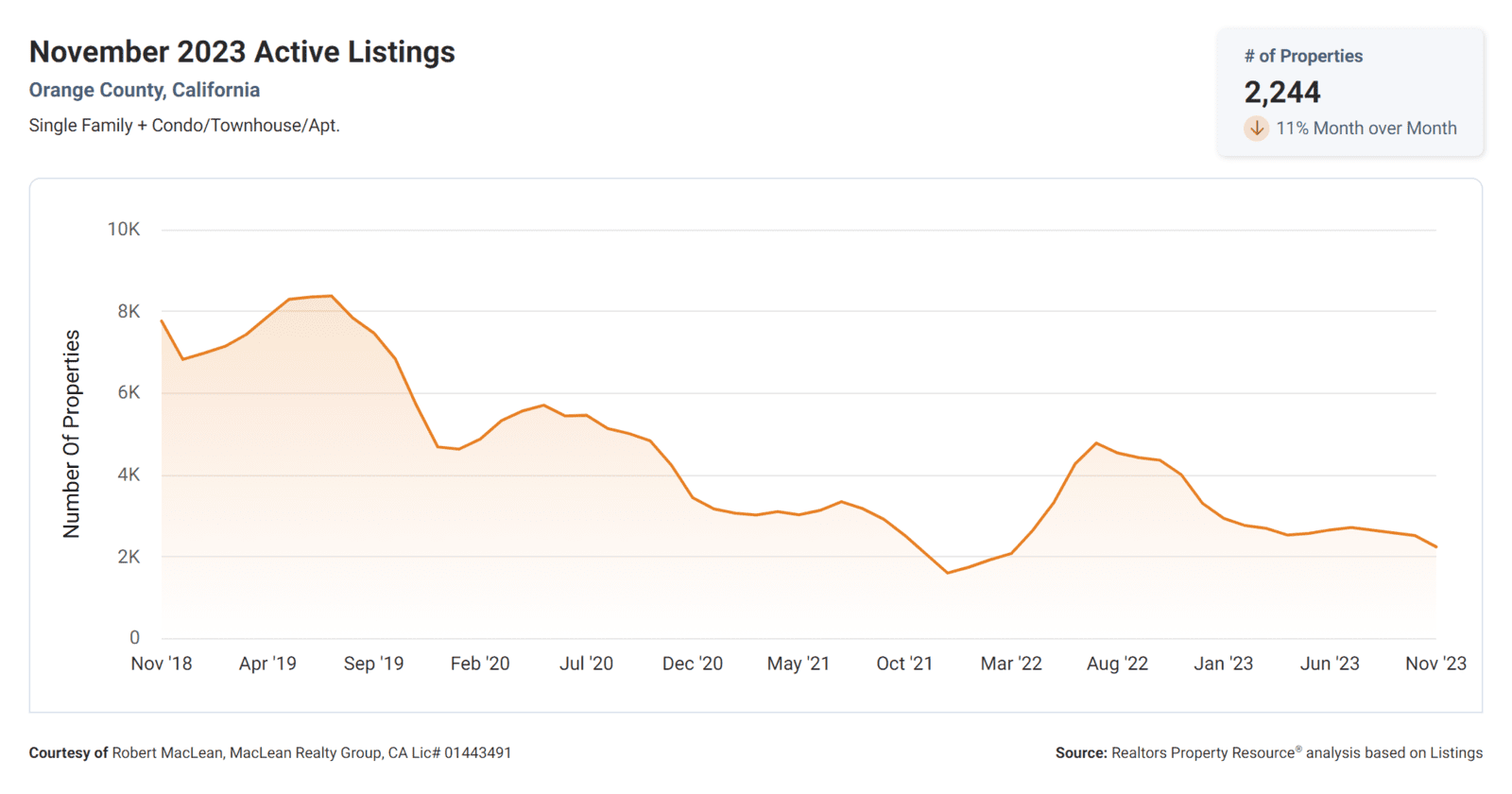

Months Supply of Inventory which is currently at 1.39. This metric represents the number of months it would take to sell all the homes currently on the market, given the current pace of sales. A lower months supply of inventory indicates a seller's market, where demand exceeds supply. In this case, with a supply of a little more than a month, it suggests a highly competitive market with limited available properties.

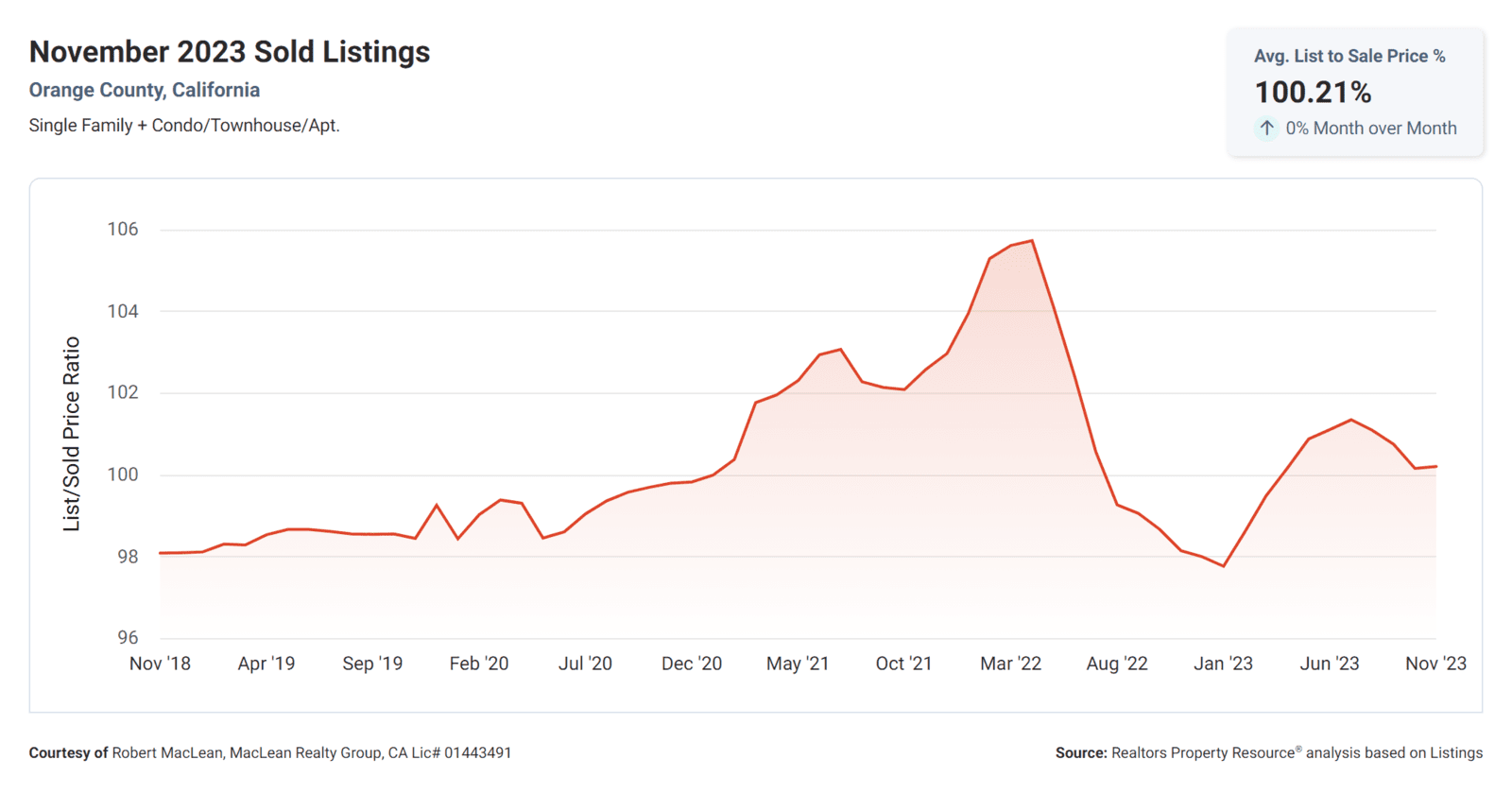

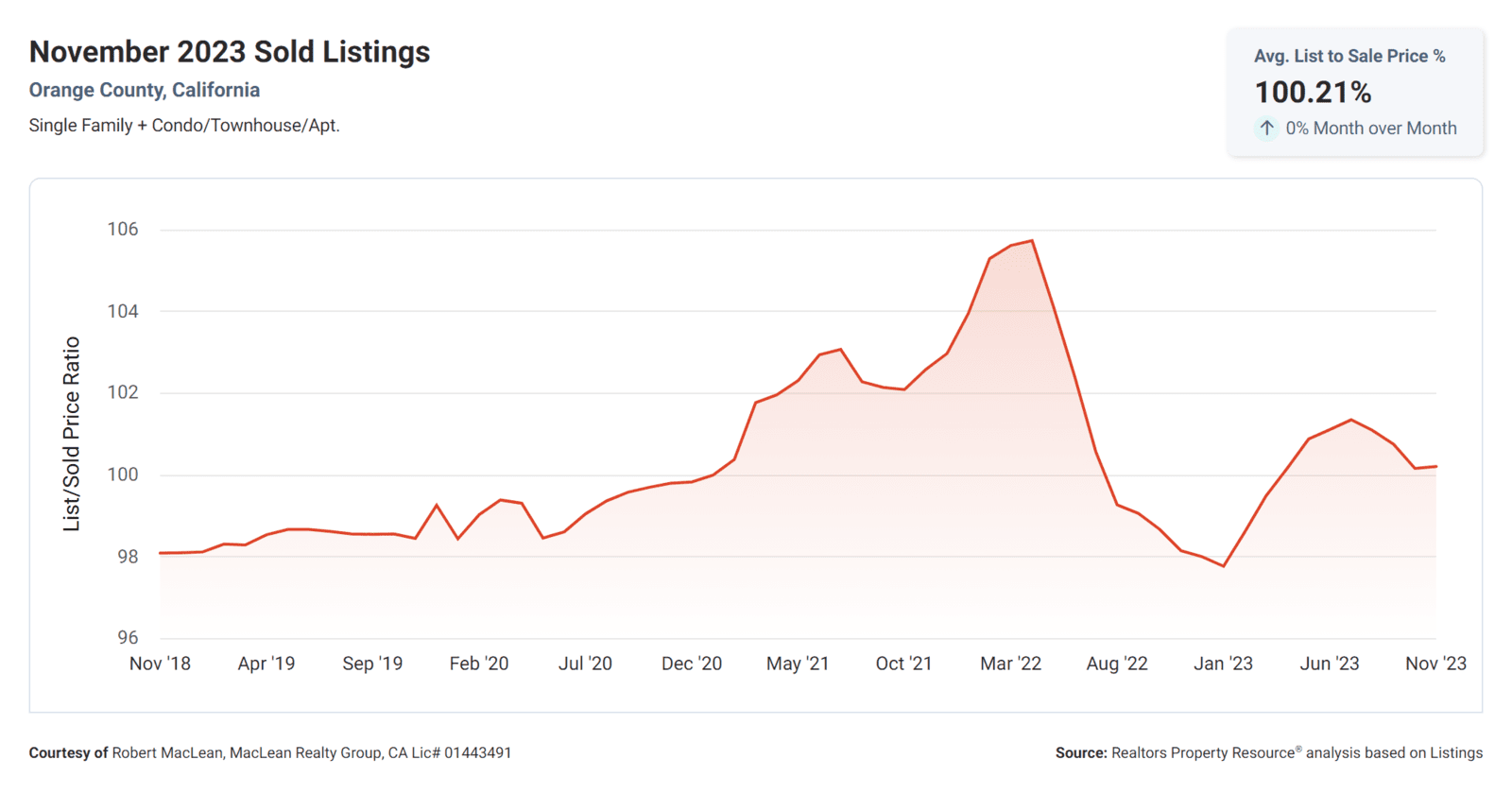

List to Sold Price Percentage, which currently stands at 100.21%. This metric represents the percentage of the listing price that a home ultimately sells for. A higher percentage indicates that homes are selling very close to their original listing price. For sellers, this implies that they have a good chance of receiving a price close to their asking price. Buyers may need to be prepared to make competitive offers to secure a property.

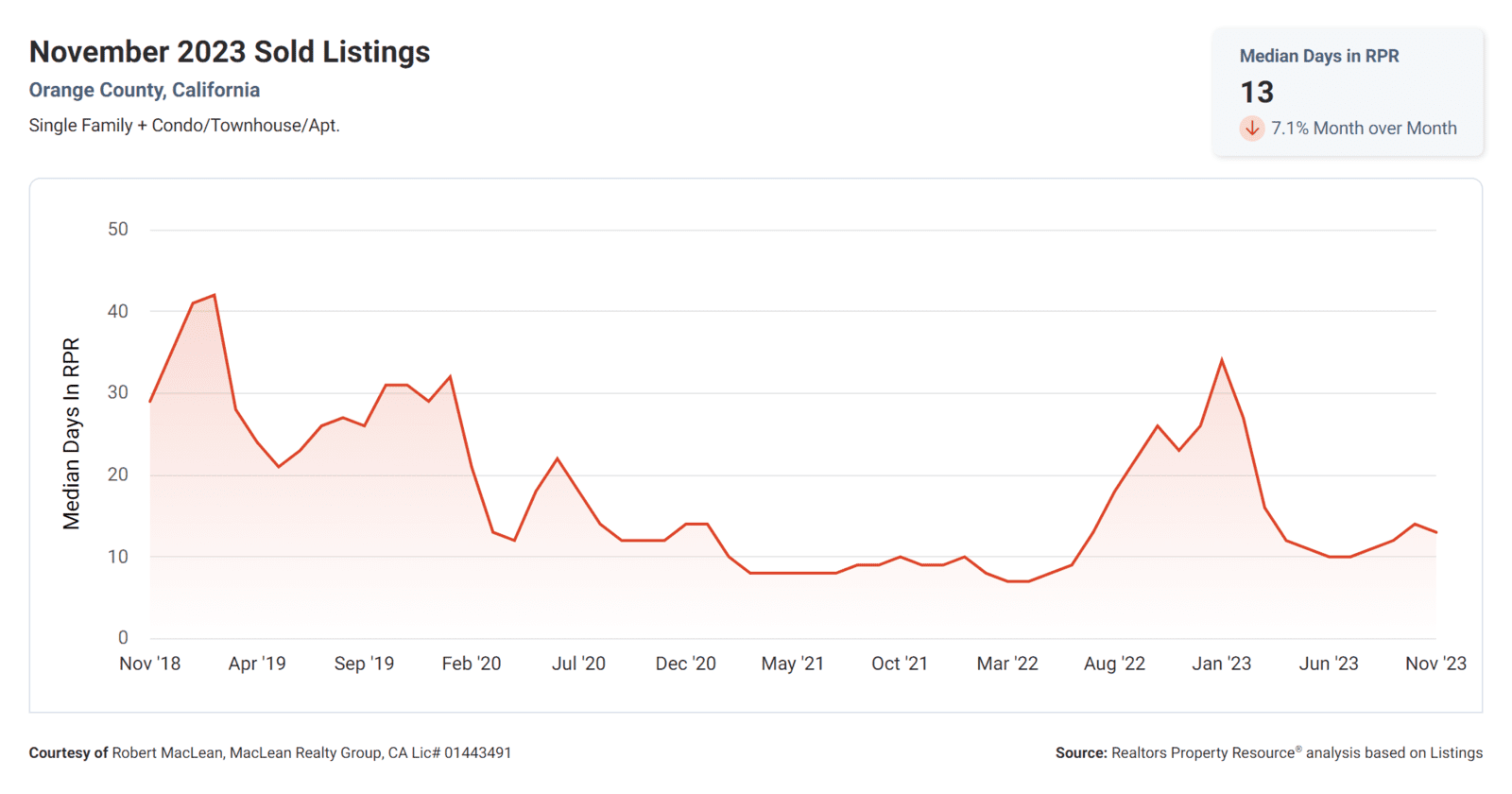

Median Days Homes are On the Market is 13 days down from 23 days last year at this time. This metric measures the average number of days it takes for a home to sell once it is listed. A lower number signifies a faster selling process, which can be advantageous for sellers. Buyers may need to act promptly to avoid missing out on desirable properties.

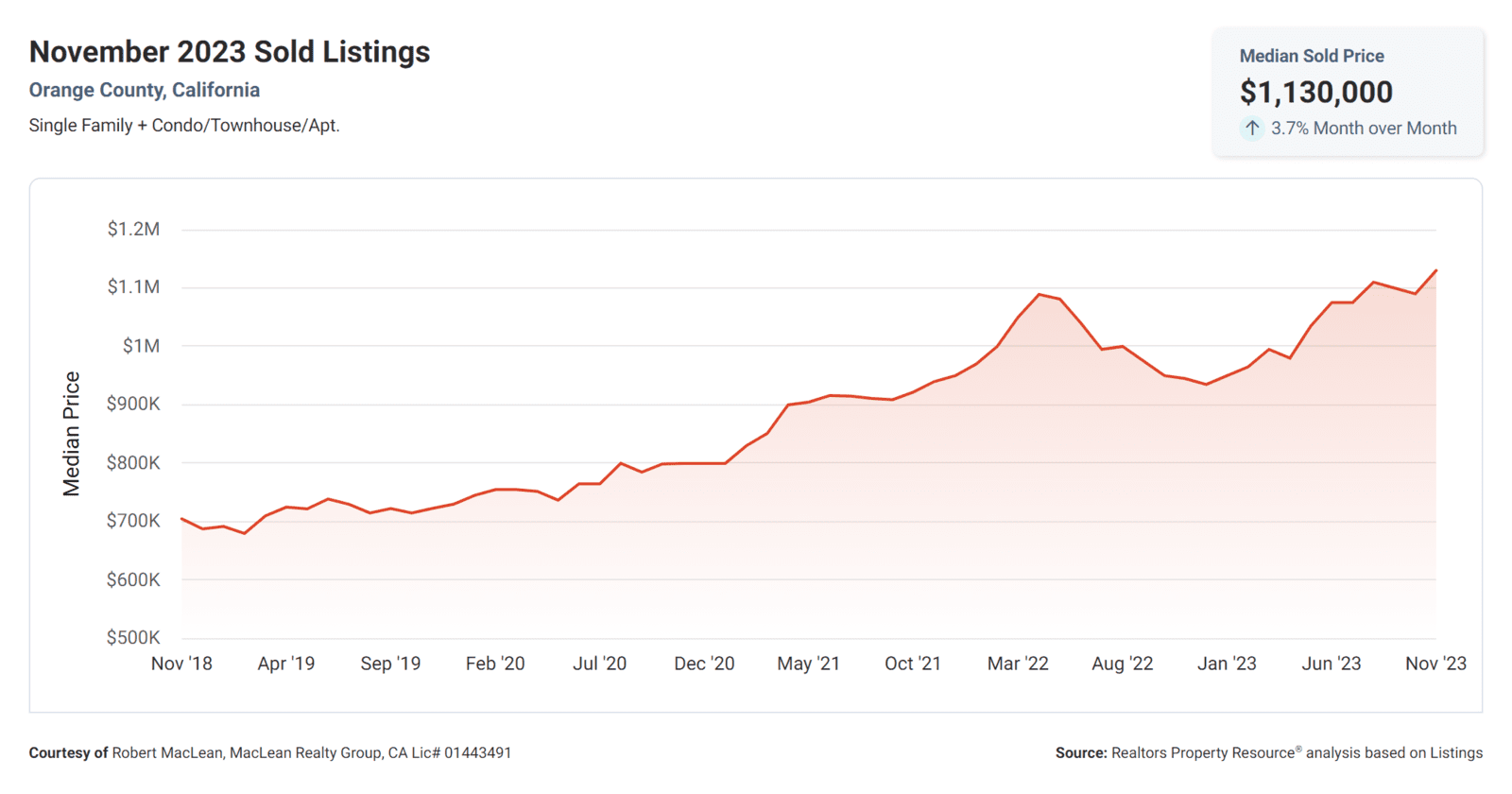

Median Sold Price, which presently stands at $1,130,000. Which is up 3.7% from last month and 19.6% from a year ago when the median sold price was $945,000. This metric provides an overview of the midpoint price at which homes are selling in the market. It is crucial for both buyers and sellers to be aware of this figure, as it gives insights into the overall market trends and helps in setting realistic expectations.

Active Listings for sale are down 11% from last month and down 79% from this time last year. Unfortunately the supply of homes for sale continues to decline making very limited the choices to pick from to purchase a home.

Mortgage

The average rate on 30-year mortgages dropped to 7.23 percent this week, down from 7.41 percent last week, according to Bankrate’s weekly national survey of large lenders.

Mortgage rates retreated partly because of a downtrend in 10-year Treasury yields, the most relevant benchmark for the 30-year mortgage. After a tepid jobs report and lower inflation numbers in recent weeks, the 10-year Treasury dropped from 5 percent to less than 4.2 percent in recent weeks.

“Mortgage rates have improved almost 1 percent and are at four-month lows,” says Michael Becker of Sierra Pacific Mortgage. “The change in sentiment in the bond market is astonishing. They went from thinking more rate hikes were possible and that the Fed would be holding rates ‘higher for longer’ to pricing in four to five rate cuts in 2024.”

Despite the recent reversal, home loans are by no means as cheap as they were two years ago. The run-up reflects a variety of factors, including the Federal Reserve's continuing fight against inflation. While the Fed doesn't directly set fixed mortgage rates, it does establish the overall tone.

The central bank decided against another rate hike at its Nov. 1 meeting, but it left open the chance of another hike before the end of the year. Given recent developments, that seems unlikely. The Fed could even begin cutting rates in 2024.

A growing number of housing economists say mortgage rates could fall below 7 percent in the coming months. If you’re shopping for a mortgage, keep in mind that 7.23 percent is just an average — some lenders advertise below-average rates on Bankrate.

Location plays a role, too. In some areas of the U.S., rates are below 7.1 percent.

Many homebuyers have been sidelined by the recent rise in rates, along with the ever-present issue of low inventory. Inflation, the economy and Fed policy will remain the main factors driving mortgage rates in the coming months.

- Bank Rate

These real estate metrics collectively paint a picture of a market that heavily favors sellers. With a low supply of inventory, a short average time on the market, and properties selling close to their listing prices, it is evident that sellers hold the upper hand. However, buyers should not be discouraged, as being aware of these metrics can help them navigate the market more efficiently and make strategic decisions. If predictions are correct and mortgage rates do start to come down a bit in 2024, what will happen to the demand for homes? Odds are that demand will increase. So, now may be a perfect time to buy and then refi.