June 2024 Real Estate Market Report

June 2024 Real Estate Market Report

Are you curious about the latest housing market trends? Are you looking to buy or sell a home? It is important to understand the correlation between various key metrics to make informed decisions. Let's dive into the numbers and see what they tell us.

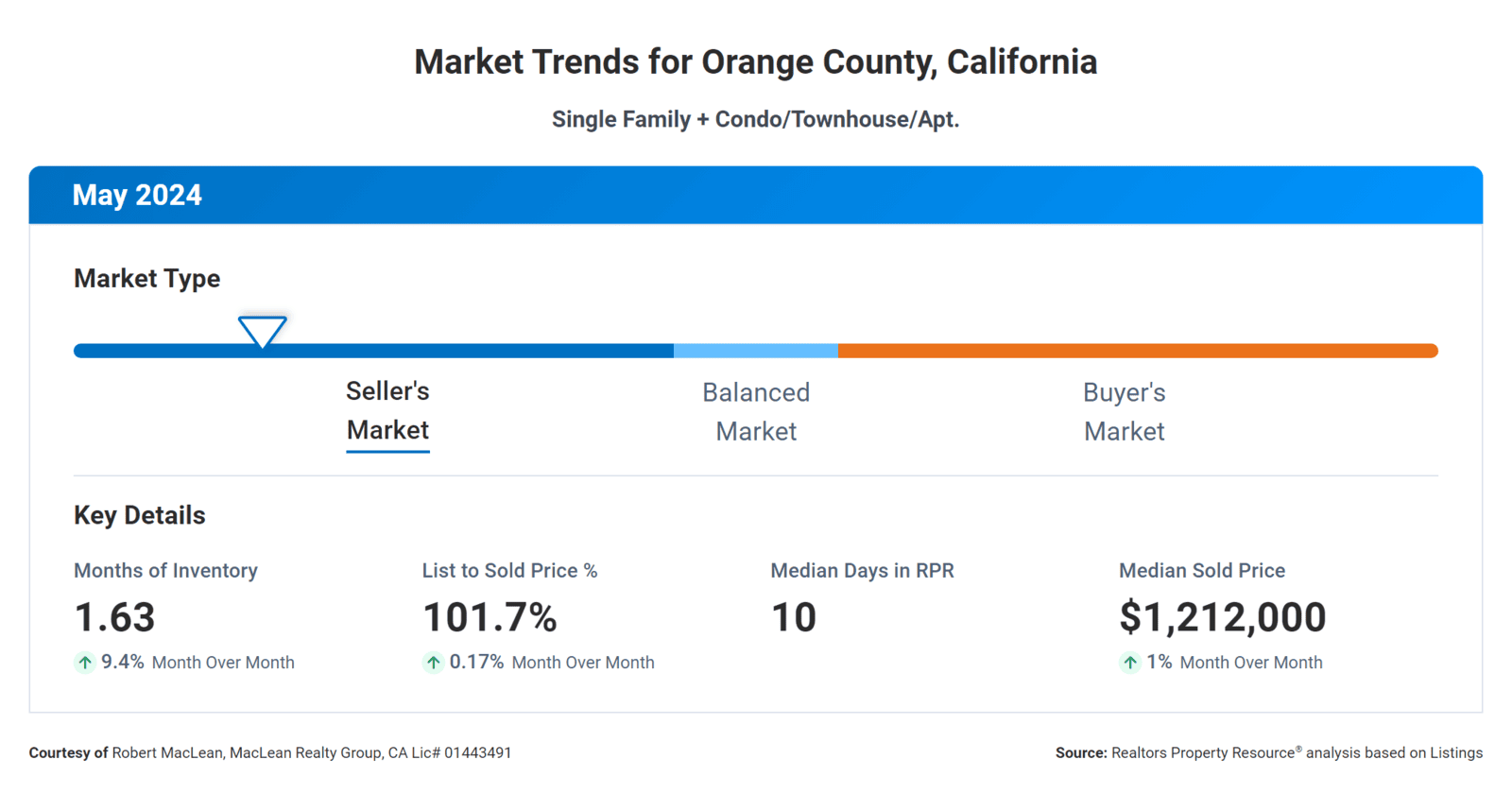

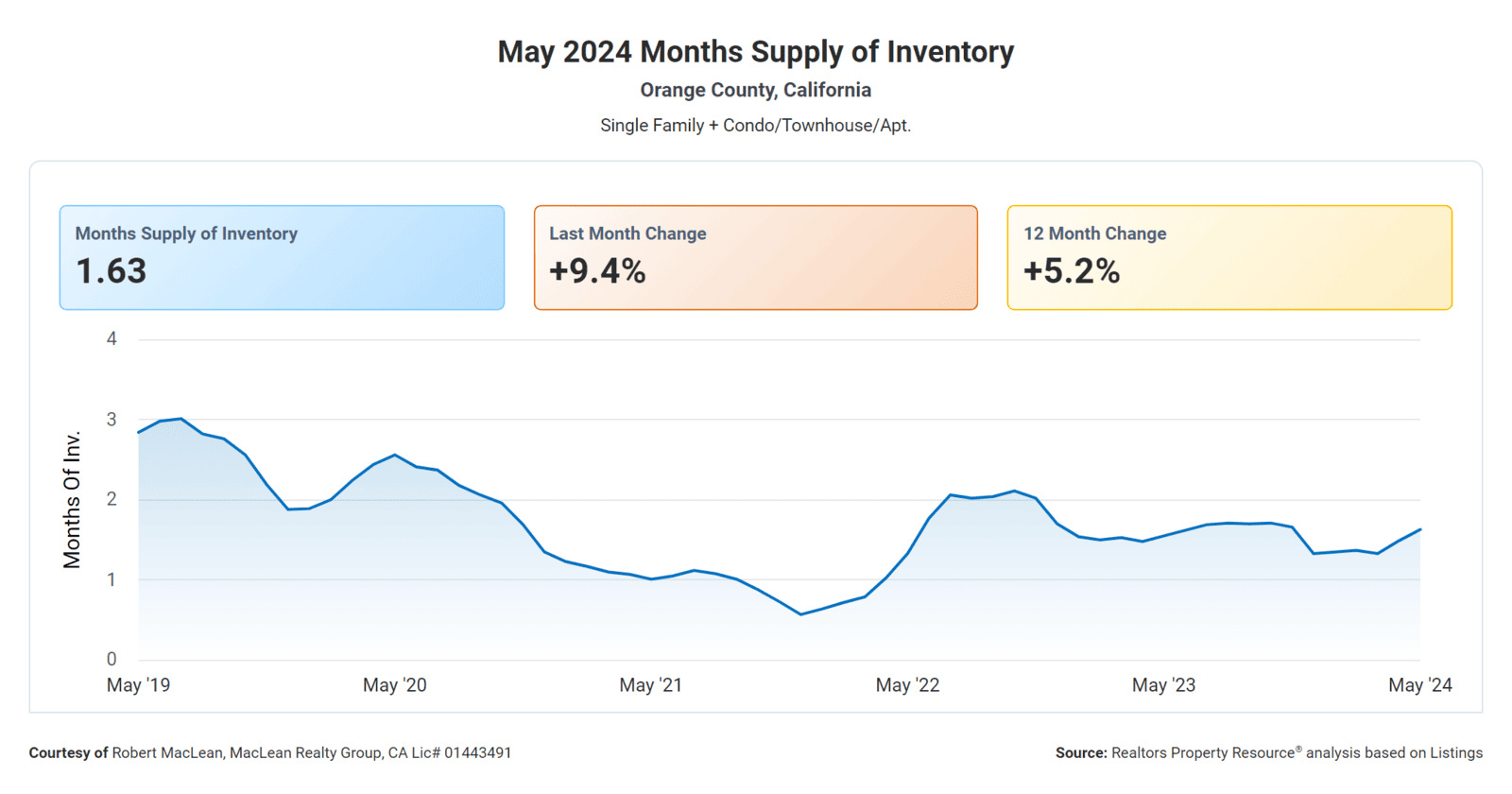

Months Supply of Inventory - The Months Supply of Inventory is at 1.63, which is a low number. We need to be in the 3 to 6 months range to have a more balanced market. This indicates that there is a high demand for homes in this market, with limited supply available. This can lead to increased competition among buyers and potentially higher prices for sellers.

12-Month Change in Months of Inventory - The 12-Month Change in Months of Inventory is +5.16%, indicating an increase in the supply of homes on the market compared to the previous year. This could suggest a shift towards a more balanced market, where buyers and sellers have more equal bargaining power.

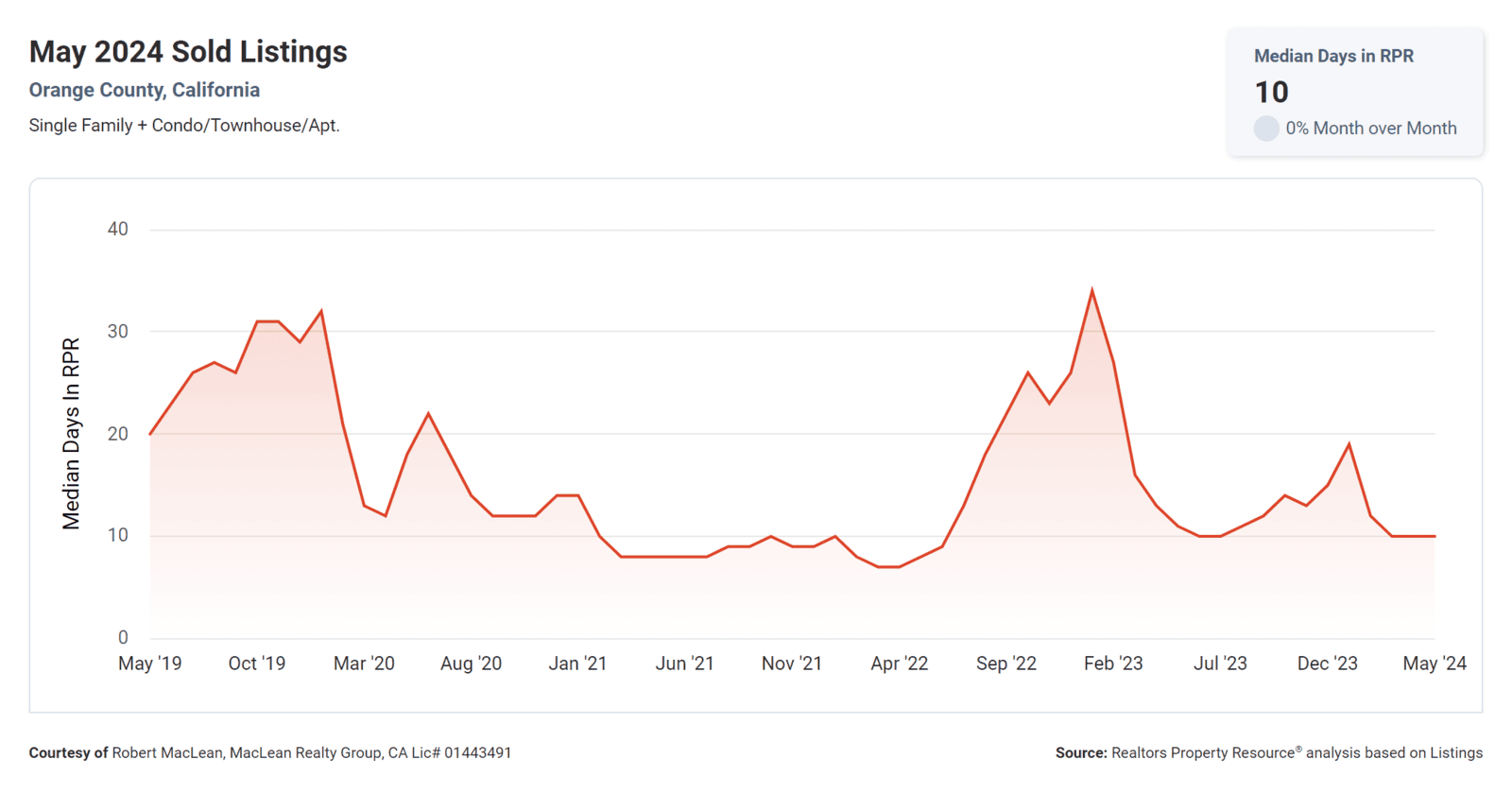

Median Days Homes are On the Market - The Median Days Homes are On the Market is 10, which is a relatively short time frame. This suggests that homes are selling quickly, due to high demand and low inventory levels. We would need to be closer to 60 to 90 days on the market to be more balanced.

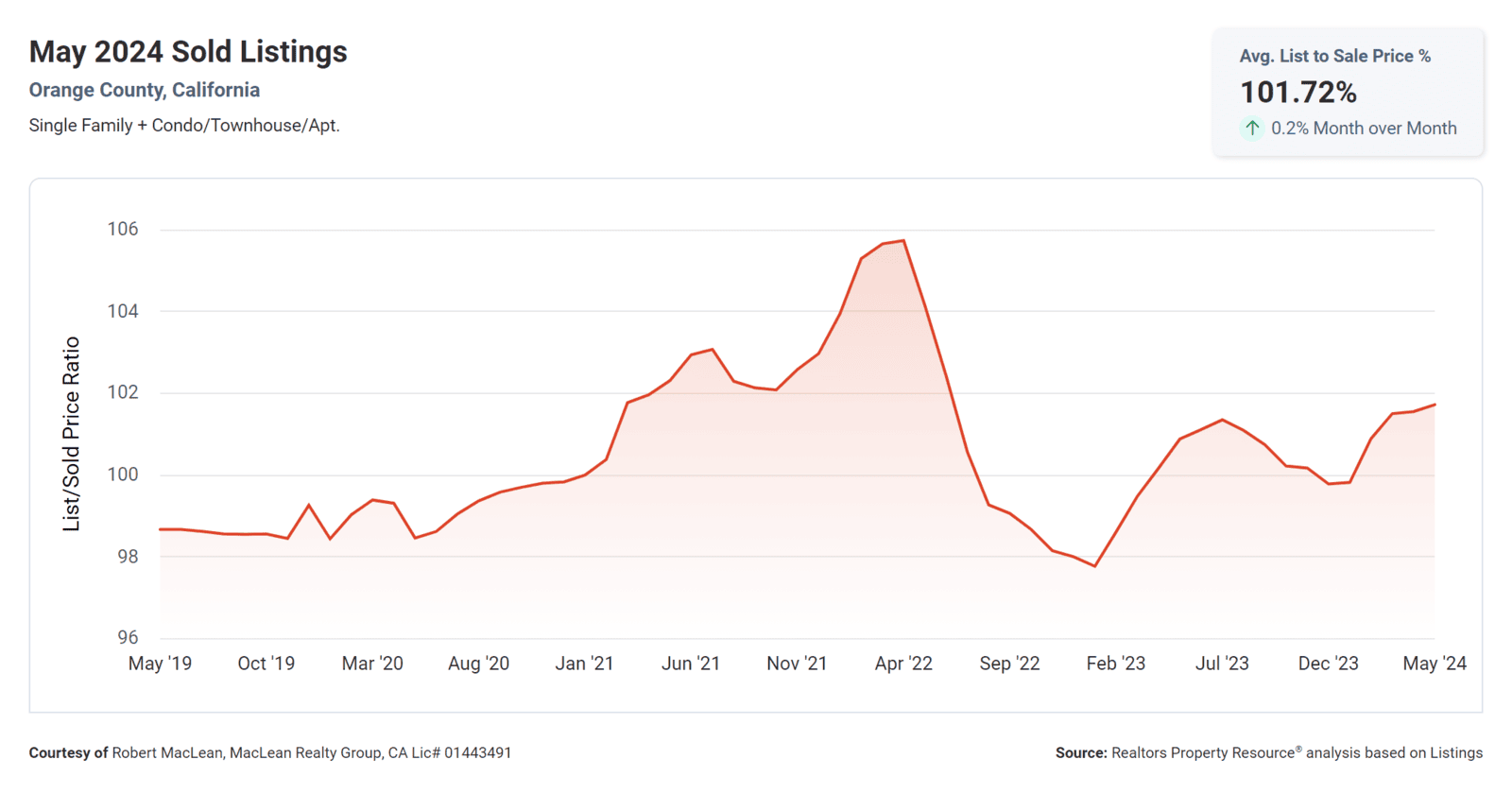

List to Sold Price Percentage - The List to Sold Price Percentage is 101.7%, indicating that on average, homes are selling slightly above their listing price. This is a result of competitive bidding among buyers in a tight market.

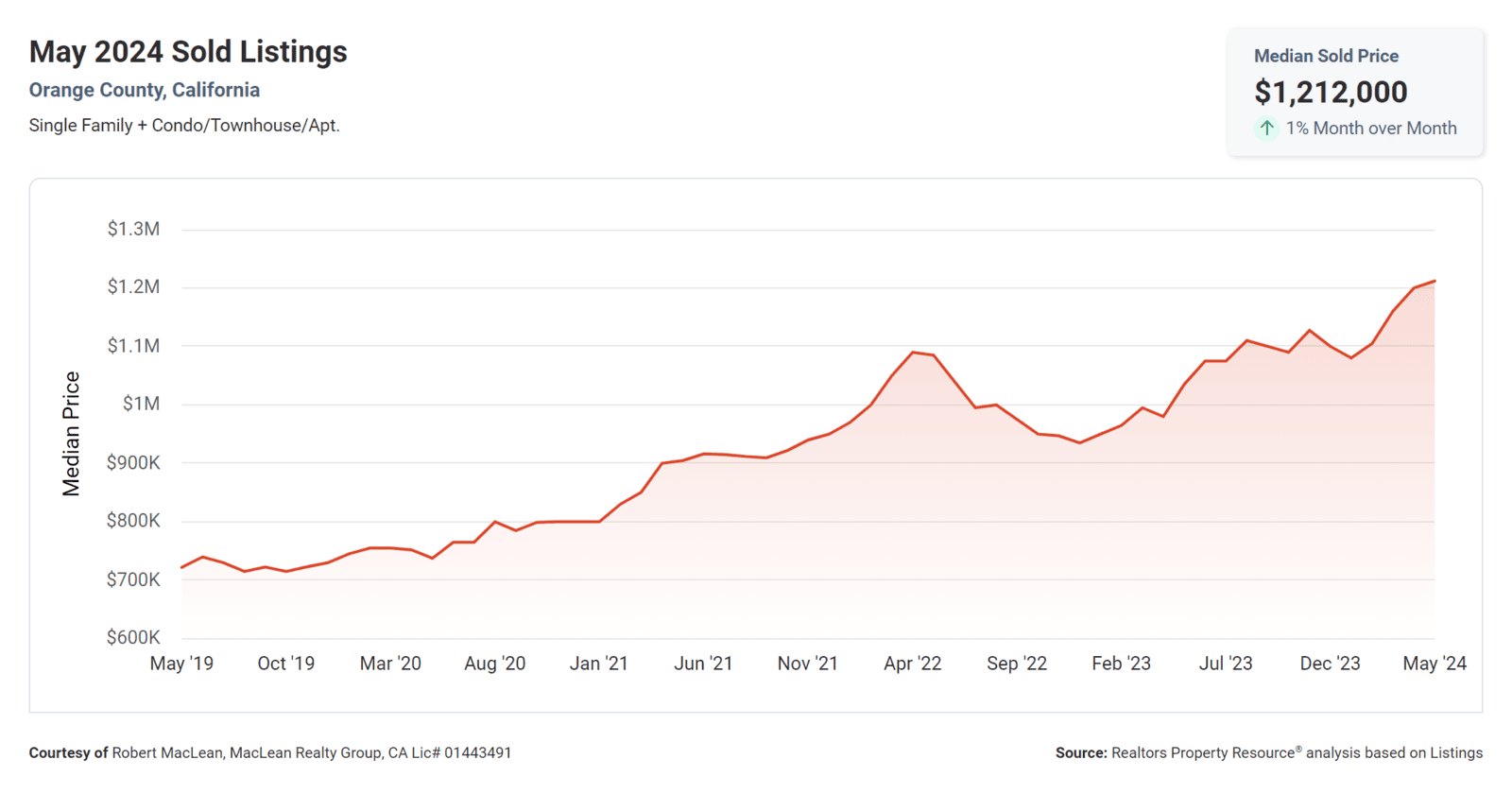

Median Sold Price the Median Sold Price is $1,212,000, which gives an idea of the average price at which homes are selling in the current market. We continue to see prices increasing. We have seen a 17% increase year over year.

Mortgage

On Monday, June 10, 2024, the current average 30-year fixed mortgage interest rate is 7.05%, falling 12 basis points since the same time last week.

Today's national average 15-year refinance interest rate is 6.64%, falling 9 basis points compared to this time last week.

For now, the consensus is that mortgage rates will ease down in 2024.

- Bank Rate

Learn more: Historical Mortgage Rates

Conclusion

Overall, these metrics suggest a competitive market with low inventory, quick sales, and potentially higher prices. Sellers may benefit from favorable selling conditions, while buyers may need to act quickly and be prepared to make competitive offers. Book a consultation now to get started on your real estate journey. If you would like a Market Report for your specific neighborhood simply send me a quick message and I will prepare that for you.