Why We Aren't Headed for a Housing Crash

Why We Aren't Headed for a Housing Crash

If you’re holding out hope that the housing market is going to crash and bring home prices back down, here’s a look at what the data shows. (If you want the data specific to your neighborhood reach out to me and I will prepare that data for you.)

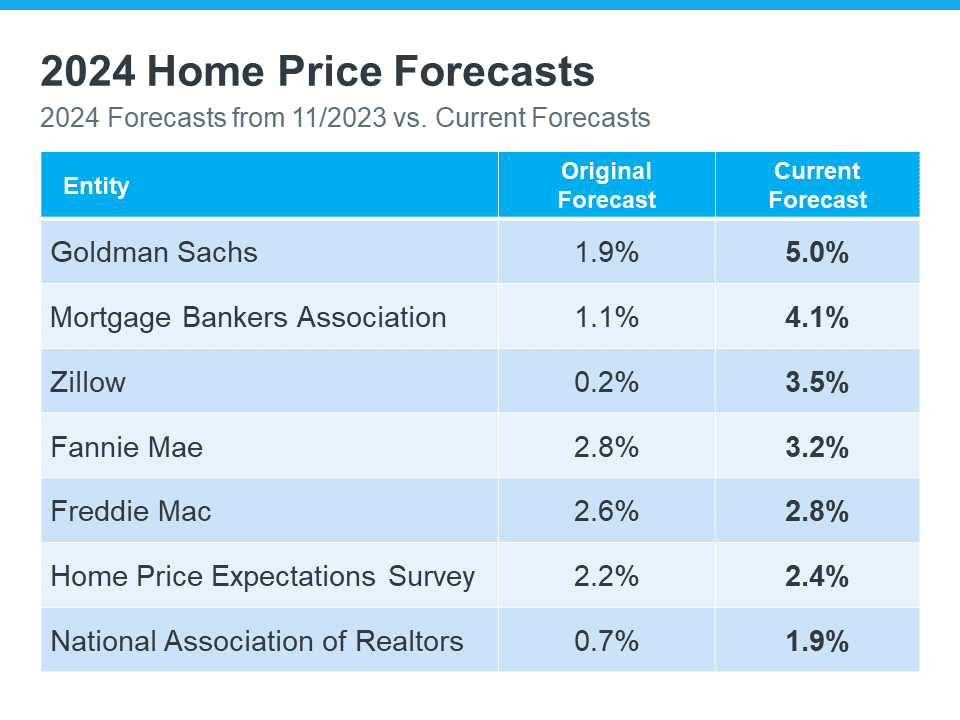

The experts seem to think home prices are going to keep going up.

Today’s market is very different than it was before the housing crash in 2008. Here’s why.

It’s Harder To Get a Loan Now – and That’s Actually a Good Thing

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one.

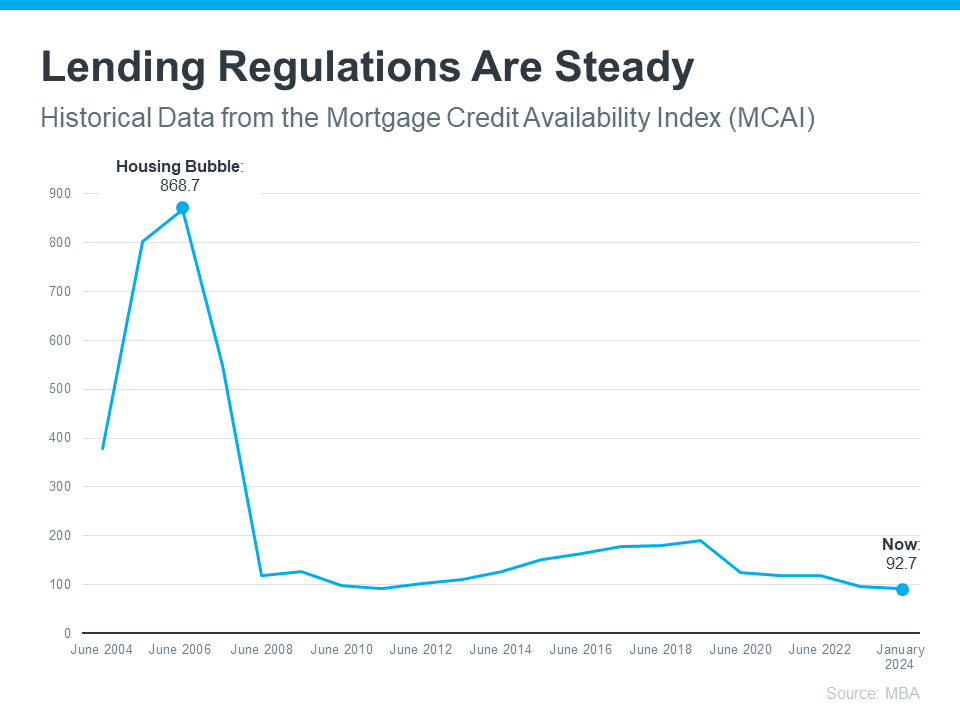

Things are different today. Homebuyers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is:

The peak in the graph shows that, back then, lending standards weren’t as strict as they are now. That means lending institutions took on much greater risk in both the person and the mortgage products offered around the crash. That led to mass defaults and a flood of foreclosures coming onto the market.

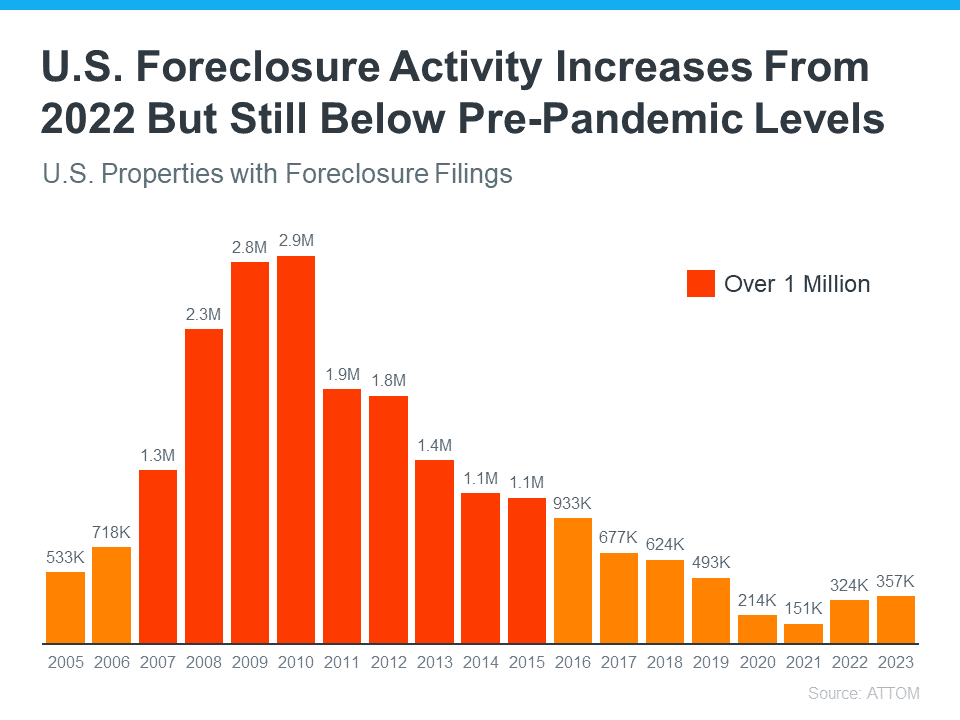

So, while foreclosure filings are up in the latest report, it’s clear this is nothing like it was back then.

In fact, we’re not even back at the levels we’d see in more normal years, like 2019. As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

That’s largely because buyers today are more qualified and less likely to default on their loans. Delinquency rates are still low and most homeowners have enough equity to keep them from going into foreclosure.

There Are Far Fewer Homes for Sale Today, So Prices Won’t Crash

Because there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), that caused home prices to fall dramatically. But today, there’s an inventory shortage – not a surplus.

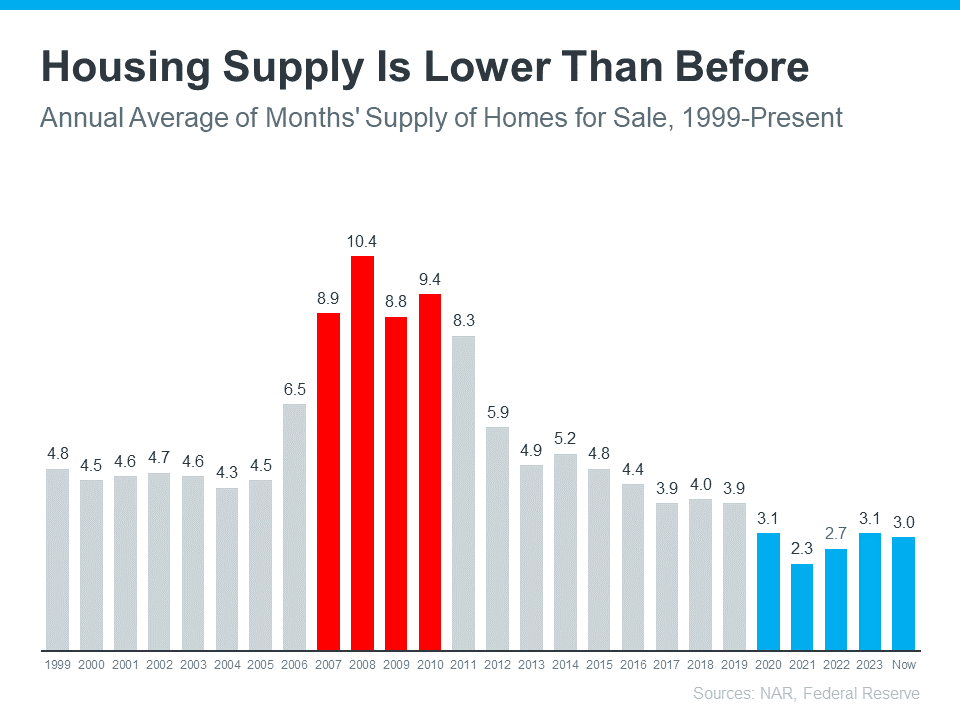

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now (shown in blue) compares to the crash (shown in red):

Today, unsold inventory sits at just a 3.0-months’ supply (National Average). That’s compared to the peak of 10.4 month’s supply back in 2008. That means there’s nowhere near enough inventory on the market for home prices to come crashing down like they did back then. In Orange County the months of inventory stands at 1.24 months' supply.

People Are Not Using Their Homes as ATMs Like They Did in the Early 2000s

Back in the lead up to the housing crash, many homeowners were borrowing against the equity in their homes to finance new cars, boats, and vacations. So, when prices started to fall, as inventory rose too high, many of those homeowners found themselves underwater.

But today, homeowners are a lot more cautious. Even though prices have skyrocketed in the past few years, homeowners aren’t tapping into their equity the way they did back then.

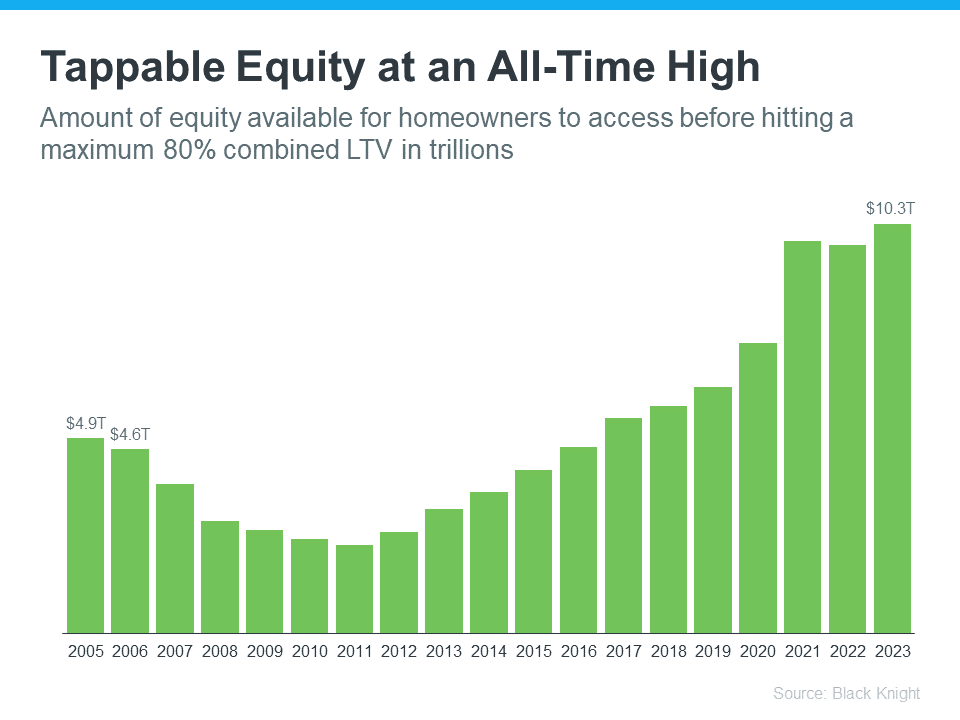

Black Knight reports that tappable equity (the amount of equity available for homeowners to access before hitting a maximum 80% loan-to-value ratio, or LTV) has actually reached an all-time high:

That means, as a whole, homeowners have more equity available than ever before. And that’s great. Homeowners are in a much stronger position today than in the early 2000s. That same report from Black Knight goes on to explain:

“Only 1.1% of mortgage holders (582K) ended the year underwater, down from 1.5% (807K) at this time last year.”

And since homeowners are on more solid footing today, they’ll have options to avoid foreclosure. That limits the number of distressed properties coming onto the market. And without a flood of inventory, prices won’t come tumbling down.

Bottom Line

While you may be hoping for something that brings prices down, that’s not what the data tells us is going to happen. The most current research clearly shows that today’s market is nothing like it was last time. Reach out to me so we can go over all your options on how to make your homeownership dreams possible. Did you know that you can put less than 20% down to buy a home?