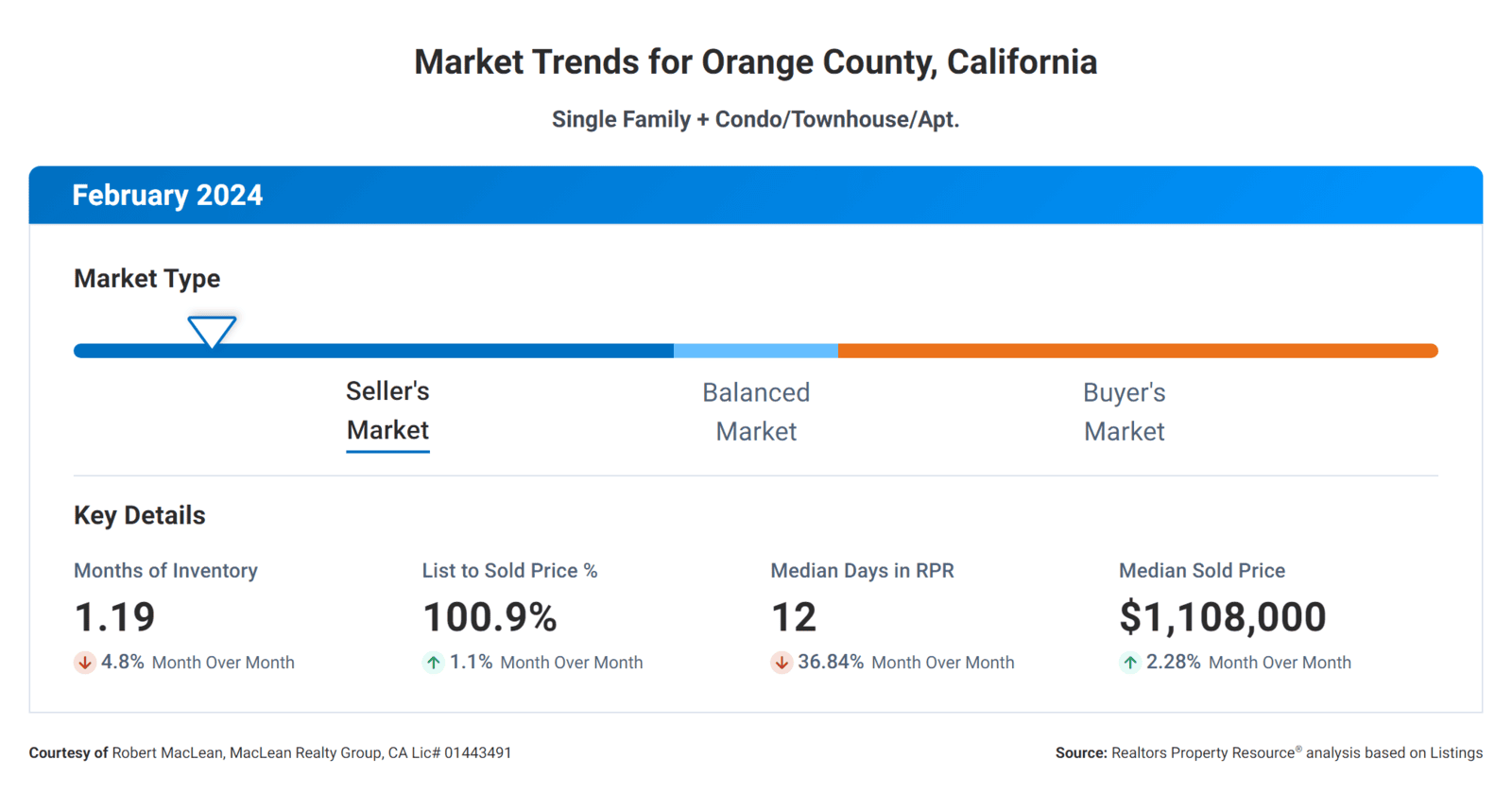

Let's break down the real estate metrics to understand how they correlate and what they mean for both buyers and sellers in the current market.

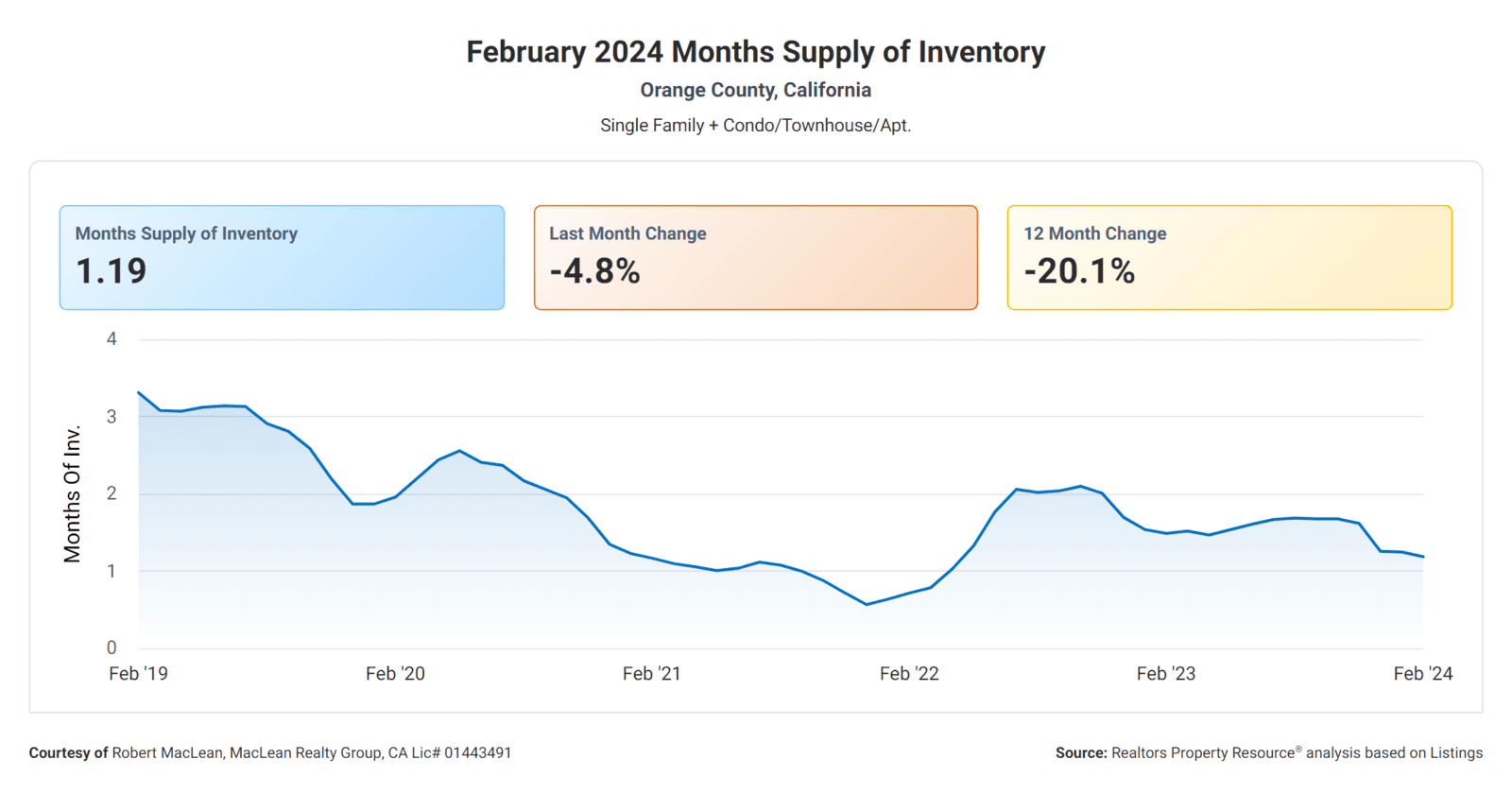

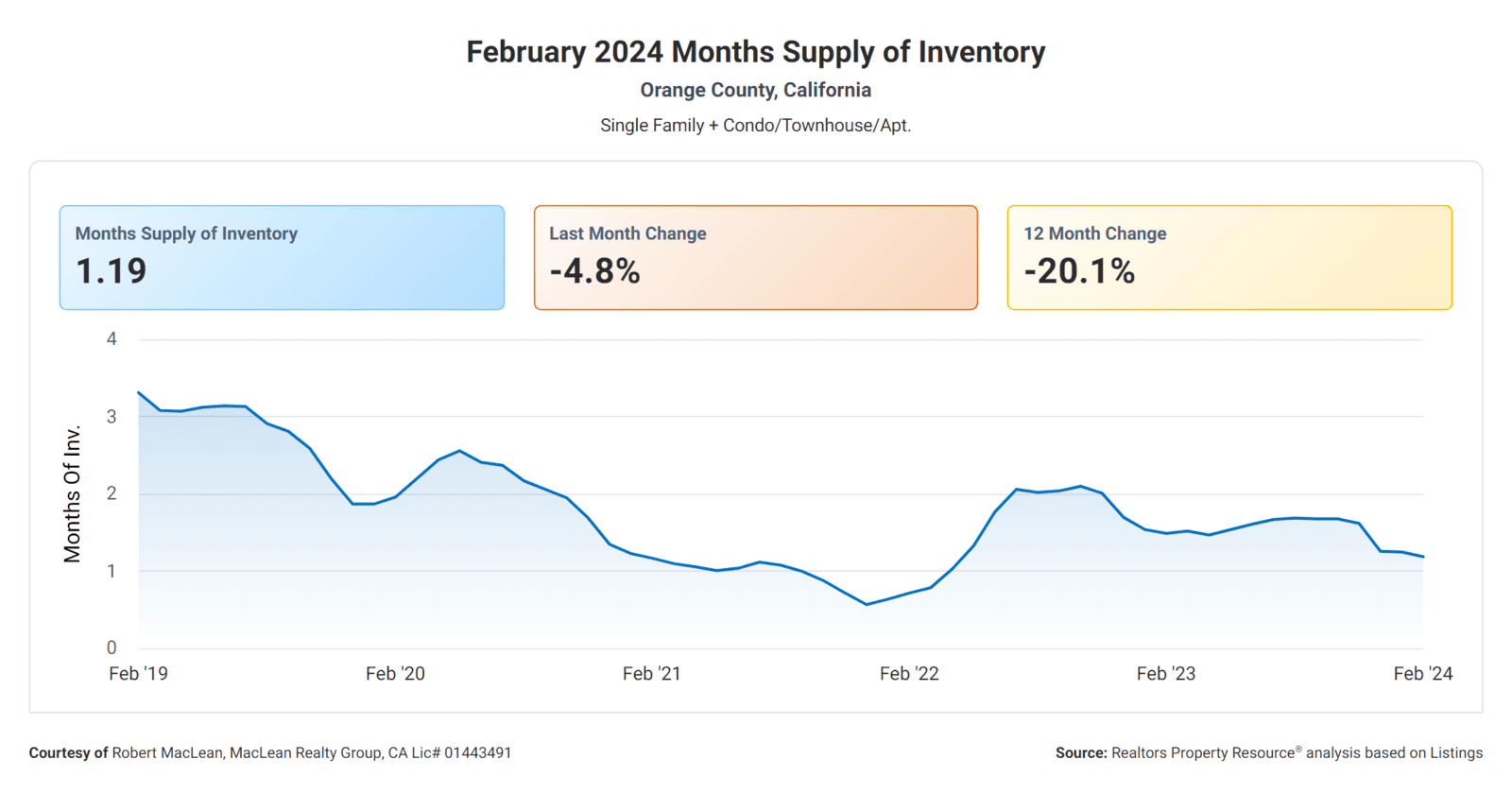

Months Supply of Inventory is 1.19, which indicates a very low inventory of homes for sale. This means that there are more buyers looking for homes than there are homes available, which can lead to increased competition and potentially higher prices.

12-Month Change in Months of Inventory is -20.13%, showing a significant decrease in the number of homes available for sale compared to the previous year. This can further contribute to the competitive market conditions and potentially drive prices up.

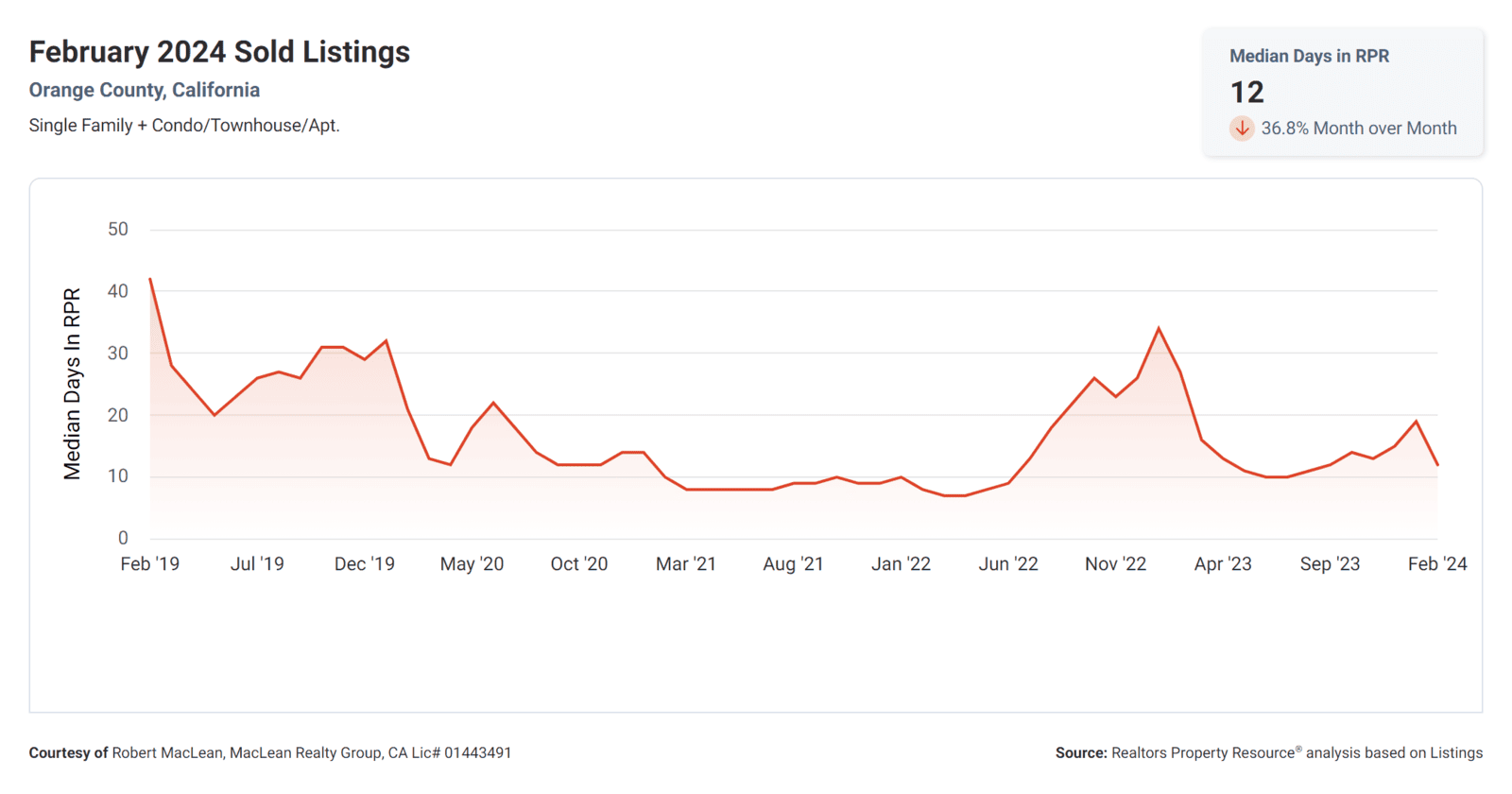

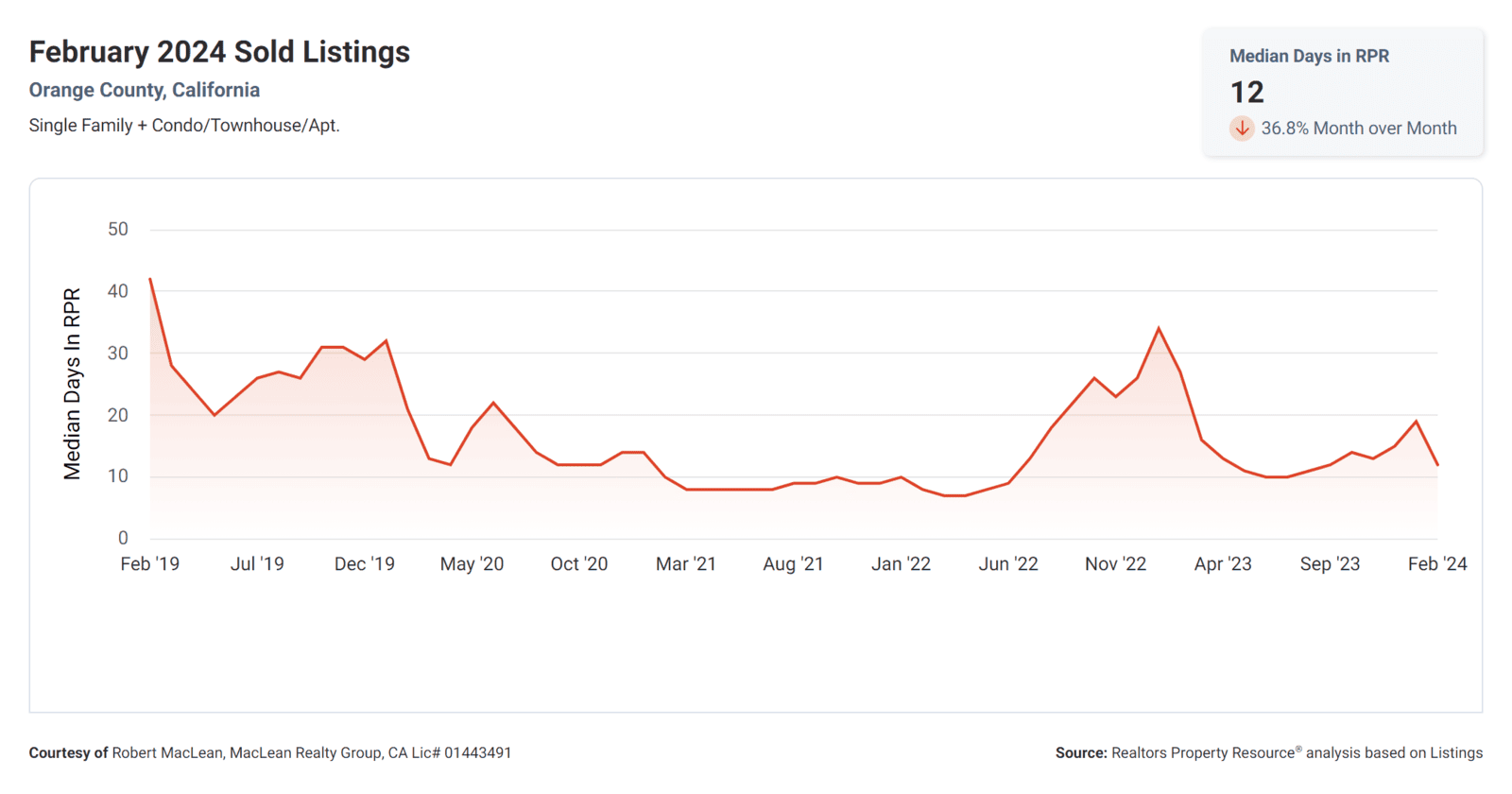

Median Days Homes are On the Market is 12, indicating that homes are selling quickly once they are listed. This is a positive sign for sellers as it suggests strong demand in the market.

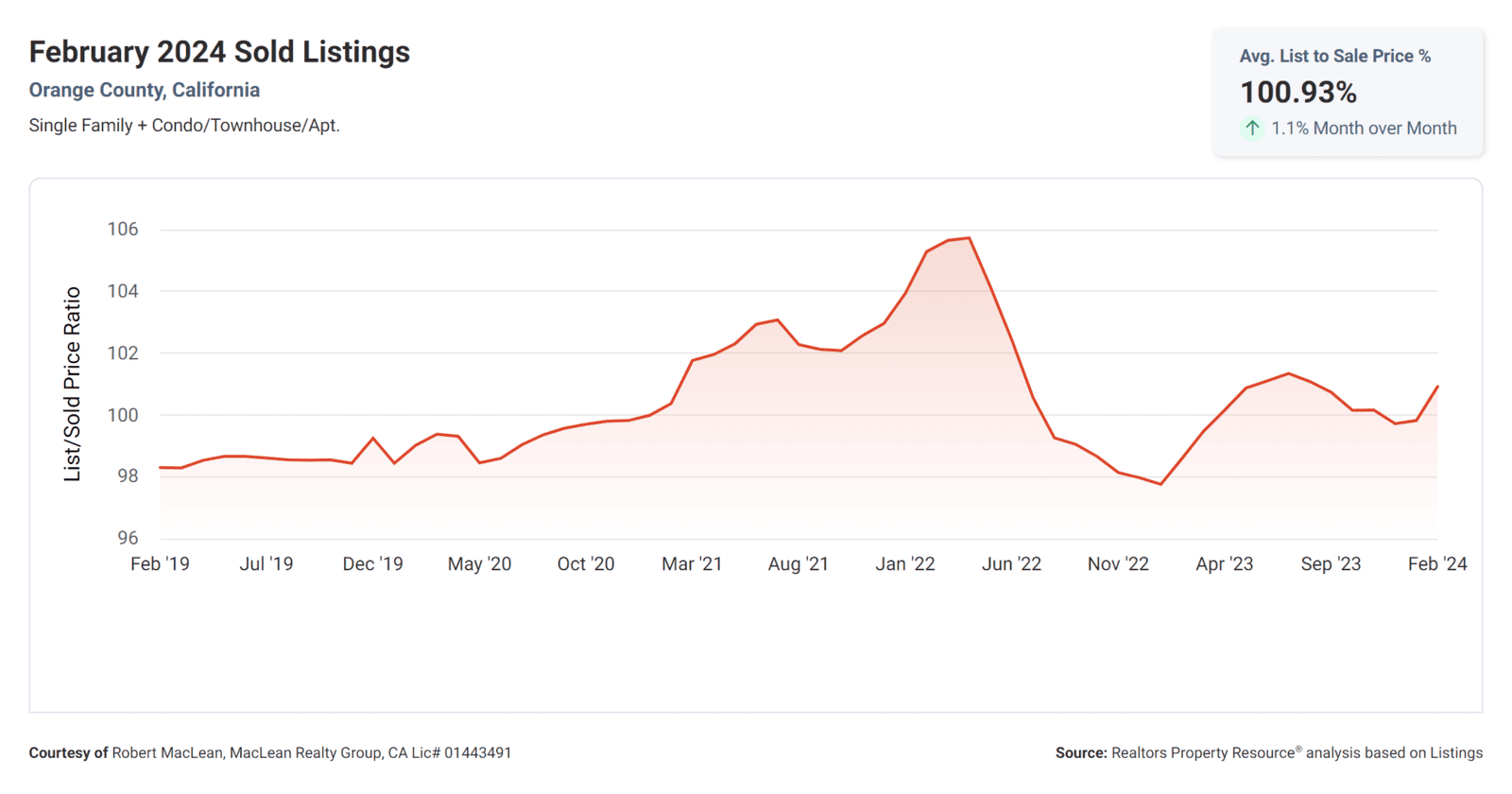

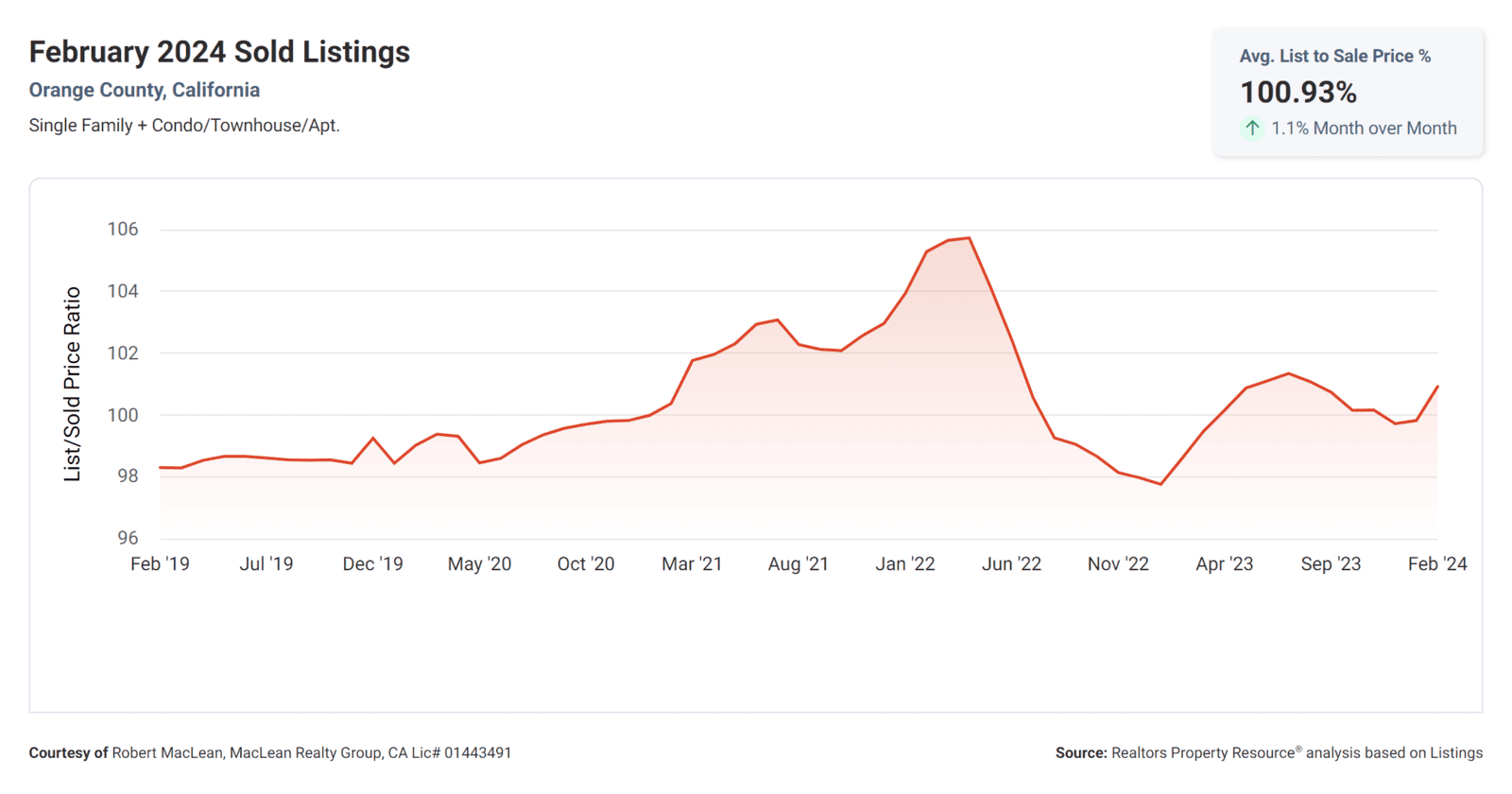

List to Sold Price Percentage is 100.9%, meaning that on average, homes are selling for slightly above their listing price. This can be a good indicator for sellers that they may be able to get a favorable price for their home.

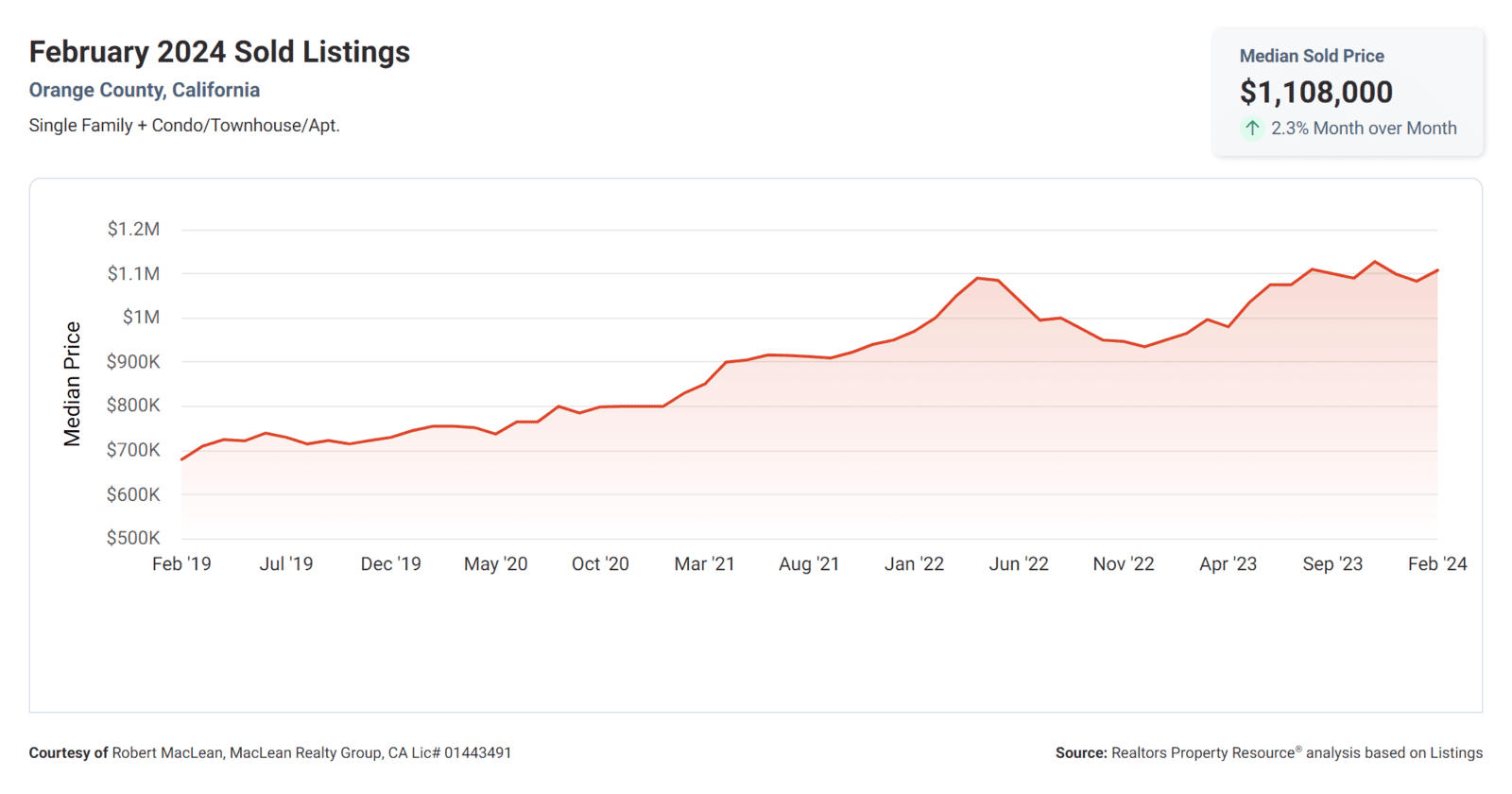

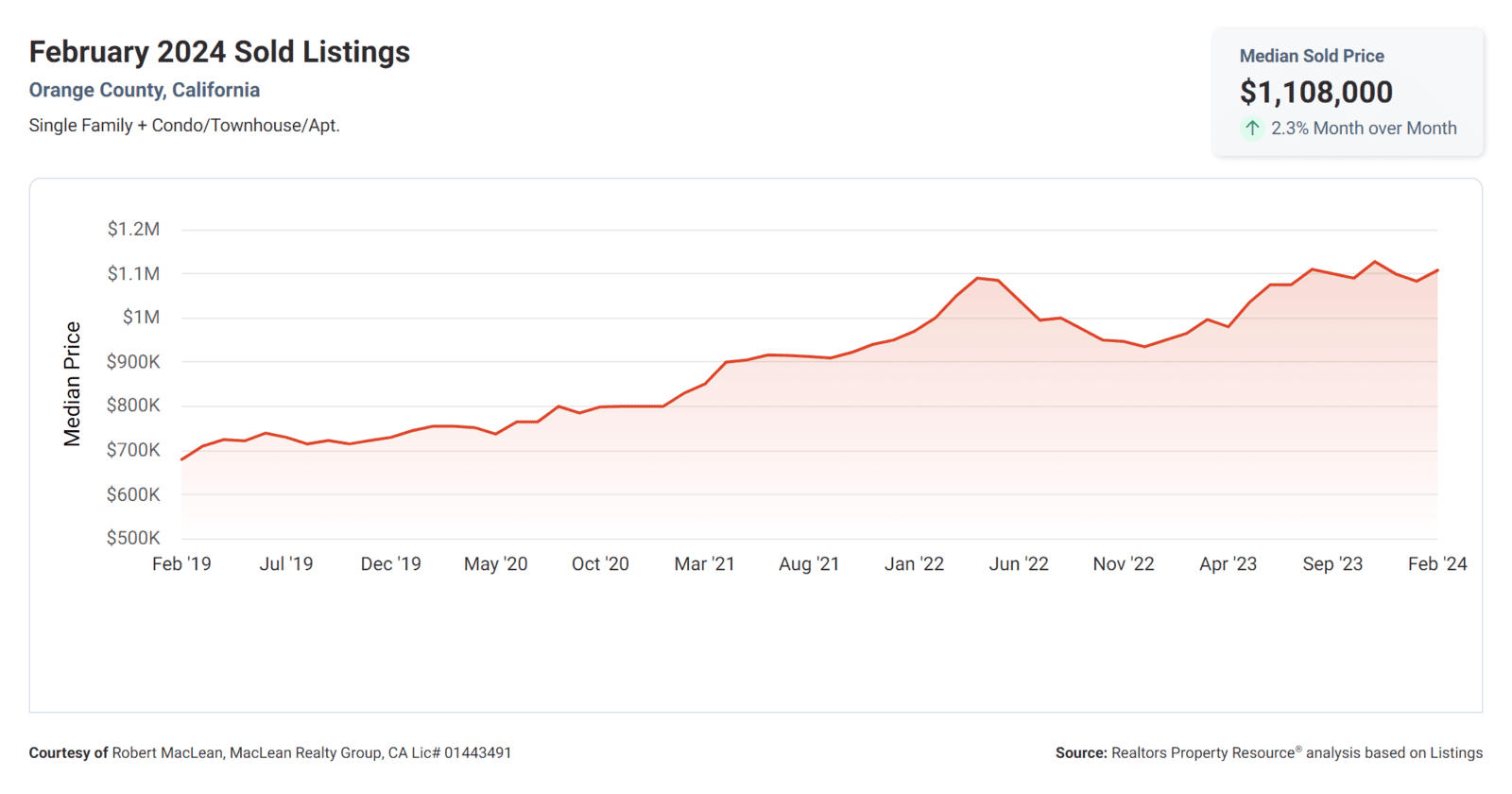

Median Sold Price is $1,108,000, showing the average price at which homes are selling in the current market. This can give both buyers and sellers a sense of the overall pricing trends in the area.

As spring homebuying season takes off, rates on some of the most popular types of mortgages ticked down this week, according to Bankrate’s weekly national survey of large lenders.

The average rate on a 30-year fixed mortgage fell to 7.09 percent the week of March 6, while the average rate on a 15-year fixed mortgage decreased to 6.46 percent.

Learn more: Historical Mortgage Rates

The Federal Reserve has been working to bring inflation to a more sustainable level of 2 percent. The Fed doesn't directly set mortgage rates, but its monetary policies do influence their direction. Fixed mortgage rates move with the 10-year Treasury yield, while adjustable-rate loans more closely follow the Fed. The central bank will meet later this month, but isn’t expected to cut rates just yet.

- Bank Rate

Overall, these metrics suggest a competitive market with low inventory, quick sales, and potentially higher prices. Sellers may benefit from favorable selling conditions, while buyers may need to act quickly and be prepared to make competitive offers. It's important for both parties to stay informed and work with a knowledgeable real estate agent to navigate the current market dynamics effectively. Book a consultation now to get even more insights and start your Home Journey.